[ad_1]

Impulsively the inventory market “geniuses” that had been minted through the Covid stimulus days do not look so sensible. And all it took was for the free cash to expire…think about that.

That was the subject of a brand new Wall Road Journal article that explored the demise of the exact same retail merchants who had been residing the excessive life simply months in the past. The article contains examples like Omar Ghias, who “amassed roughly $1.5 million as shares surged through the early a part of the pandemic” however now works at a deli in Las Vegas making $14 per hour, plus suggestions, after blowing all of it on unhealthy bets and extreme spending.

“I’m ranging from zero,” he advised the Journal, after spending on issues like sports activities betting, bars and luxurious automobiles. He outlined the trail of his now-deceased fortune to the Journal:

As soon as the pandemic started, he gravitated to shares and funds monitoring the efficiency of metals in addition to choices, which permit traders to purchase or promote shares at a sure worth. He used these to generate earnings or revenue from inventory volatility. He additionally borrowed from his brokerage companies to amplify his positions, a tactic referred to as leverage.

In 2021, he began growing that leverage, his brokerage statements present. He typically turned to trades tied to the Invesco QQQ Belief, a preferred fund monitoring the tech-heavy Nasdaq-100 index, whereas persevering with to guess closely on metals. At instances, he dabbled in choices tied to scorching shares similar to Tesla Inc. and Apple.

At one level, his leverage amounted to greater than $1 million, brokerage statements reviewed by The Wall Road Journal present. By round June 2021, based on these brokerage statements, his portfolio was value roughly $1.5 million.

“I actually began treating the market like a on line casino,” he stated. He began betting 1000’s on soccer video games – together with a $35,000 dropping guess on the Tremendous Bowl – having fun with late nights at bars and consuming Don Julio 1942 tequila. He additionally took on Vegas, paying for mates to return stick with him and renting a black Lamborghini to race up and down the strip.

“I felt like I used to be indestructible. It was irrational,” he advised WSJ.

One among his largest bets available in the market, betting on gold and silver to rally through a place in Hecla Mining, was swiftly carried out after the Fed introduced it was going to drag again on its simple cash insurance policies in late 2021. He misplaced $300,000 in a single account even because the S&P was up 27% that yr. “That was my breaking level,” he stated.

Omar is not alone. He’s like many different retail merchants who noticed their heyday through the runups of names like GameStop, AMC and Mattress Tub and Past – all spurred by the Fed’s cash printer rattling off trillions of {dollars} to stimulate the economic system within the midst of the pandemic.

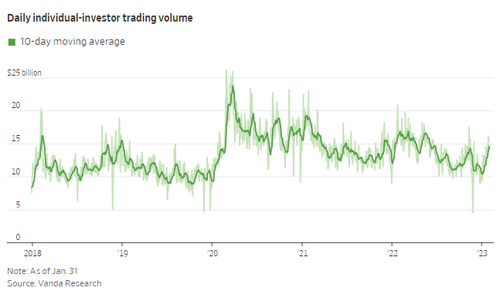

The truth is, “The typical particular person investor’s portfolio has declined 27% since peaking in December 2021,” the Journal writes, citing Vanda Analysis. Month-to-month lively customers on Robinhood – the brokerage of alternative for retail traders through the pandemic – fell to their lowest stage because the firm went public.

The Journal additionally interviewed Sumit Gupta, a 49-year-old ophthalmologist in Charlotte. He says he’s now being extra conservative along with his bets and greenback price averaging as markets transfer decrease. “Now there’s yield on money once more. At this stage in my profession, I don’t should be aggressive,” he stated.

One other dealer interviewed by the Journal was 32 yr previous Navroop Sandhu, who began buying and selling through the early days of the pandemic with eToro. “It was like a snowball impact, the place I simply bought addicted,” she stated, after making a living from the onset. However she now locations solely 2 to five trades every week the place she used to position as much as 10 every week, she stated. She’s attempting to be affected person in deciding on her positions because the market falls.

But nother dealer, 28 yr previous Jonathan Javier, watched his portfolio double by means of November 2021 – however by the center of 2022, it was down about 8%. He has slowed down his common investments however is shopping for some tech inventory once more this yr.

He stated: “Now I do know the important thing to creating a revenue is shopping for when the inventory is at a low worth level as a substitute of simply shopping for and ‘hoping’ that I’ll make a acquire from it.”

Wonderful evaluation, Jonathan.

Loading…

[ad_2]