[ad_1]

aluxum/E+ through Getty Photos

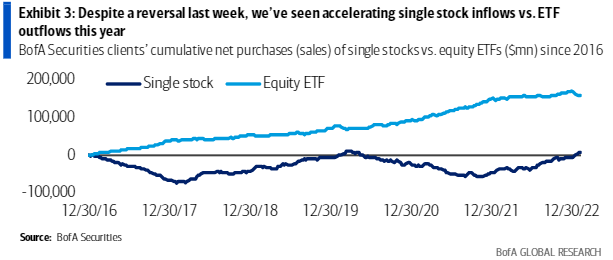

Financial institution of America shoppers had been web sellers of property final week, throughout which the S&P 500 (SP500) (SPY) declined by 1.1%. In accordance with knowledge compiled by a survey of its fairness shoppers, BofA customers had been sellers of single shares and patrons of trade traded funds — the primary time this has occurred up to now in 2023.

The survey highlighted that traders had been web retractors of US equities within the quantity of -$0.1B, following two weeks of shopping for. Traders bought shares in six of the 11 sectors, led by the buyer discretionary and vitality segments. On the opposite facet of the spectrum, industrials noticed essentially the most vital outflows.

On an ETF entrance, BofA shoppers bought ETFs throughout most large-, and mid-cap broad market funds in addition to progress areas. Nonetheless, they had been patrons of small cap and worth ETFs.

Whereas BofA did not specify particular ETFs that had been common amongst its shoppers, listed below are some high-profile small-cap and worth ETFs: (NYSEARCA:IWM), (VBR), (SCHA), (NYSEARCA:VBK), (NYSEARCA:VTV), (RZV), (IWD), (IVE), (VLUE), and (IWN).

Even with the pattern final week, BofA outlined that it has witnessed an over acceleration of shopping for in direction of single shares when in comparison with ETFs. See the chart under:

In broader monetary information, main market averages opened buying and selling on Tuesday greater after the newest inflation report got here in.

[ad_2]