[ad_1]

This put up was initially revealed on TKer.co

Shares declined, with the S&P 500 falling 1.1% final week. The index is now up 6.5% yr so far, up 14.4% from its October 12 closing low of three,577.03, and down 14.7% from its January 3, 2022 closing excessive of 4,796.56.

Over the previous two weeks or so, it appears attitudes have begun to shift favorably relating to financial coverage, financial progress, and the trajectory of inventory costs.

1. The Fed acknowledges inflation is coming down 🦅

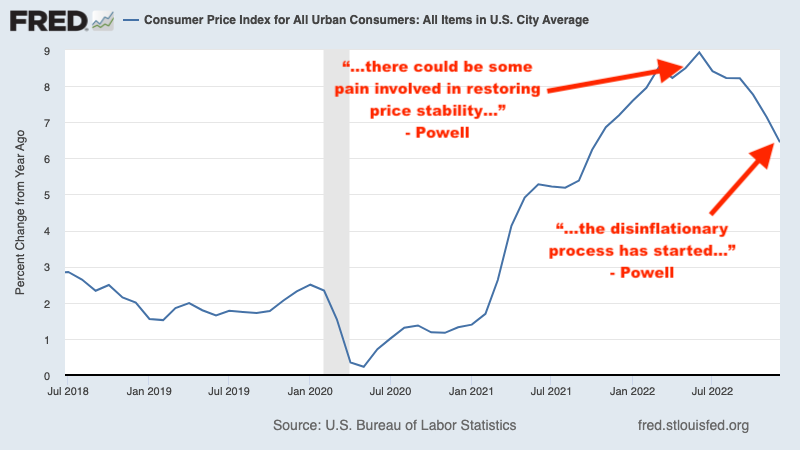

In Could of final yr, Fed Chair Jerome Powell warned “there might be some ache concerned in restoring value stability.” A month later, we discovered inflation was unexpectedly heating up once more. After which on June 15, the Fed introduced an eye-popping 75-basis-point rate of interest hike, the most important enhance the central financial institution made in a single announcement since 1994.

Again then, I defined how these dynamics introduced a conundrum for the inventory market as market beatings would proceed till inflation improved within the Fed’s eyes.

Quick ahead to February 1, following a number of months of cooling inflation information, when Powell stated on the conclusion of the Fed’s financial coverage assembly: “We are able to now say, I feel, for the primary time that the disinflationary course of has began. We are able to see that.“ (Emphasis added.)

“Powell cited the phrase ‘disinflation’ 13 instances on this press convention,” Tom Lee, head of analysis at Fundstrat International Advisors, wrote that day in a word to shoppers. “It is a main change in language and tone and exhibits that the Fed is now formally recognizing the rising disinflation forces underway. In [the December press conference], ‘disinflation’ was used ZERO instances by Powell.”

It is a fairly huge deal for the inventory market, as costs are inclined to backside within the weeks and months earlier than main bullish developments. If this much less hawkish tone from the Fed holds, then it’s potential the October 12 low for the S&P 500 was the start of the subsequent bull market.

“In our view, Chair Powell is inserting extra weight on an ‘immaculate disinflation’ situation, the place inflation pressures subside with out some softening in labor market situations, together with increased unemployment,” Michael Gapen, U.S. economist at BofA, wrote on Tuesday. “This stands in distinction to the Powell from Jackson Gap, Wyoming, final August, who leaned strongly into doing no matter it takes to deliver inflation down and emphasised that inflation was unlikely to subside with out some ‘ache’ in labor markets.”

So long as the inflation numbers proceed to development on the cooler aspect, the Fed appears prone to preserve its much less hawkish tone.

For extra, learn: TKer’s 2022 phrase of the yr: ‘Ache’ 🥊, When the Fed-sponsored market beatings will finish 📈, and The market beatings will proceed till inflation improves 🥊.

Improve to paid

2. The financial system is much less doubtless to enter recession 💪

I can’t pinpoint precisely when the consensus amongst economists was that the U.S. was due for a recession. The troubles actually intensified after we discovered GDP progress was unfavourable in Q1 of final yr, they usually obtained an entire lot worse once we discovered progress was unfavourable in Q2 as nicely.

For extra on how recessions are and aren’t outlined, learn: You name this a recession? 🤨.

Over this era, I’ve been skeptical of the concept the U.S. was destined for a downturn given the large financial tailwinds I couldn’t cease interested by and nonetheless can’t cease interested by.

Coming into 2023, the baseline expectation for a lot of Wall Road companies was that the U.S. would enter a recession in some unspecified time in the future in the course of the yr.

However after the strong January jobs report and expansionary January ISM Companies survey earlier this month, sentiment amongst economists has shifted a bit.

On Monday, Goldman Sachs economist Jan Hatzius revealed a word titled, “Receding Recession Threat,“ wherein he lowered the percentages of the U.S. coming into a recession within the subsequent 12 months to 25% from 35%.

“Continued energy within the labor market and early indicators of enchancment within the enterprise surveys recommend that the chance of a near-term hunch has diminished notably,“ Hatzius wrote.

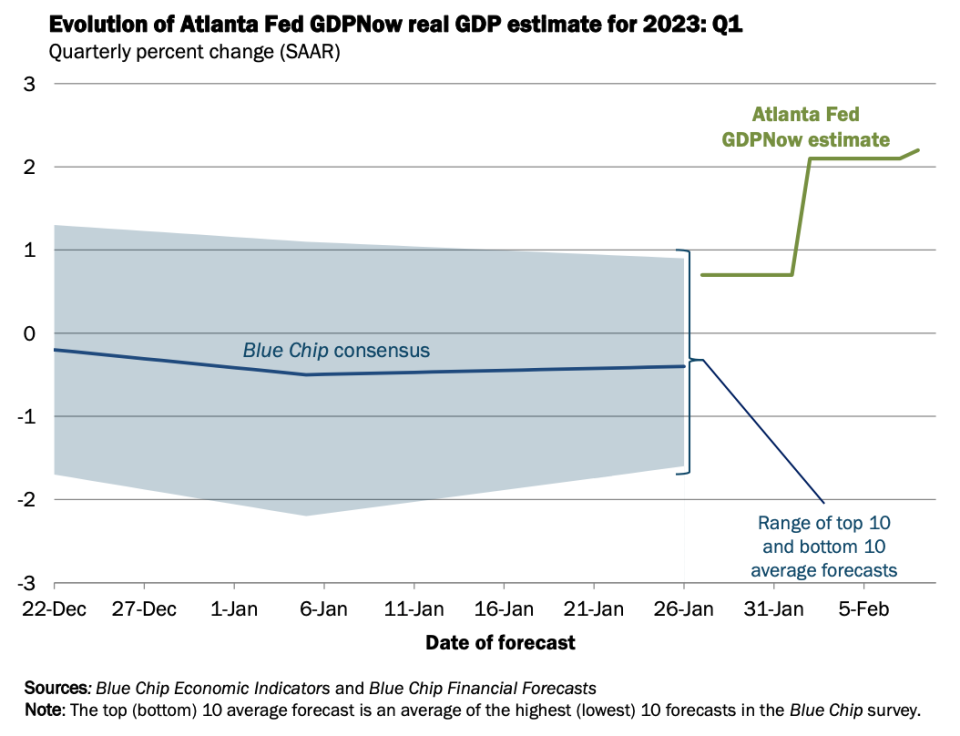

On Wednesday, we discovered the Atlanta Fed’s GDPNow mannequin noticed actual GDP progress climbing at a 2.2% price in Q1. This metric is up significantly from its preliminary estimate of 0.7% progress as of January 27.

On Thursday, The New York Instances revealed an article from Jeanna Smialek titled: “What Recession? Some Economists See Possibilities of a Progress Rebound.“ The title speaks for itself.

On Sunday, The Wall Road Journal revealed an article from Nick Timiraos titled: “Laborious or Delicate Touchdown? Some Economists See Neither if Progress Accelerates.“ It addresses the identical themes.

All that stated, it may take a number of extra weeks of resilient financial information earlier than extra economists formally revise their forecasts to the upside.

For extra, learn: 9 causes to be optimistic in regards to the financial system and markets 💪 and The bullish ‘goldilocks’ smooth touchdown situation that everybody desires 😀.

3. The inventory market won’t crater within the first half 📉

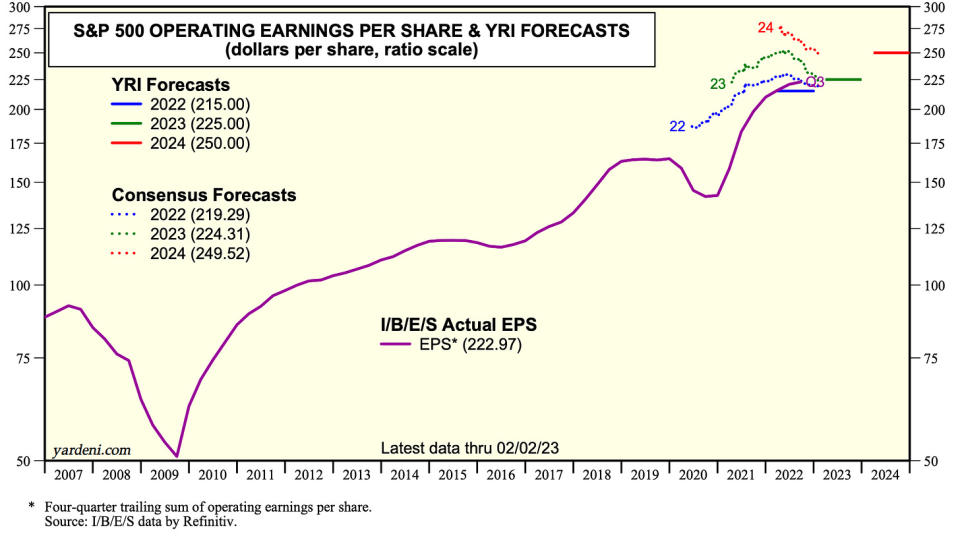

Many distinguished Wall Road strategists warned that the S&P 500 was prone to sell-off sharply in the course of the early a part of 2023 earlier than recovering at the very least a few of these losses later within the yr. This was pushed by the expectation that expectations for earnings would proceed to get revised decrease.

However there have been at the very least three points with all this: 1) shares typically rise in years when earnings fall, 2) shares normally backside earlier than earnings backside, and three) when many individuals anticipate shares to sell-off for a similar purpose, then that data is prone to be already priced into the market.

The S&P 500 is up 6.5% in 2023 up to now, and the index has spent a lot of this era increased than the place it began the yr.

A minimum of one high strategist has deserted his name for an early sell-off. Right here’s Goldman Sachs’ David Kostin in a Feb. 3 word to shoppers (emphasis added):

Current macro developments have strengthened our economists’ confidence in a smooth touchdown and decreased fairness draw back threat within the close to time period. Exterior the US, the expansion image in China has brightened following an earlier-than-expected reopening and Europe is now on observe to keep away from a recession following a warmer-than-expected winter. As well as, Fed Chair Powell this week did little to push again on the easing of economic situations. Our charges strategists’ anticipated path of Treasuries recommend little near-term upside to yields. We due to this fact consider the chance of a considerable drawdown within the close to time period has diminished, barring unexpected information surprises. We elevate our 3-month S&P 500 value goal to 4,000 (-3% from immediately) from 3,600. As proven this week, still-light institutional investor positioning factors to the chance of a chase that might see the market quickly overshoot our S&P 500 goal of 4,000.

A lot of the S&P 500 have introduced quarterly monetary leads to current weeks, and primarily based on what they’ve revealed, it appears to be like just like the outlook for earnings might not be as grim as beforehand anticipated.

“[W]e see no recession forward within the broad financial system — or in earnings — however a smooth touchdown,” Ed Yardeni, president of Yardeni Analysis, stated on Tuesday (h/t Carl Quintanilla). “We’re presently estimating that S&P 500 working earnings might be up 4.7% this yr to $225 per share and 11.1% subsequent yr to $250.”

The S&P 500 is presently buying and selling above most strategists’ year-end goal for the index. Ought to these positive factors maintain and maybe enhance, we may quickly see some strategists revise up their targets.

For extra, learn: Wall Road’s 2023 outlook for shares 🔭, Shares typically rise in years when earnings fall 🤯, Some of the incessantly cited dangers to shares in 2023 is ‘overstated’ 😑, and Everybody’s speaking a few near-term sell-off. A contrarian sign?

What to make of all this

Not everybody thinks resilient financial progress is unambiguously excellent news.

“With very robust job progress, a better labor drive participation price, and a decline within the unemployment price to the bottom stage since 1969, it’s starting to look extra like a ‘no touchdown’ situation,” Apollo’s Torsten Slok wrote in a February 4 word. “Beneath the no touchdown situation the financial system doesn’t decelerate, and upside dangers to inflation are coming again after the preliminary decline in inflation pushed by provide chain enhancements.”

Renewed issues about inflation may drive the Fed to get extra hawkish, which places financial progress and rising inventory costs in danger. In different phrases, excellent news may turn out to be unhealthy information as soon as once more. For extra on this dynamic, learn: Your information to ‘excellent news is unhealthy information’ and ‘unhealthy information is sweet information’ 🙃.

But when there’s one factor we’ve discovered in current months, it’s that we will concurrently have consecutive months of wholesome job progress and inflation readings that are available cool. For extra on this dynamic, learn: The bullish ‘goldilocks’ smooth touchdown situation that everybody desires 😀.

As all the time, time will inform what really occurs. However in the interim, the optimists look like triumphing over the pessimists as inflation, financial progress, and inventory costs have been trending favorably in current months.

–

Extra from TKer:

That’s attention-grabbing! 💡

Do you know cricket is the second most watched sport on the planet? And it’s rising within the U.S. in a giant manner. From JohnWallStreet:

…American Cricket Enterprises (ACE), the entity working Main League Cricket (MLC), has raised greater than $100 million. ACE founders Sameer Mehta, Vijay Srinivasan, Satyan Gajwani and Vineet Jain — and the steadiness of firm buyers — are betting the league will be capable of draw the game’s high gamers and entice curiosity from followers across the globe, turning into a staple of the cricket calendar within the course of. If it will possibly, membership valuations will “develop like a hockey stick,” Sanjay Govil (chairman, Infinite Laptop Options and CEO, Zyter Inc.) stated. Govil owns the crew in Washington D.C. Dallas, San Francisco, Los Angeles, New York Metropolis and Seattle may also have golf equipment taking part in within the inaugural ’23 season, which is slated to happen from June 13-30.

Reviewing the macro crosscurrents 🔀

There have been a number of notable information factors from final week to contemplate:

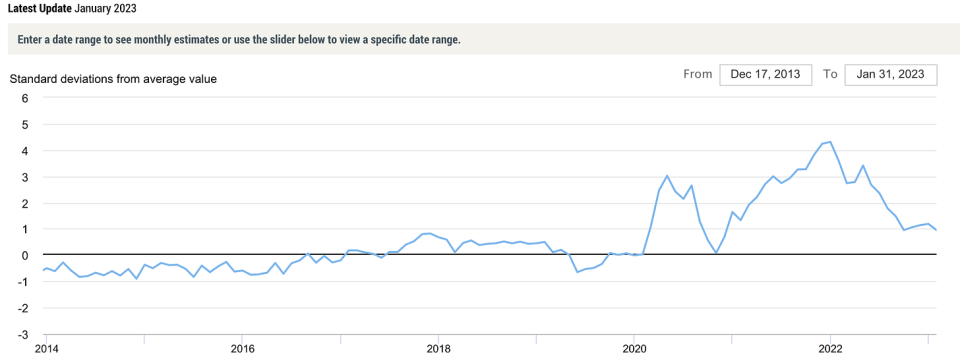

⛓️ Provide chains proceed to enhance. The New York Fed’s International Provide Chain Stress Index

— a composite of varied provide chain indicators — fell in January and is hovering at ranges seen in late 2020. It is manner down from its December 2021 provide chain disaster excessive.

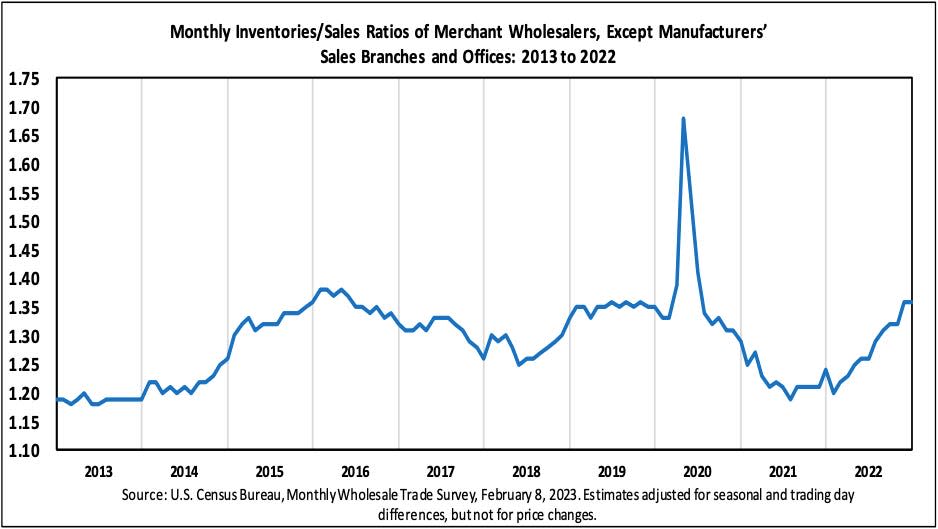

📈 Stock ranges are up. In line with Census Bureau information launched Tuesday, wholesale inventories climbed 0.1% to $932.9 billion in December. The inventories/gross sales ratio was 1.36, up considerably from 1.24 the earlier yr.

For extra on provide chains and stock ranges, learn: “We are able to cease calling it a provide chain disaster ⛓,“ “9 causes to be optimistic in regards to the financial system and markets 💪, “and “The bullish ‘goldilocks’ smooth touchdown situation that everybody desires 😀.“

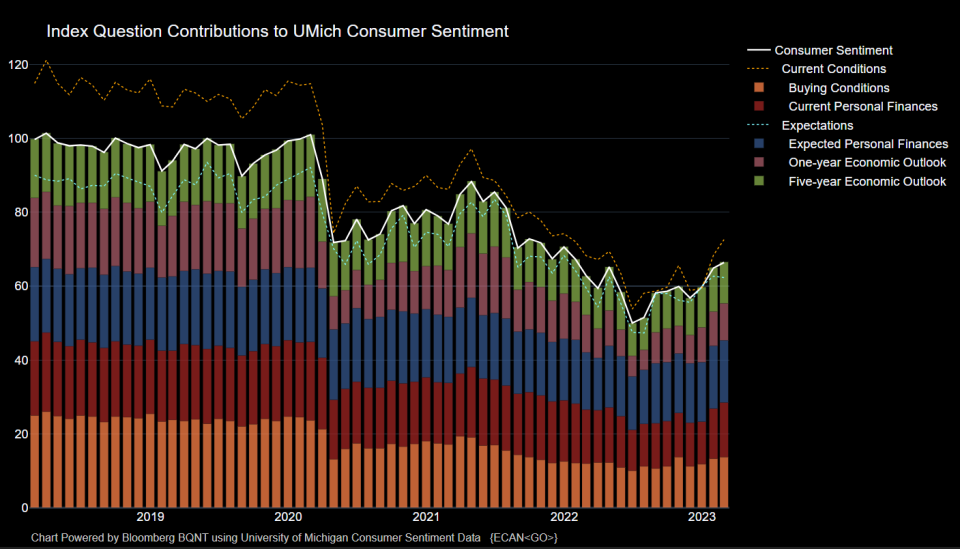

👍 Shopper sentiment is enhancing. From the College of Michigan February Survey of Shoppers: “After three consecutive months of will increase, sentiment is now 6% above a yr in the past however nonetheless 14% beneath two years in the past, previous to the present inflationary episode. General, excessive costs proceed to weigh on customers regardless of the current moderation in inflation, and sentiment stays greater than 22% beneath its historic common since 1978.“

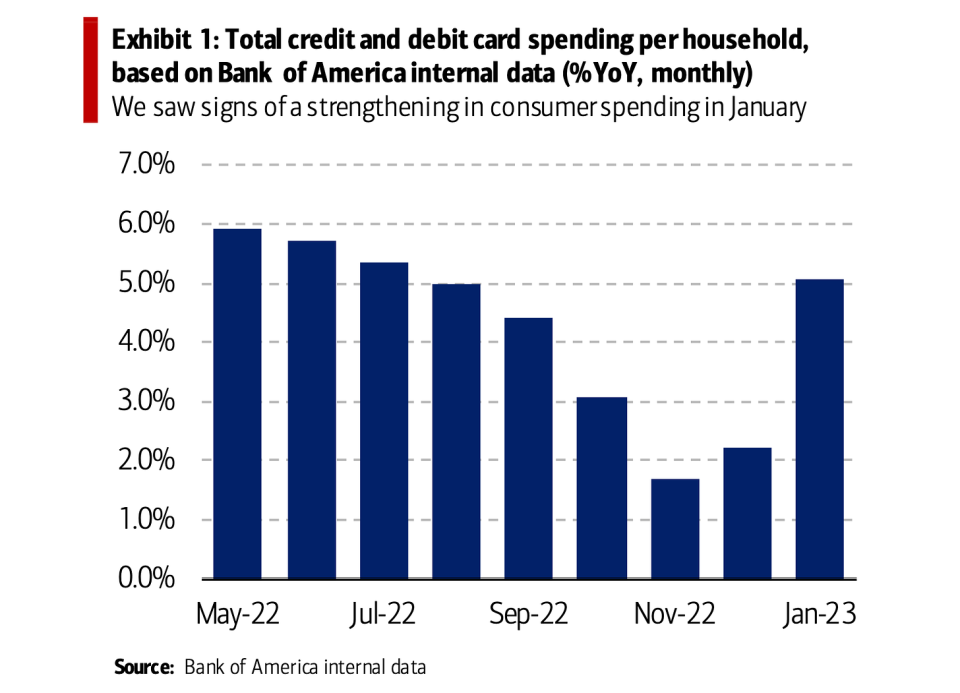

🛍️ Shoppers are spending. From BofA: “We noticed indicators of strengthening in shopper spending in each retail and providers in January, accelerating from December. Whole Financial institution of America credit score and debit card spending per family was up 5.1% YoY in January, vs. 2.2% YoY in December. On a month-over-month (MoM) seasonally adjusted (SA) foundation, whole card spending per family was up 1.7%, greater than reversing the 1.4% MoM decline in December.“

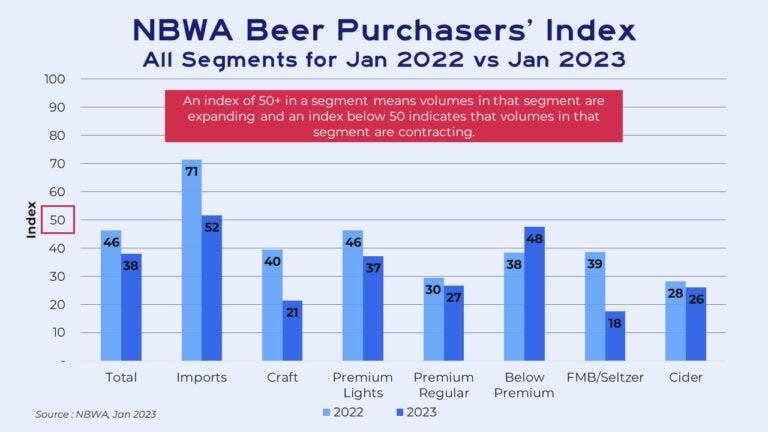

🍻 They’re shopping for low cost beer. From FreightWaves’ Rachel Premack: “…Beer turned immediately dear on the finish of final yr. Beer costs at retail, which doesn’t embody bars or eating places, popped 7% over the past 13 weeks of 2022… That value enhance is exhibiting up in how individuals are shopping for brews, stated Dave Williams, vp of Bump Williams Consulting. Persons are more and more shopping for, say, 12-packs over 30-packs and even single servings of beer. They’re buying and selling down too — snagging the extra financial Keystone over comparatively dear Coors. That explains why the “beneath premium” section was the one one to see a rise in demand in January in comparison with January 2022, in accordance with the Nationwide Beer Wholesalers Affiliation’s Beer Purchasers’ Index…”

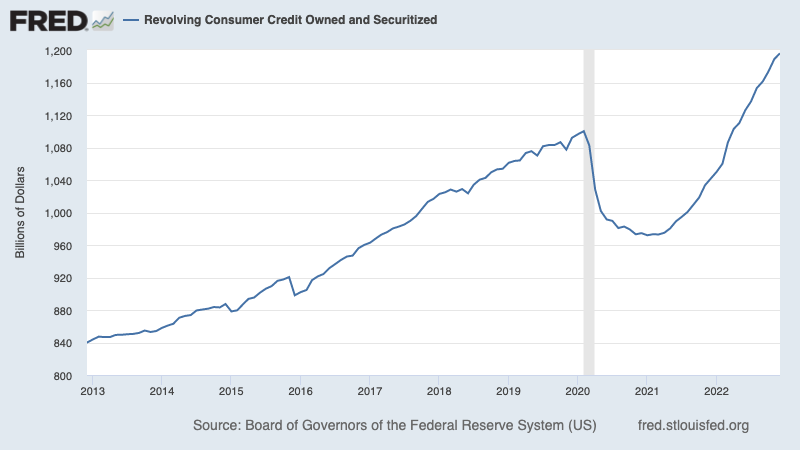

💳 Shoppers are taking up extra debt, however ranges are manageable. In line with Federal Reserve information, whole revolving shopper credit score excellent elevated to $1.196 trillion in December. Revolving credit score consists largely of bank card loans.

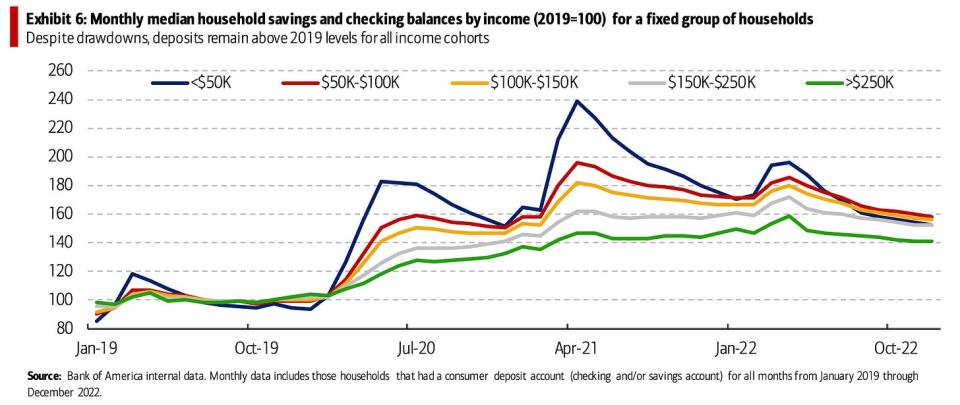

Whereas the combination borrowing appears excessive, they’re way more affordable whenever you have a look at shopper funds extra holistically. From BofA: “On the financial savings aspect, Financial institution of America inner information suggests median family financial savings and checking balances throughout earnings teams have been trending down since April 2022, with the bottom earnings group (<$50k) seeing the steepest drawdown. However deposits stay above 2019 ranges (Exhibit 6) for all earnings cohorts.“

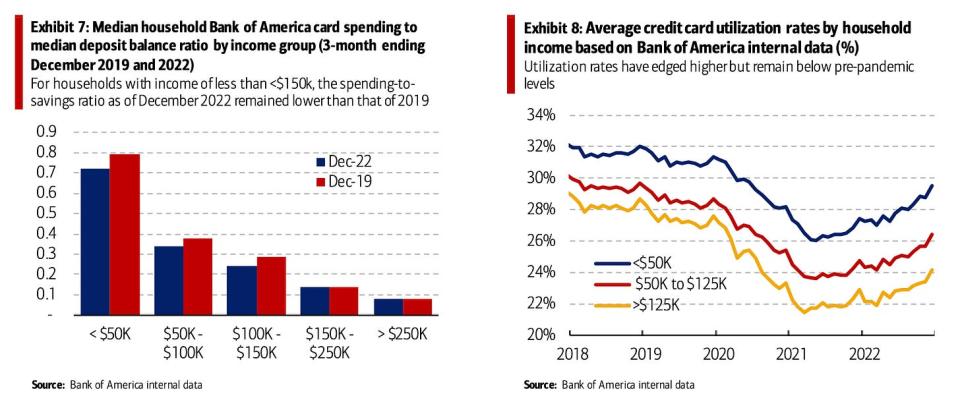

💳 No, they aren’t maxing out their bank cards. From BofA: “Decrease earnings customers seem to nonetheless have some stage of consolation by way of their monetary constraints. On the one hand, the ratio of median family card spending to median deposit balances (spending-to-savings ratio) remained decrease than in 2019 for households with an annual earnings of lower than <$150k (Exhibit 7). This means this cohort’s spending wouldn’t must be decreased an excessive amount of for the spending-to-savings ratio to return to 2019 ranges. However, the Financial institution of America bank card utilization price additionally remained decrease than in 2019 throughout earnings teams (Exhibit 8).“

For extra on this, learn: Shopper funds are in remarkably fine condition 💰

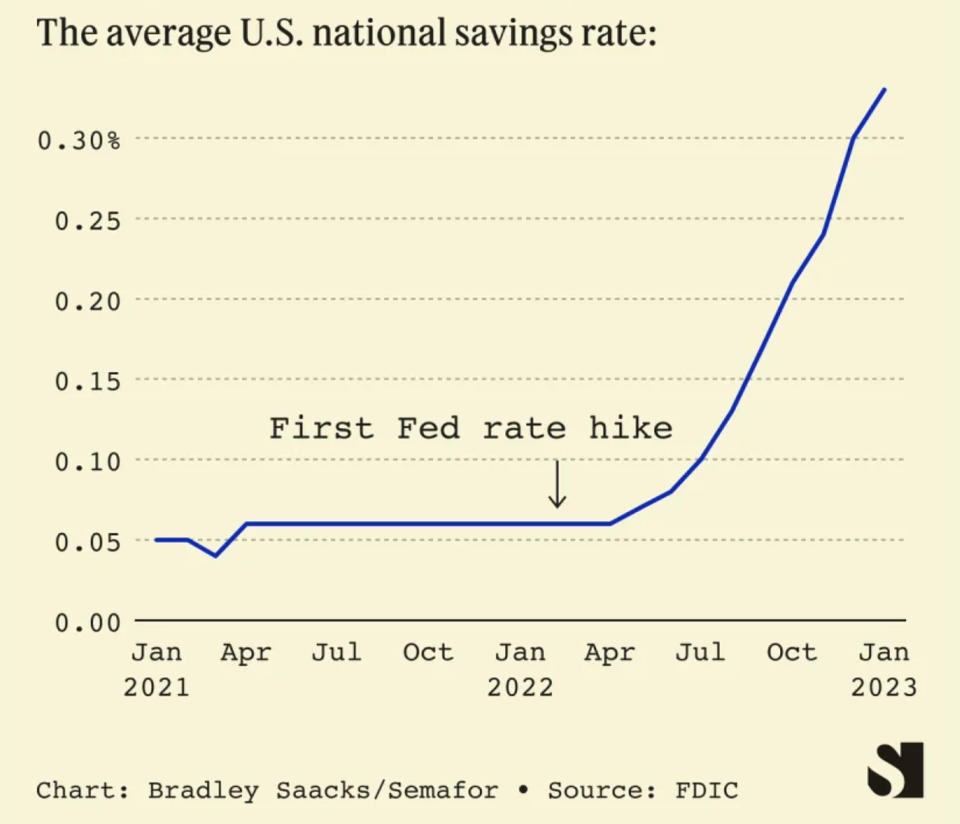

💵 Shoppers are getting extra on their financial savings accounts. From Semafor’s Liz Hoffman: “The common financial savings account price has quintupled since final January to 0.33%, in accordance with information from the U.S. Federal Deposit Insurance coverage Company…“

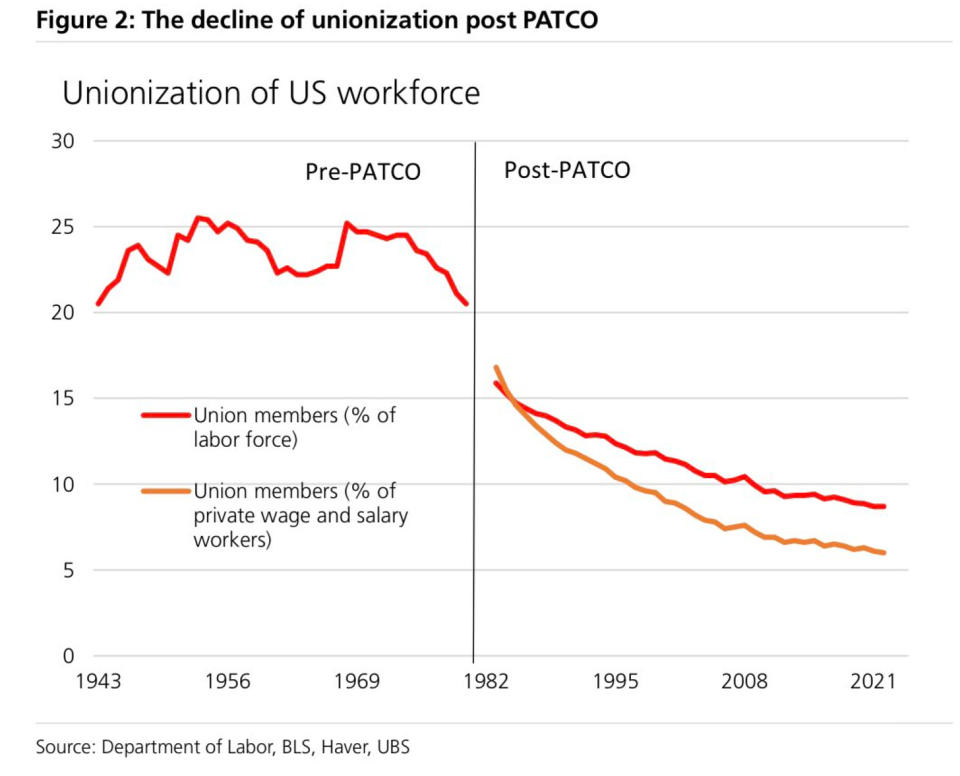

🤔 Low union participation helps clarify low wage progress. From UBS: ““Wage progress is slowing noticeably alongside a number of measures even with a a long time low unemployment price. Why? … One purpose might be low bargaining energy for employees… The share of unionized employees amongst personal workers fell to six% in 2022, in accordance with the BLS.”

💰 Wall Road is busy. From Bloomberg on Tuesday: “About seven IPOs are anticipated to boost a mixed $900 million and start buying and selling by Friday [Feb. 10], making for the busiest week since October’s $990 million itemizing by Intel Corp.’s self-driving know-how unit Mobileye International Inc., in accordance with information compiled by Bloomberg. [Last] week’s debuts embody solar energy tools maker Nextracker Inc., which plans to boost as a lot as $535 million in what can be the yr’s greatest deal but. Enlight Renewable Vitality Ltd., which is already public in Israel, plans so as to add an inventory on the Nasdaq.“

And it’s not simply IPOs. There have been quite a few experiences of dealmaking exercise final week involving some huge names (hyperlink).

📉 👎 Massive firms announce layoffs. On Monday, Bloomberg reported that Dell Applied sciences can be “eliminating about 6,650.“ On Tuesday, Zoom introduced it will “say goodbye to round 1,300 hardworking, gifted colleagues.“ On Wednesday, Disney introduced it will be “decreasing our workforce by roughly 7,000 jobs.“ On Thursday, Information Corp introduced “an anticipated 5% headcount discount, or round 1,250 positions,” and Axios reported that Yahoo would lay off “greater than 1,600 folks.”

Right here’s UBS economist Paul Donovan providing some perspective: “One other firm—Disney this time — has introduced headcount reductions. We get US preliminary jobless claims information [Thursday], and the macroeconomic information doesn’t match the excessive profile press releases of job losses. A serious purpose is that giant firms will not be that essential economically — smaller companies matter most to labor markets. Smaller companies are inclined to have underemployment relatively than unemployment. It’s fairly exhausting to fireplace 10% of a three-person firm.“

For extra on this, learn: Making sense of conflicting information on the labor market 🤔.

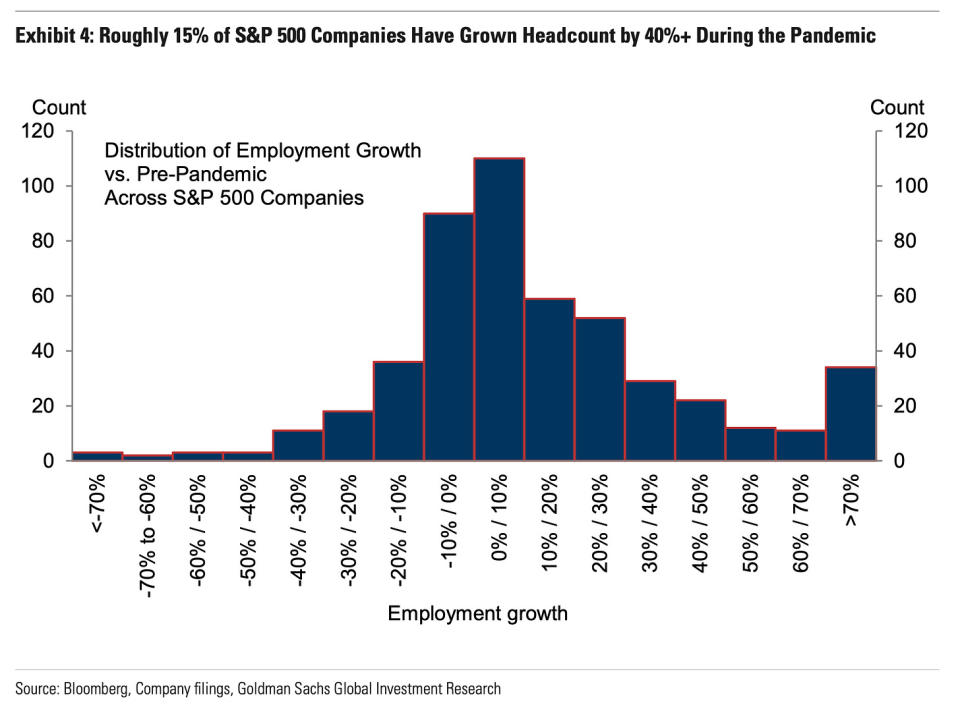

⚠️ Extra huge layoff bulletins to come back? Goldman Sachs economists suppose it’s potential. From a analysis word revealed Monday: “…on the unfavourable aspect, there might be further layoff bulletins but to come back from different giant firms, as roughly 15% of firms within the S&P 500 have seen headcount will increase of 40% or extra because the begin of the pandemic (Exhibit 4), and solely one-fifth of them have introduced layoffs up to now.“

However: “…on the optimistic aspect, just like the rebalancing seen up to now within the broader labor market, even these firms which have introduced layoffs have decreased their whole demand for employees overwhelmingly by decreasing job openings relatively than by conducting layoffs.“ For extra on job openings, learn: How job openings clarify all the things within the financial system and the markets proper now 📋.

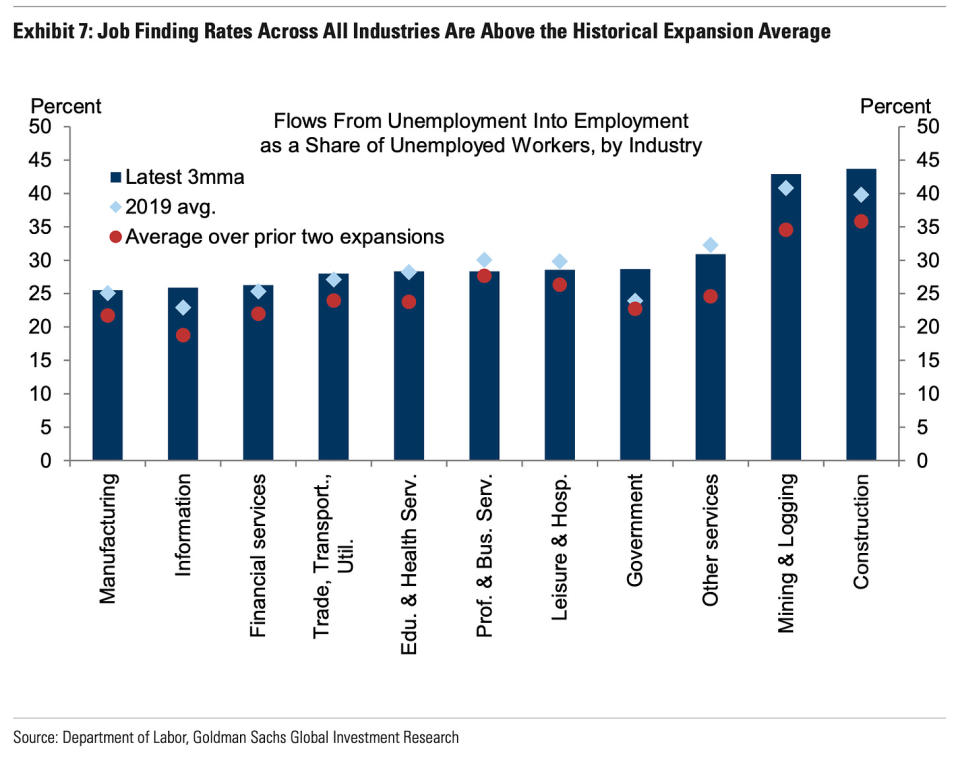

Additionally: “…Exhibit 7 exhibits that the majority industries (8 out of 11) have reemployment charges above pre-pandemic ranges, together with the knowledge sector (the sector of most main tech firms), and that each one of them have reemployment charges which are above the current growth common.”

I’ve began an off-the-cuff thread on Twitter monitoring anecdotes of firms hiring (Hyperlink).

For extra on hiring, learn: That is quite a lot of hiring 🍾 and You shouldn’t be stunned by the energy of the labor market 💪.

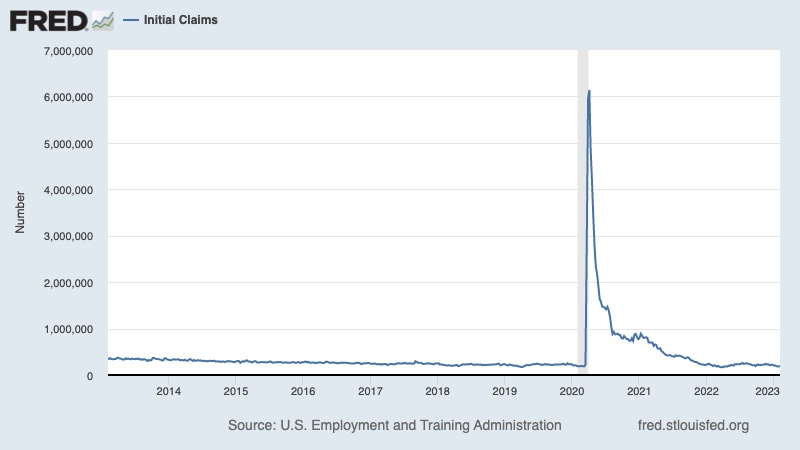

💼 Unemployment claims stay low. Preliminary claims for unemployment advantages climbed to 196,000 in the course of the week ending Feb. 4, up from 183,000 the week prior. Whereas the quantity is up from its six-decade low of 166,000 in March, it stays close to ranges seen in periods of financial growth.

For extra on low unemployment, learn: 9 causes to be optimistic in regards to the financial system and markets 💪.

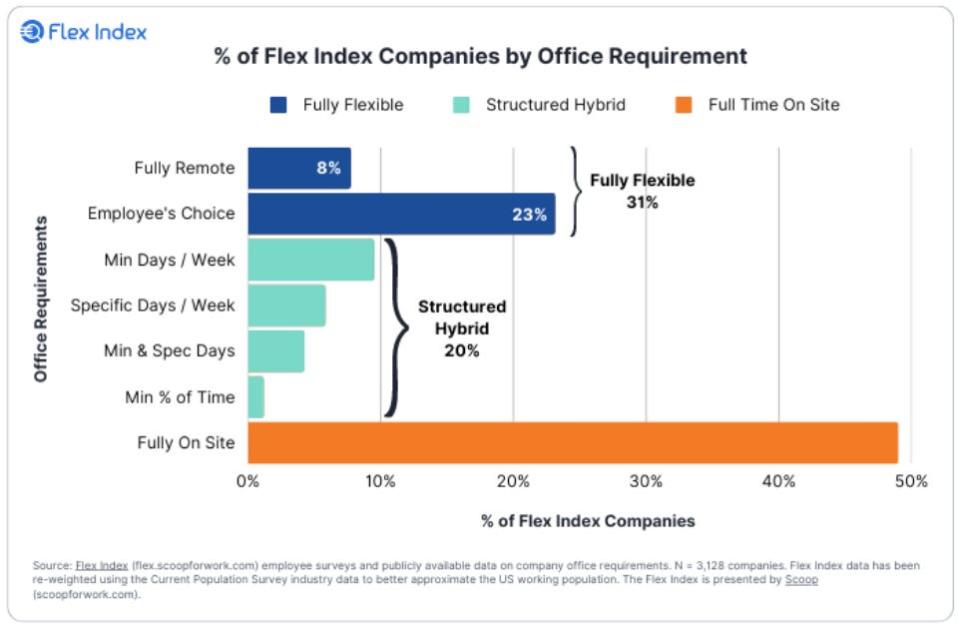

🏠 On work at home #WFH. From Stanford professor Nick Bloom: “Information on 4,000 U.S. companies #WFH insurance policies: 1) 50% of companies are absolutely on-site, like food-service, lodging and retail, 2) 40% mix #WFH and in individual days in varied methods: min-days, anchor days, worker selection and so on, 3) 8% are absolutely distant“

Placing all of it collectively 🤔

We’re getting quite a lot of proof that we might get the bullish “Goldilocks” smooth touchdown situation the place inflation cools to manageable ranges with out the financial system having to sink into recession.

And the Federal Reserve has not too long ago adopted a much less hawkish tone, acknowledging on February 1 that “for the primary time that the disinflationary course of has began.“

However, inflation nonetheless has to come back down extra earlier than the Fed is snug with value ranges. So we should always anticipate the central financial institution to proceed to tighten financial coverage, which implies we must be ready for tighter monetary situations (e.g. increased rates of interest, tighter lending requirements, and decrease inventory valuations). All of this implies the market beatings might proceed and the chance the financial system sinks right into a recession might be elevated.

It’s essential to do not forget that whereas recession dangers are elevated, customers are coming from a really robust monetary place. Unemployed individuals are getting jobs. These with jobs are getting raises. And plenty of nonetheless have extra financial savings to faucet into. Certainly, robust spending information confirms this monetary resilience. So it’s too early to sound the alarm from a consumption perspective.

At this level, any downturn is unlikely to show into financial calamity on condition that the monetary well being of customers and companies stays very robust.

As all the time, long-term buyers ought to do not forget that recessions and bear markets are simply a part of the deal whenever you enter the inventory market with the intention of producing long-term returns. Whereas markets have had a horrible yr, the long-run outlook for shares stays optimistic.

For extra on how the macro story is evolving, take a look at the earlier TKer macro crosscurrents »

For extra on why that is an unusually unfavorable setting for the inventory market, learn: The market beatings will proceed till inflation improves 🥊 »

For a more in-depth have a look at the place we’re and the way we obtained right here, learn: The sophisticated mess of the markets and financial system, defined 🧩 »

This put up was initially revealed on TKer.co

Sam Ro is the founding father of TKer.co. Comply with him on Twitter at @SamRo

Learn the most recent monetary and enterprise information from Yahoo Finance

Obtain the Yahoo Finance app for Apple or Android

Comply with Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube

[ad_2]