[ad_1]

Just_Super/iStock by way of Getty Photos

Bitcoin (BTC-USD) is ready to finish the week 7.7% decrease as sentiment was hit by renewed macroeconomic issues in addition to regulatory scrutiny after the U.S. SEC shut down cryptocurrency alternate Kraken’s staking service.

Broader monetary markets have been weighed by more and more hawkish commentary from Federal Reserve audio system, in response to current knowledge that signaled a stubbornly resilient labor market.

In the meantime, Kraken ended its crypto asset staking-as-a-service program and can pay $30M to settle the SEC’s fees. The regulator alleged that Kraken did not register its staking program, which uncovered buyers to dangers with minimal safety.

“Because the SEC has thus far not even authorized a Bitcoin spot ETF, it appears unlikely that it will have authorized a barely extra obscure product like staking,” stated Markus Thielsen, head of analysis, Matrixport. “Whereas the SEC enforcement is damaging for the business, it excluded U.S. crypto customers from being a part of the innovation. The winners will possible be staking suppliers in Asia.”

Coinbase (COIN) CEO Brian Armstrong warned that the SEC might wish to eliminate crypto staking for retail prospects totally.

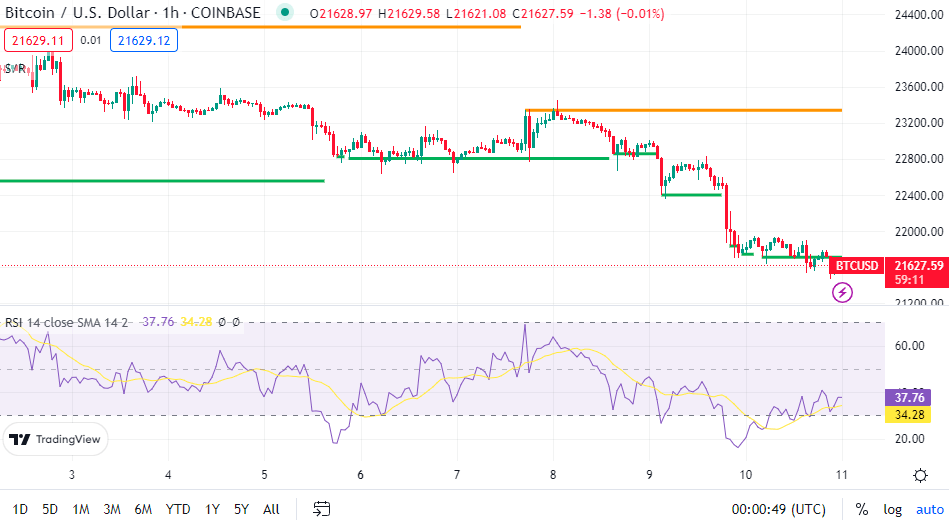

Bitcoin (BTC-USD) remained inside $21.55K-$23.68K this week, stalling its rally this 12 months. The worldwide crypto market cap presently stands at $1.01T, down 0.7% over Thursday, in line with CoinMarketCap.

Regulatory Updates

- Fed Board Governor Christopher Waller known as crypto a “speculative asset, like a baseball card.” He additionally cautioned that if the value of cryptos drop to zero, “do not count on taxpayers to socialize your losses.”

- However Philadelphia Fed President Patrick Harker stated cryptos will possible stay in demand regardless of the current bear market.

- In the meantime, the SEC warned buyers that crypto investments in some self-directed IRAs could also be unregistered securities.

Contagion Continues

- Crypto alternate LocalBitcoins is shutting down after working for over 10 years because of the “very chilly crypto-winter”.

- Crypto ATM operator Coin Cloud filed for Chapter 11 chapter safety, with estimated liabilities of as much as $500M. The corporate owes over $100M to bancrupt crypto lender Genesis, its largest creditor.

- Digital Forex Group started offloading shares in trusts operated by its unit Grayscale Investments at a deep low cost because it seeks to lift funds to repay collectors of its unit Genesis.

- Ishan Wahi, a former Coinbase (COIN) government, reportedly pleaded responsible to 2 counts of conspiracy to commit wire fraud, within the first ever crypto insider buying and selling scheme.

Notable Information

- Hut 8 Mining (HUT) will merge with US Bitcoin in an all-stock merger of equals that is anticipated to offer the mixed firm a market cap of ~$990M. The information despatched crypto mining shares decrease as extra consolidation is predicted within the sector.

- Deutsche Financial institution’s asset administration unit, DWS Group, is reportedly contemplating taking minority stakes in two crypto corporations as a way to spark progress.

- PayPal has halted stablecoin work as New York regulators are reportedly investigating its key accomplice within the challenge.

Bitcoin worth

- Bitcoin (BTC-USD) dipped 0.7% to $21.64K at 7 pm ET and ether (ETH-USD) fell 2.1% to $1.51K.

- SA contributor Ryan Wilday stated bitcoin’s (BTC-USD) rally over the past month is promising, however bulls have extra work to do to verify that the bearish development that started in 2021 has ended.

Crypto-related shares that ended decrease on Friday: CleanSpark (CLSK) -8.8%, Hut 8 Mining (HUT) -8.2%, Bitfarms (BITF) -6.6%. Coinbase (COIN) -4.3%, Riot Platforms (RIOT) -2.5%.

[ad_2]