[ad_1]

By Greg Miller of FreightWaves,

Containerized imports to the Port of Los Angeles in January adopted the identical sample as in neighboring Lengthy Seaside: up versus December however down 12 months on 12 months and down versus pre-COVID ranges.

It seems like it would worsen in Los Angeles earlier than it will get higher.

Throughout a information convention on Thursday, Port of Los Angeles Government Director Gene Seroka predicted “a major quantity decline” in February, with extra canceled sailings within the weeks and months forward and “a softer market heading into the second quarter.”

Nevertheless, Seroka does count on volumes to enhance within the second half, with a return to a extra conventional peak-season import sample. “Whereas final 12 months we noticed sturdy volumes within the first six months, 2023 is shaping as much as be extra sturdy within the again half of the 12 months,” he mentioned.

Nonetheless no labor deal

Seven and a half months after the West Coast port labor contract expired on July 1, 2022, there’s nonetheless no deal. Seroka as soon as once more acknowledged the dearth of a deal is affecting imports and pushing cargo to East and Gulf Coast ports and conceded “a few of that cargo could also be misplaced for good.”

“There’s nonetheless trepidation,” Seroka mentioned. “There are various transportation managers who couldn’t return to the boss for a 3rd straight 12 months and say, ‘I obtained our cargo caught within the jaws of congestion out in California.’ To satisfy the criticism and to fulfill the conjecture that’s on the market, we’ve obtained to get this collective bargaining settlement accomplished and take away that from the dialogue.”

Seroka had beforehand predicted a brand new West Coast port labor contract within the February-March timeframe. He sounded much less assured about that Thursday.

“With respect to timing, we’re now on the outer edges of what traditionally has been the [longest period] of negotiations between these two sides,” he mentioned. “It might not get accomplished in February or March, however I’m nonetheless fairly assured that we’ll see some actual progress within the springtime.”

‘Mini-bump’ in January

The Port of Los Angeles reported whole throughput of 726,014 twenty-foot equal models, down 16% 12 months on 12 months (y/y).

Imports got here in at 372,040 TEUs, down 13% y/y. Exports totaled 102,723 TEUs, up 3% y/y. Empty containers totaled 251,251 TEUs, down 26% y/y.

On a constructive observe, Los Angeles’ January imports had been up 6% in comparison with December. That “mini-bump” will be attributed to “cargo house owners who pushed their product right here forward of the Lunar New 12 months holidays,” mentioned Seroka.

West Coast vs. East Coast

The unprecedented COVID-era import surge was in full swing at the moment in 2022, which means that y/y comparisons at U.S. ports are down.

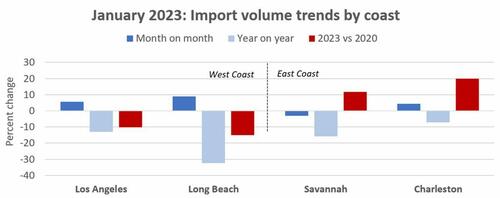

Lengthy Seaside’s imports plunged 32% y/y in January, a a lot steeper fall than in Los Angeles. On the East Coast, January imports to Savannah had been down 16% y/y, with imports to Charleston, South Carolina, down 7%.

In distinction, Lengthy Seaside did even higher in January versus December than Los Angeles, with imports up 9% sequentially. Charleston’s January imports had been up 4% versus the month earlier than, whereas Savannah’s pulled again by 3%.

The large divide between the East and West coasts will be seen in comparisons to the pre-pandemic interval. Whereas Los Angeles was down 10% and Lengthy Seaside was down 15% in comparison with January 2020, Savannah’s imports had been up 12% over the identical timeframe and Charleston’s had been up 20%.

Seroka maintained that the shift from the West Coast to the East Coast shouldn’t be all about latest labor points.

“Let’s be clear. This cargo shift isn’t new. It began greater than 20 years in the past,” he mentioned. “Since 2002, the West Coast share of the trans-Pacific commerce has declined from 80% to 56%. Proper right here at dwelling in San Pedro Bay, the share of import quantity has dropped from 50% of our nation’s bins all the way down to 33%.

“Cargo house owners and resolution makers inform us we’re too costly, overregulated and have sophisticated labor points. In the meantime, East and Gulf Coast ports have employed management aligned with policymakers and so they associate collectively state to state with elected officers going to D.C. to get cash for infrastructure tasks.

“Between 2010 and 2020, we obtained left behind on federal funding right here alongside the West Coast. East and Gulf Coast ports acquired greater than $11 billion in comparison with simply over $1.2 billion invested in West Coast ports throughout that 10-year span. And the early tackle the bipartisan infrastructure invoice: two tasks for the West Coast in comparison with greater than 30 for the East and Gulf coast ports.”

Loading…

[ad_2]