[ad_1]

The CalPERS long-term care fiasco continues, with the board and employees taking a plan of action that will increase hurt to policyholders by persevering with to bleed them somewhat than put this system in chapter.

For these new to this practice wreck, the general public remark on the February 14 CalPERS board assembly by policy-holder and authorized monetary planner Lawrence Grossman gives an introduction. A key little bit of background is that state laws allowed CalPERS to leap on the long-term care insurance coverage bandwagon within the Nineteen Nineties. Most of those insurance coverage have gotten right into a world of harm by underestimating the diploma to which correct elder care would lengthen lifepsans of policy-holders and overestimating the lapse fee (lapsed insurance policies imply the premiums paid by dropouts profit the remaining policyholders). However CalPERS’ recklessness and incompetence had been in a league of its personal.

CalPERS not solely significantly underpriced its insurance policies in comparison with business rivals, however it made issues worse by way of giving CalPERS policyholders the choices of lifetime advantages (versus fastened greenback advantages) and inflation safety. Inflation safety would appear like an unimaginable promise for any long-term insurance coverage scheme. But the insurance policies had been marketed as CalPERS insurance policies, not these of a free-standing “CalPERS Lengthy-Time period Care Fund,” as in not backed by CalPERS or the state of California.

It doesn’t appear like there will likely be a contented ending for the over 100,000 CalPERS long-term care coverage holders who’re represented within the class motion lawsuit, Wedding ceremony v. CalPERS. That doesn’t imply there’s a great consequence for CalPERS both. Nevertheless, issues ought to work out for the plaintiffs’ attorneys.

The bone of rivalry is that CalPERS accredited an eye-popping 85% enhance in premiums in 2013, hitting solely the insurance policies with essentially the most beneficiant cost options. The plaintiffs contend that these will increase weren’t permissible and are looking for substantial damages.

The case has been grinding by means of the California courts since 2013. Decide William Highberger, in his choice from a June 10 trial, explicitly known as on the legislature and state authorities to bail out the long-term care scheme.

Evidently, it is a extremely uncommon step for a decide to absorb a contract dispute. At a minimal, it alerts an expectation that CalPERS will lose and lose huge.

However CalPERS dropping can be of no profit to the policyholders as an entire (there could possibly be some reallocation amongst them). It’s extremely unlikely that the state will throw cash at CalPERS. In contrast to CalPERS’ pensions, the state has no obligation. The long-term care insurance coverage plan was set as much as be self-funded. So in a worst-case situation, and “worst-case” appears all too seemingly, the related plans will likely be bancrupt.

If the case ends in a big cash judgment towards CalPERS, and the decide’s physique language is that that’s a possible consequence, the one place the funds can come from is the long-term care plans themselves. As we’ll focus on, that signifies that CalPERS would want to bankrupt the long-term care plan or take different measures to take care of their insolvency. Word that CalPERS has simply put out a bid alternative for an outdoor chapter counsel.

However count on CalPERS to tug issues out. Defaulting on this scale can be an enormous embarrassment. CEO Marcie Frost and Common Counsel Matt Jacobs will do every thing they will to attempt to kick this mess over to successors. The almost certainly course is for CalPERS to attraction and delay a proper chapter or various (a runoff plan?) so long as attainable.

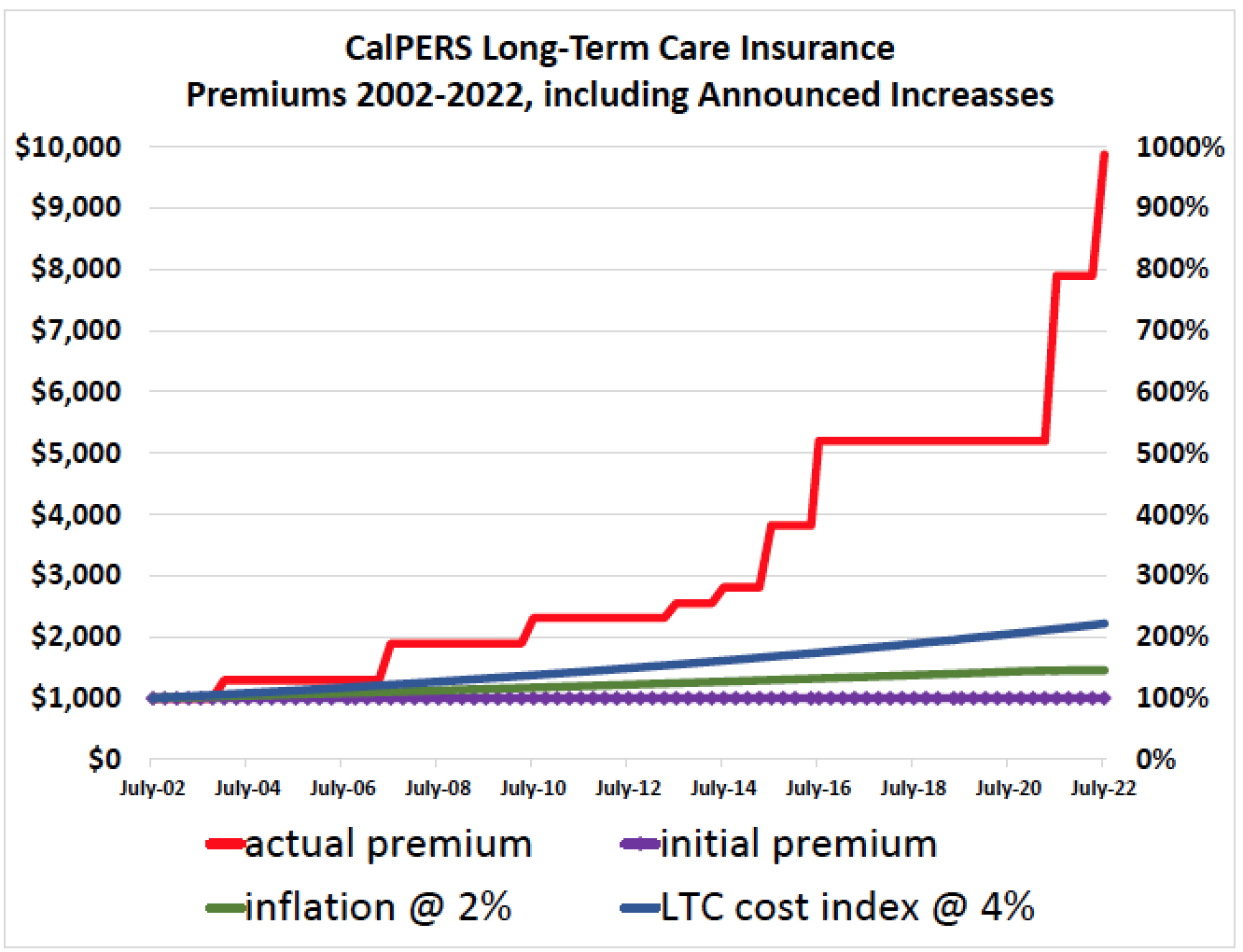

4 years later and issues are going in accordance with CalPERS’ abusive plan. Despite the fact that Decide Highberger clearly rejected CalPERS’ place that it will probably violate coverage phrases and lift premiums, CalPERS has continued to extend premiums as a result of the courtroom to date has issued solely preliminary choices. Word these will increase are vastly in extra of these applied by business carriers.

By dragging issues out and placing by means of punitive premium will increase, CalPERS hopes to perform two issues:

Have extra coverage holders die, lowering the variety of potential claimants on a too small pot of funds

Having extra coverage holders lapse, both attributable to lack of ability to afford the vastly increased premiums or dropping the coverage out of the assumption that the price of maintaining the coverage is simply too excessive in comparison with any payoff.

Discover CalPERS’ abusive strategy is succeeding. We wrote of “over 100,000” plaintiffs within the class motion go well with in 2019. It’s now all the way down to “over 80,000”.

Now to Grossman’s replace, beginning at 1:10:

President Taylor, members of the Board, good morning, thanks for 5 minutes.

My identify is Lawrence Grossman and I reside in Benicia, California. I’m right here to touch upon the CalPERS long-term care insurance coverage disaster.

Allow me to be completely frank: If the CalPERS long-term care insurance coverage program had actually disclosed what it’s, I imagine that no affordable particular person would have purchased a coverage.

However CalPERS has been extraordinarily dishonest by not disclosing materials info. And it offered a couple of quarter of one million insurance policies.

This system has been applied incompetently and is now a monetary catastrophe, primarily of CalPERS’ creation. But CalPERS desires policyholders to pay for its failings and to that finish has damaged contracts and has risen premiums at instances ten fold, as in 100% .

The continuing class motion lawsuit, which this Board has fought for 9 years, addresses solely a part of the issue. There stay earlier and later fee will increase that are inconsistent with coverage contracts in addition to damages brought on by misleading gross sales practices.

That is why a public audit of this system is important.

Probably you observed that every candidate final 12 months for the CalPERS Board seat that Ms. Walker received emphatically acknowledged throughout their debate that the CalPERS long-term care program is a “failure” or “debacle”. This Board has denied that, with employees asserting publicly that the CalPERS program has merely skilled issues which all of the business long-term care insurance coverage firms have skilled. That assertion appears fairly inconsistent with the info and must be publicly examined.

CalPERS has did not comply with its enabling laws which requires it to supply a business coverage choice within the CalPERS program if there’s a program in any respect. However CalPERS determined to disregard the regulation as a result of, I’ve been advised by former CalPERS Board members, employees asserted that the so-called self-funded choice was far superior.

But even when one believes the business choice is much less enticing, how was it attainable to disregard the regulation? Why did CalPERS not let shoppers select? CalPERS’ Common Counsel was requested that query in writing by a colleague of mine. The Common Counsel had an affiliate reply, who merely wrote that “that is how the long-term care program has at all times operated and there are not any current plans to vary it”.

Not providing a business long-term care insurance coverage choice signifies that the self-funded choice didn’t must compete with one other coverage that CalPERS endorsed. Competitors would have let patrons see the essential variations between a coverage topic to Division of Insurance coverage oversight and a self-funded one with out oversight.

The self-funded choice, I submit, is also dangerously handy to CalPERS. It signifies that CalPERS will not be topic to Division of Insurance coverage regulation. Undoubtably, the Division of Insurance coverage wouldn’t have permitted the 900% premium will increase that CalPERS has imposed; the Division of Insurance coverage actually has not accredited such fee will increase for any business service.

As President Biden stated lately throughout his State of the Union deal with, “Capitalism with out competitors will not be capitalism. It’s extortion. It’s exploitation”. Successfully, that’s what we’ve got with the CalPERS long-term care program. We now have neither competitors nor regulation, simply extortion and exploitation.

In only a few months, one of many largest class-action lawsuits in US historical past will go to trial in Los Angeles, CalPERS versus 80,000 or so of its long-term care policyholders, the remaining ones. CalPERS settling the go well with now with policyholders on equitable phrases is each essential and the moral factor to do. Then CalPERS should flip to the rest of the long-term care mess. Till it’s cleaned up, we aggrieved policyholders are usually not going away.

And since I’ve 42 seconds, thanks, allow me a private remark. I ponder if any of you has spoken with a long-term care policyholder; it’s heart-breaking to take action. I’ve spoken with practically 100 policyholders who reached out to me for assist after studying my articles about this long-term care CalPERS disaster. Every one believes that they’ve been cheated by CalPERS and that their monetary and bodily safety throughout their remaining days has been stolen by CalPERS. As an eighty-year-old policyholder wrote me: “There is no such thing as a escaping the conclusion that the individuals we’ve got completely entrusted to look out for our pursuits have determined to journey it out, ready for us to die.”

After all the board ignored Grossman and went on to the subsequent particular person on deck for public feedback. The present board has no incentive to take care of the plaintiffs in good religion as a result of they don’t have any pores and skin within the sport. Solely seven former board members are named defendants. No executives are named.

I urge the attorneys pursuing this case to contemplate amending this case to incorporate present executives and board members as defendants for the extra, willful injury executed for the reason that submitting of this case by their punitive remedy of the plaintiffs, in defiance of the decide’s repeated rulings about CalPERS’ permitted scope of motion. CalPERS’ high brass has relied over-much on self-dealing, underpriced self-insurance somewhat than third social gathering administrators’ and officers’ insurance policies. It is rather seemingly that the perps within the monetary torture of aged CalPERS long-term care insureds are flying bare so far as their publicity is worried. Turning the warmth on them may expedite a long-overdue settlement.

[ad_2]