[ad_1]

By Michael Msika, Bloomberg markets reside reporter and analyst

An rising variety of traders are shopping for any dip they will, satisfied {that a} extra dovish flip from central banks is simply across the nook towards the comforting backdrop of a gentle touchdown for the economic system. However on the similar time, they’re bulking up on hedges, simply in case.

All eyes had been on Fed Chair Jerome Powell this week as he cautioned that charges could transfer increased than beforehand anticipated, given the energy of the job market. Suffice to say, any weak spot in inventory futures prompted by his warning was purchased on each side of the Atlantic.

In response to Barclays strategist Emmanuel Cau, a sample of brief masking by hedge funds and systematic methods including fairness publicity is now “properly superior.” However long-only funds that missed out on latest beneficial properties are nonetheless defensively positioned and could also be tempted to make up floor by capitalizing on any declines, he says.

“Threat-reward after such a robust run feels extra balanced, and a few consolidation is logical,” Cau says. “However for now, we expect markets should still have good causes to imagine in a gentle touchdown.”

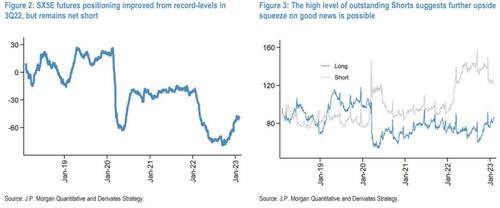

Whereas some traders may be chasing the rally, others are boosting their hedges, with an eye fixed on dangers that also lie forward. The entire variety of places traded on the Euro Stoxx 50 was greater than thrice the variety of calls this week, a comparatively uncommon incidence. In the meantime, total positioning in equities remains to be low and a very good motive why markets may preserve rising for at the very least just a few weeks.

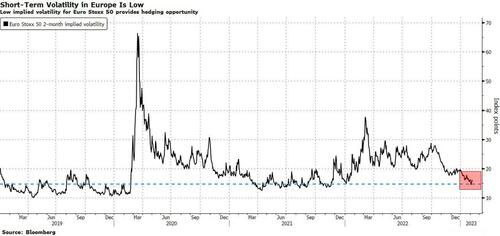

“Positioning stays comparatively weak regardless of its enchancment over the past quarter,” says JPMorgan derivatives strategist Davide Silvestrini. “This in flip may assist short-term efficiency.” Low implied volatility gives a hedge towards the danger of market squeezing increased within the close to time period — by means of April name spreads, for instance, Silvestrini says.

Within the medium time period, the image is more likely to reverse, in keeping with JPMorgan’s crew of strategists. Whereas markets are shifting increased on expectations that disinflation can happen with out important weak spot in financial progress, this state of affairs is unlikely to materialize, they are saying. They count on earnings and macro expectations to disappoint past the primary quarter and advocate utilizing present energy to cut back publicity.

Buyers could have been too fast to cost in a gentle touchdown. The job market remains to be on hearth, threatening to maintain inflation increased for longer, one thing that central banks have warned about many times.

US inflation numbers subsequent week loom as an enormous take a look at for equities. “The labor market wants to chill for the Fed to hit its inflation goal,” says UBS Wealth Administration CIO Mark Haefele. “With unemployment at 3.4%, the bottom stage since 1969, this seems onerous to realize.”

Down the road, many giant asset managers stay skeptical of a benign final result and count on the economic system to weaken, which can finally deal a blow to shares. Developed-market equities have rallied on hopes of a rebound in progress, prompting some traders to dive in for worry of lacking out. However these shares “aren’t absolutely pricing the recession hit we see forward,” BlackRock Funding strategists led by Jean Boivin say.

Loading…

[ad_2]