[ad_1]

Whereas Janet Yellen continues to ‘hope’, the nonpartisan Congressional Finances Workplace is out with its first public opinion on the chance of default by the US federal authorities if lawmakers fail to boost the debt ceiling.

“If the debt restrict stays unchanged, the federal government’s skill to borrow utilizing extraordinary measures might be exhausted between July and September 2023,” the CBO estimated.

Extra ominously, they warn that decrease tax receipts may convey the ‘x date’ even nearer…

The projected exhaustion date is unsure as a result of the timing and quantity of income collections and outlays over the intervening months may differ from CBO’s projections.

Particularly, earnings tax receipts in April may very well be kind of than CBO estimates.

If these receipts fell in need of estimated quantities – for instance, if capital positive aspects realizations in 2022 have been smaller or if U.S. earnings development slowed by extra in early calendar yr 2023 than CBO projected – the extraordinary measures may very well be exhausted sooner, and the Treasury may run out of funds earlier than July.

CBO concludes that if the debt restrict was not raised or suspended, the Treasury wouldn’t be licensed to challenge further debt aside from to exchange maturing securities.

That restriction would in the end result in delayed funds for some authorities actions, a default on the federal government’s debt obligations, or each.

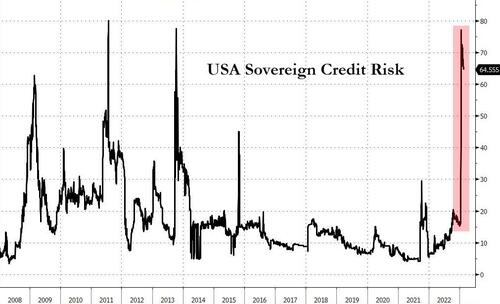

The credit score market continues to fret in regards to the likelihood of a USA sovereign default (or devaluation)…

Supply: Bloomberg

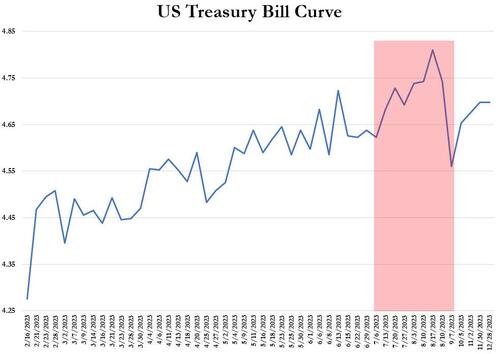

And the Treasury Invoice curve is ‘kinked’ in that July-to-September interval…

And whereas it seems the Invoice market sees a return to regular after the sport of hen is full in late Summer time, we notice, in a unique extra broad report, CBO tasks one thing much more ominous…

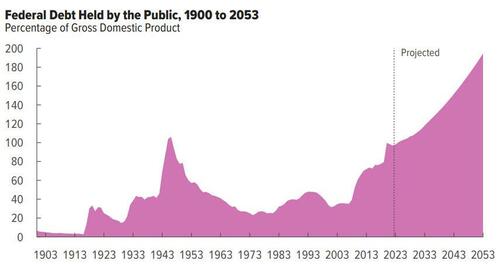

Federal debt held by the general public is projected to rise from 98 p.c of GDP in 2023 to 118 p.c in 2033 – a median improve of two share factors per yr. Over that interval, the expansion of curiosity prices and obligatory spending outpaces the expansion of revenues and the financial system, driving up debt.

These components persist past 2033, pushing federal debt greater nonetheless, to 195 p.c of GDP in 2053.

So anticipate much more ‘debt ceiling debacles’ to come back… or finish of the greenback hegemony in some unspecified time in the future.

Loading…

[ad_2]