[ad_1]

This text is an on-site model of our Disrupted Occasions e-newsletter. Enroll right here to get the e-newsletter despatched straight to your inbox thrice per week

At this time’s high tales

-

Turkey was hit by a second earthquake after greater than 1,900 have been killed by the most important tremor in 80 years, inflicting destruction throughout the nation and in neighbouring Syria.

-

Recriminations continued over the US resolution to shoot down China’s climate/spy balloon on the weekend. Right here’s our explainer on the affair.

-

The Rothschild household is planning to take its funding financial institution, Rothschild & Co, personal as rising rates of interest and financial uncertainty deliver an finish to the interval of frenzied dealmaking through the pandemic.

For up-to-the-minute information updates, go to our stay weblog

Good night.

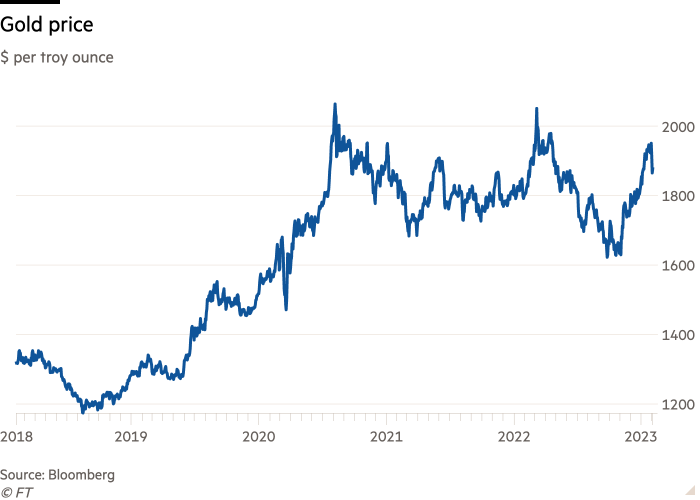

A $17bn takeover bid — doubtlessly the most important acquisition deal this yr — has thrown the highlight on the surging world demand for gold, pushed by big purchases from central banks in addition to retail traders searching for safety towards inflation.

The transfer by US-listed Newmont, the world’s largest gold miner, to purchase Australian rival Newcrest, might spark a bidding struggle as different teams look to consolidate.

A deal would reunite the businesses. Newcrest was initially established as Newmont’s Australian arm within the Sixties earlier than being spun out in 1990 after it merged with BHP’s gold property. It will additionally put 4 of Australia’s 5 largest gold mines beneath the management of 1 firm and require Australian authorities approval.

The rise in gold demand to a document 4,741 tonnes final yr — the very best in a decade — has been fuelled by “colossal” purchases from central banks, led by China and Russia. Its standing as a protected haven asset at a time of geopolitical upheaval has been turbocharged by the “distrust, doubt and uncertainty” that has adopted the choice of the US and its allies to freeze Russia’s greenback reserves.

Costs have additionally been buoyed by the anticipated slowdown in US rate of interest will increase.

The final time the world skilled this degree of shopping for marked an enormous turning level within the world financial system. A European rush to purchase US gold in 1967 led to a run on the value, the collapse of the London Gold Pool of reserves and the eventual finish of the Bretton Woods system that tied the worth of the US greenback to the valuable steel.

And whereas disruption from the struggle in Ukraine has helped make gold a sought-after asset, it’s also helpful for would-be sanctions busters, notes Jonathan Guthrie, head of the FT Lex column. Bullion might be traded way more simply past US oversight than {dollars}.

Given its historical past of embroilment in cash laundering, sanctions enforcers may wish to take a detailed curiosity within the London market particularly, he suggests. Greater than 9,000 tons of gold, value greater than $500bn, sits in repositories inside the M25 — greater than in Fort Knox.

Must know: UK and Europe financial system

At this time’s motion by nurses, ambulance employees and paramedics in England and Wales is the largest strike in NHS historical past. Because the well being system nears its seventy fifth birthday, world well being editor Sarah Neville tackles the large query: is the NHS damaged? The pinnacle of pharma firm Sanofi stated UK financial coverage meant the nation was falling behind in healthcare innovation.

The “wrecking ball of upper inflation and rates of interest” has led to UK building exercise hitting its lowest degree of exercise in additional than two years, in response to new PMI survey knowledge. Financial institution of England policymaker Catherine Mann stated it was too early to make sure excessive inflation had been defeated and that extra rate of interest rises have been seemingly.

Must know: world financial system

US president Joe Biden provides his state of the nation tackle tomorrow. Our newest Huge Learn examines his case for a second time period and whether or not excellent news on job creation — as evidenced in Friday’s bumper figures — might override voters’ anger over inflation.

Whereas overseas vacationers have returned, many Japanese are nonetheless reluctant to journey for fears of catching Covid-19, in addition to the weak spot of the yen. Earlier than the pandemic, about 20mn Japanese residents travelled abroad annually and spent $21.3bn, in response to the UN World Tourism Group.

The pinnacle of Anglo American, one in all South Africa’s largest traders, warned that the nation’s financial system was beneath menace from energy cuts, logistical issues and corruption.

An export growth and the top of pandemic restrictions helped Indonesia’s financial system to develop on the highest charge in virtually a decade final yr. Gross home product progress of 5.3 per cent was fuelled by a 16.3 per cent soar in exports, led by commodities reminiscent of coal.

Thousands and thousands of former dabai or “large whites” — the hazmat-suited employees who enforced China’s strict pandemic restrictions — have been left jobless, disillusioned and indignant by the abrupt finish of Beijing’s zero-Covid coverage.

Must know: enterprise

The Premier League accused Manchester Metropolis of breaching monetary guidelines after a four-year investigation into the English soccer champions. An unbiased fee could have the facility to impose sanctions, together with “limitless” fines, factors deductions and even expulsion from the league.

A $3.9bn accounting scandal surrounding retail chain Americanas has shaken Brazil, ensnaring a few of the nation’s richest males and sparking bitter recriminations and accusations of fraud.

Monetary markets are rallying as fears of an financial slowdown begin to fade and traders pile again into riskier property. “Markets are pricing in the long run of the inflation drawback and . . . very closely discounting the danger of a tail occasion,” stated one analysis chief.

The search wars are again, this time targeted on the usage of synthetic intelligence. Huge Tech corporations are utilizing their cloud computing arms to pursue tie-ups with AI start-ups, sparking questions on their function as each suppliers and opponents within the battle over “generative AI”. Columnist Rana Foroohar warns of the risks of essential regulatory selections being left to consultants behind closed doorways.

Whereas world air journey is recovering, the US home market has been hit by cancelled flights, lacking luggage and disappearing routes, spurring requires tighter regulation. The growth in on-line procuring and congestion at ports drove an enormous improve in air freight through the pandemic, however will the expansion proceed as delivery issues ease? Watch our new video.

The world of labor

Organisations must rethink standard profession timetables and introduce components reminiscent of a “mid-life MOT” if they’re to lure again older employees, says columnist Camilla Cavendish.

How lengthy might you survive and not using a common earnings? Listed here are some suggestions on methods to survive the monetary shocks of redundancy.

Some excellent news

Chinese language researchers have found a approach of producing hydrogen by splitting seawater with out the necessity to desalinate or purify it first. FT science commentator Anjana Ahuja explains the know-how and its significance.

Really helpful newsletters

Working it — Uncover the large concepts shaping at present’s workplaces with a weekly e-newsletter from work & careers editor Isabel Berwick. Enroll right here

The Local weather Graphic: Defined — Understanding crucial local weather knowledge of the week. Enroll right here

Thanks for studying Disrupted Occasions. If this article has been forwarded to you, please join right here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks

[ad_2]