[ad_1]

By John Liu and April Ma, BBG Markets Dwell strategists and reporters

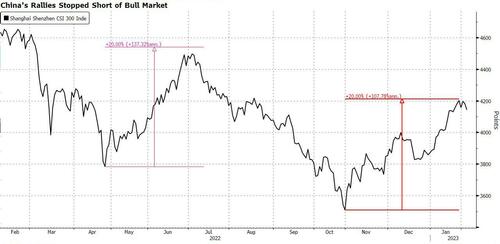

The reopening euphoria that vaulted a key Chinese language benchmark to the brink of a bull market is shedding steam, highlighting investor warning in regards to the tempo of financial restoration.

China’s inventory market carried out poorly final week whilst knowledge through the Lunar New Yr holidays confirmed customers are venturing out once more and a slew of financial knowledge beat estimates.

The CSI 300 benchmark snapped a four-week profitable streak, whereas the Shanghai Composite Index’s 0.7% drop on Friday was its steepest in almost seven weeks. The Hold Seng China Enterprises Index completed its worst week since October with a 5% drop.

The deliberate overhaul to China’s IPO guidelines that might make it simpler for corporations to checklist onshore, hailed a “important milestone” by Goldman Sachs, additionally did not elevate sentiment. As an alternative, buyers nervous in regards to the potential oversupply of shares.

“Sentiment within the weeks earlier than the Lunar New Yr vacation was lifted by expectations of a spending splurge over the vacation, however the actuality wasn’t as sensible as anticipated,” mentioned Du Kejun, fund supervisor at Beijing Gelei Asset Administration Heart Restricted Partnership. “Buyers could look to first-quarter figures for extra conviction, however I believe hesitation is regular when the market is shifting out of bear mentality.”

Abroad funds are additionally turning into extra cautious as they turned web sellers of Chinese language shares on Friday, ending 17 straight periods of shopping for. That got here after international funds added 141.2 billion yuan ($21 billion) price of mainland shares in January, the largest month-to-month influx on report.

Analysts additionally say merchants are likely to take revenue after a rally nears the 20% milestone, which heralds a technical bull market. Positive aspects within the CSI 300 Index fizzled final summer season after they hit 19%, and the gauge of mainland shares pulled again from the brink of a bull market twice final week as buyers awaited new catalysts.

Nonetheless, long-term buyers consider there’s additional upside for China shares as soon as the economic system begins to ship progress. “Whereas some like to attend and see for now, we don’t doubt that there are nonetheless alternatives,” mentioned Liu Dejun, managing director at Beijing Guanghua Non-public Fund Administration Co.

For now, some hesitation is cheap. China holds a key political assembly in March, the place extra readability on the brand new management and the coverage path might be provided. “Some volatility helps to maintain a degree head, and long run buyers don’t actually like enormous beta from index strikes,” mentioned Liu.

Loading…

[ad_2]