[ad_1]

The author is professor of economics and finance at UCL and director of the UCL Centre for Finance

Globally, banks have been posting document will increase in income in 2022. Within the UK as an example, Lloyds introduced that income virtually doubled. One could surprise how financial institution income can dramatically go up throughout a financial coverage tightening cycle.

In any case, banks are imagined to do maturity transformation: borrow brief time period and lend long run. When rates of interest are going up sharply, this implies a fall in web curiosity earnings and subsequently a lower in income.

In reality, web curiosity earnings for banks has dramatically gone up lately and is by far the important thing motive for the surge in financial institution revenue. The rise in web curiosity margins in 2021-22 accounts for 60 per cent of the surge in income, based on a current report by McKinsey.

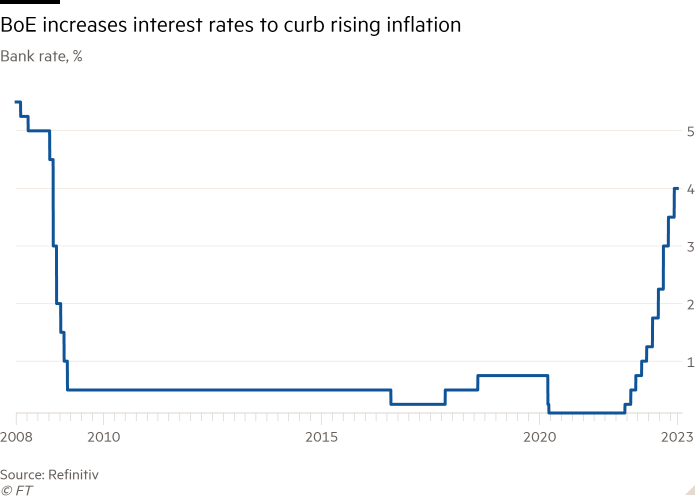

Over the previous 5 quarters, the Financial institution of England’s benchmark base charge went from 0.1 per cent to 4 per cent. Whereas coverage rate of interest rises are shortly handed on to debtors (as anybody with a mortgage properly is aware of), they’re barely transmitted to savers.

As UK readers are in all probability conscious, deposits charges went up solely modestly for the reason that starting of the tightening cycle: the usual charges supplied by the primary British excessive avenue banks are nonetheless under 1 per cent (they had been basically at zero a yr in the past). However banks can now earn a base charge of 4 per cent by parking deposits on the central financial institution.

One may anticipate certainly one of these banks to compete to draw deposits by bidding up charges to take market share, say providing 2 per cent. Then one other financial institution would bid up additional, say to 2.5 per cent, and so forth. In the end, competitors would then convey the deposit charge nearer to 4 per cent.

The speed wouldn’t attain 4 per cent as a result of the banks face prices of offering the providers, however such prices are more likely to be in foundation factors, reasonably than in per cents. Some closing of the hole ought to be anticipated in a aggressive business. That it doesn’t occur is a powerful signal of lack of competitors and it’s the predominant motive why financial institution income go up when central banks sharply tighten financial coverage.

The rationale why competitors doesn’t play out right here just isn’t apparent as there appear to be sufficient banks, in precept to set off such mechanisms. Nevertheless, additionally it is true that the market is dominated by a small variety of huge gamers. Provided that deposits are notoriously sticky (savers should not have the behavior to buy round for higher charges) it might be the case that no main participant has an incentive to deviate and provide greater charges, so long as the others don’t both.

Lack of competitors is a matter generally. Whereas market energy generates further income for shareholders and enormous compensations for managers, it makes shoppers worse off. It additionally hurts the economic system as an entire as a result of the losses to shoppers are higher than the positive factors for the agency. Past this conventional argument, there are right here two extra issues. Luckily, there may be additionally a easy treatment.

The issues are linked to excessive inflation. First, excessive inflation is the explanation for nominal charge will increase. But when will increase are solely partially transmitted to the actual economic system, greater nominal charges are more likely to be wanted to realize the identical tightening. In brief, the shortage of competitors within the deposit sector impairs the transmission of financial coverage.

Second, excessive inflation tends to disproportionally have an effect on much less financially refined family. Such households usually tend to hold their financial savings as deposits than to take a position them in financial institution fairness as an example. If saving charges stored tempo with nominal charge rises, this is able to mitigate the issue. As a substitute, the shortage of competitors within the deposit sector magnifies the price of dwelling disaster.

The answer is easy: make curiosity fee on reserves conditional on banks passing the upper charges to depositors. As an example, the central financial institution may set a most margin as a situation.

That is one thing it may possibly do and may do, as this is able to enhance the transmission of financial coverage, thereby making it simpler to ship on its worth stability mandate. It could additionally assist ease the burden on shoppers throughout what BoE governor Andrew Bailey acknowledged this week as a price of dwelling disaster for many individuals. On the time when central bankers’ jobs is to take painful but wanted choices, a easy reform that goes in the direction of each easing their job and serving to the general public shouldn’t be missed.

[ad_2]