[ad_1]

Authored by Brandon Smith through Alt-Market.us,

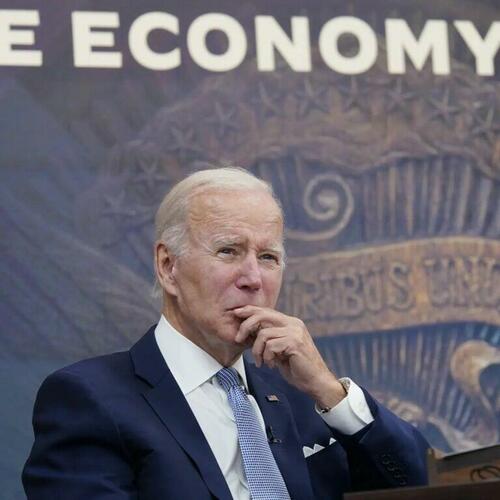

This previous month a ballot held by ABC and the Washington Submit with a 37 yr historical past requested Individuals in the event that they have been higher or worse off within the two years since Biden entered the White Home.

When you have been to ask Biden this query, you’ll be regaled with a flurry of nice information a few incredible financial restoration, epic jobs numbers, falling inflation and a dropping deficit.

Once you ask precise common residents, you get a a lot completely different reply.

In accordance with the ABC/Submit ballot, Individuals say they’re worse off than they’ve ever been, with essentially the most adverse knowledge within the historical past of the survey. Over 40% of respondents indicated their monetary state of affairs was worse below Biden. Solely 16% of individuals mentioned they have been higher off. Not solely that, however 60% of Democrats polled mentioned they did NOT need Joe Biden as their candidate in 2024, and 62% of all individuals polled mentioned they’d be disenchanted and even offended if Biden remained within the White Home for a second time period. That is astounding.

How does one reconcile this actuality with the claims made by Joe Biden on the financial system? If that is the “biggest financial restoration ever” then why are so many Individuals in monetary distress?

The variety of lies surrounding Biden’s financial platform are too many to depend, however I’ll attempt to undergo the important thing arguments that the White Home is selling nowadays and description why these claims are manipulative or outright fraudulent.

Let’s get began…

File Jobs Creation?

Biden and his group are fast to counsel that knowledge from the Bureau of Labor Statistics signifies an unbelievable jobs restoration which he’s blissful to take credit score for. “You don’t have a recession when you will have 500,000 jobs and the bottom unemployment price in additional than 50 years,” Treasury Secretary Janet Yellen informed ABC’s “Good Morning America” program on Monday. “What I see is a path wherein inflation is declining considerably and the financial system is remaining robust,” Yellen added.

That is coming from the identical lady who denied for years that inflation was actual and a menace to our monetary system. The identical lady that reluctantly admitted to inflation solely after it hit 40 yr highs. So, needless to say Yellen’s observe report signifies she is both an fool or a liar.

Additionally, these sorts of statements are made whereas intentionally ignoring the context and particulars of the state of affairs. Over 25 million+ jobs have been misplaced on Biden’s watch as he aggressively pushed for nationwide covid lockdowns. These lockdowns have been ineffective in stopping the unfold of the virus, however they have been very efficient at killing the financial system.

Many conservative purple states defied Biden, Fauci and the CDC and reopened after a couple of months when it turned clear that covid was not a menace to the overwhelming majority of individuals. Blue states languished in lockdowns and irrational worry for for much longer. Solely not too long ago have most US states backed away from the covid hysteria and so jobs are returning. 25 million+ have been misplaced, and 12 million have been recovered. Hardly something to brag about, however whenever you take a look at it as if the lockdowns by no means occurred, it may be spectacular.

Past the return of jobs misplaced in the course of the lockdowns, there may be additionally the difficulty of round $8 trillion+ in stimulus in lower than two years of pandemic response. The lockdowns couldn’t have occurred with out covid checks and PPP loans, and the covid stimulus helped immediately set off the inflation avalanche that had been constructing for years. A part of this course of occurred below Trump’s watch, to make certain. Nonetheless, it was Biden and the leftists that attempted to maintain the mandates and lockdowns going even when the info confirmed they have been ineffective.

With $8 trillion in fiat pumped immediately into the system, retail and repair industries exploded in 2021 as individuals rushed to purchase items. Costs exploded, too, as a result of provide couldn’t meet demand. The issue is that the roles created throughout this occasion are a brief situation of inflation, not a pure results of a recovering financial system. In different phrases, Biden’s jobs market is an phantasm constructed on fiat. I predict we are going to see appreciable job losses this yr as financial savings gathered from covid stimulus run out and as client credit score runs dry.

Then, there may be the difficulty of doubtless faux or exaggerated BLS jobs knowledge. Solely final yr the Philly Fed needed to revise and refute White Home labor positive aspects and minimize over 1 million jobs from their stats within the course of. It is a huge discrepancy. Although it’s unattainable to show at this stage, I think that there’s a concerted agenda to lie about employment numbers, both to make Biden look good, or to facilitate an excuse for the continuance of rate of interest hikes into financial weak spot.

If the BLS numbers are correct, then why is there a report variety of Individuals worse off below Biden? One, the roles being created are low wage. Two, the numbers are faux. Three, inflation is so excessive that wages can’t sustain with the rise in costs.

Falling Inflation?

If we calculate inflation in accordance with the requirements set over the last stagflation disaster within the Seventies and early 1980’s, then the true inflation price is nearer to fifteen%. Official CPI in accordance with the brand new method of calculation is 6.4%. Did inflation fall not too long ago? Sure, however not due to Biden.

The Federal Reserve has raised rates of interest to just about 5%. Remember that that is after maintaining charges at close to zero for round 14 years, and they’re anticipated to proceed to climb to a doable 6% or extra this yr. Larger charges imply far much less lending and much much less spending by customers and the federal government. Additionally they imply that company inventory buybacks which initially relied on low cost in a single day loans from the Fed are going to slowly die out, inflicting inventory markets to fall. The obvious consequence of this development will probably be mass job losses as firms minimize prices.

Falling Price range Deficit?

Once more, this has nothing to do with Biden. He’s attempting to spend extra and add extra to the funds by way of his “Inflation Discount Act”. Regardless of his many guarantees, he isn’t attempting to scale back the funds. He will probably be FORCED to do that, nevertheless, by tightening fiscal coverage.

Why is the deficit falling? As a result of the Fed is elevating rates of interest and this makes it costlier for the federal government to borrow and spend. Larger rates of interest elevate the federal authorities’s borrowing prices and future curiosity funds on the nationwide debt. As charges rise authorities packages should curb spending – that means they’re compelled to scale back the funds deficit as an alternative of spending cash they don’t have.

The Actuality

US retail gross sales simply witnessed a steep decline by way of the top of 2022 and the vacation season, indicating that the results of covid stimulus are properly and actually over. Manufacturing tumbled as 2022 closed, defying Biden’s assertions that he’s bringing again home manufacturing. US imports of products have additionally tumbled and transport is down throughout the board, one more signal that the financial system is stalling.

Intermittent spikes in retail gross sales have occurred, as we noticed in January, however so has bank card debt, suggesting that customers at the moment are leaning on credit score with the intention to cowl elevated prices triggered by inflation. Retail gross sales will not be rising, simply the costs and credit score expenditures. In truth, polls present 33% of Individuals say it’s going to take them no less than 2 years to repay their bank card money owed, and 50% of Individuals say they want their bank cards simply to cowl regular important dwelling bills. 45% of individuals mentioned they needed to tackle extra debt in the course of the pandemic.

The Tech sector is beginning mass layoffs proper now and could also be a canary within the coal mine for what’s about to occur to the remainder of the roles market this yr. And, inflation stays excessive sufficient that 56% of Individuals say they can’t sustain with the price of dwelling, whereas 77% are apprehensive about their future monetary prospects.

This info doesn’t jive with Biden’s story in any respect. There isn’t any restoration, we’re within the midst of a stagflation disaster with parts of a rising recession. I imagine 2023 would be the yr that the restoration narrative collapses, however the authorities below Biden will search to cover the implosion for so long as doable.

* * *

If you want to help the work that Alt-Market does whereas additionally receiving content material on superior ways for defeating the globalist agenda, subscribe to our unique e-newsletter The Wild Bunch Dispatch. Be taught extra about it HERE.

Loading…

[ad_2]