[ad_1]

Your humble blogger took a gander via NC archives, to see if her recollection that the cramdown of Cyprus depositors to bail out its banking system, a measure by no means earlier than or since taken within the Eurozone, might be considered as primarily supposed to harm Russia. Whereas Europe sticking to a brand new dangerous coverage of “no bailouts” which in the end can and right here did imply depositors take losses appears just like the proximate trigger, a widely-touted rationalization on the time was that Cyprus was a hotbed of soiled Russian cash and due to this fact its financial institution depositors didn’t need to be handled nicely. Not solely was that false, however large financial significance of Cyprus to Russia was as a conduit for international traders, together with respectable multinationals like BP, to make investments in Russia. So the injury to Cyprus virtually actually had an impact on Russian investments, however how a lot and the way shortly Russia and industrial events got here up with new approaches is over my pay grade.

I very a lot welcome knowledgeable reader remark. We lined the non-bailout negotiations in depth on the time, because the deposit haircut was a horrible precedent. But it surely appeared depositors in different Eurozone banks concluded that dangerous issues occurred solely to depositors in small and weak periphery international locations or have been in any other case silly. Recall that Spain had inside the final 12 months come near doing a bail in through having its banks aggressively pitch a “higher than deposits” product: most popular inventory that paid extra curiosity than deposits with cash market fund kind liquidity. Then oopsie! These most popular stockholders took haircuts of 16% to 46%. That was admittedly much less brutal than the 70% cramdown administered to holders of comparable paper at Allied Irish Financial institution the 12 months earlier than. However yours actually is fairly certain the financial institution itself didn’t aggressively hawk these devices to trusting depositors shortly earlier than goring them.

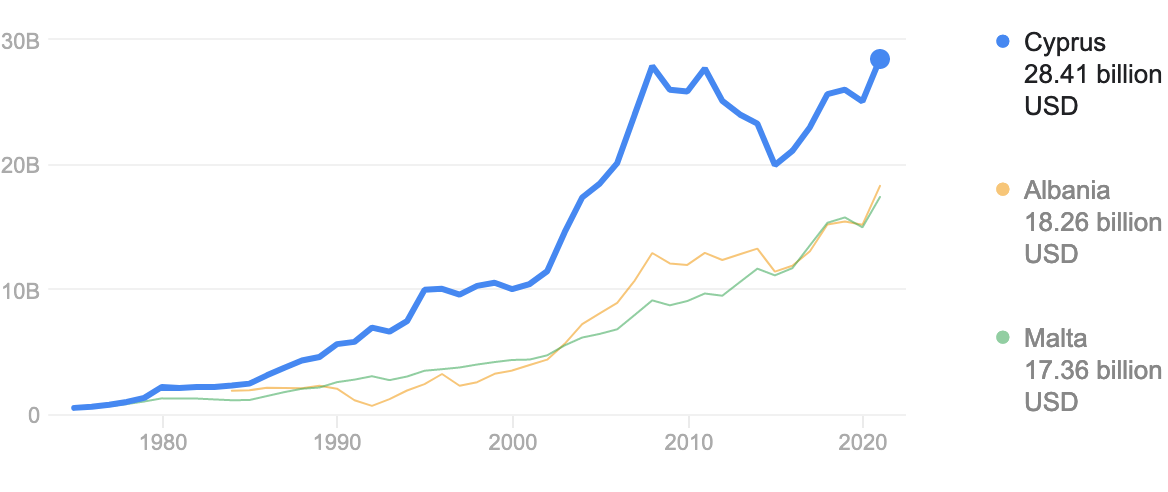

A fast, excessive stage recap. Cyprus was susceptible to mishap by having an outsized banking system, with financial institution property at 9x GDP. That sounds actually horrible, however Luxembourg has no actual economic system to talk of after which had a banking system with property at 21x GDP. And Cyprus was in giant measure a sufferer of its large financial institution’s publicity to Greece. From a 2012 submit:

It’s key to grasp that this disaster was created by the Troika. Cyprus requested for a bailout 9 months in the past and the deadline is a bond fee this June. And whereas it has develop into modern to pin the blame for this mess on Cyprus, the backstory is extra difficult. From Cyprus.com:

Not all of the banks are in the identical situation.

(a) Cyprus has two money-center kind banks: Laiki (Well-liked) Financial institution and Financial institution of Cyprus.

(b) Laiki was bought by a Greek automobile (Marfin Funding Group) backed by Gulf cash. Marfin’s buy of Laiki took Laiki from being a reasonably conservative native financial institution to being extremely uncovered to Greece. Laiki is unquestionably bancrupt and must be restructured.

(c) Financial institution of Cyprus has been extra conservative vis-a-vis Greece, however nonetheless has significant publicity. It’s conceivable that, given time, Financial institution of Cyprus might survive.

(d) Past the primary two banks, there’s Hellenic Financial institution (a a lot smaller financial institution with a lot much less Greek publicity), Cyprus Growth Financial institution (no Greek publicity), the Co-ops (no Greek publicity) and the Cyprus subsidiaries of international banks (aka, Russian, English, and many others banks), additionally with no Greek publicity.

(e) All of the native oriented banks (BoC, Laiki, Hellenic, Coops) have publicity to the native actual property market that went via a bubble through the 2000-2009 interval. This publicity nevertheless isn’t short-term and might be resolved over the interval of years. It’s a drawback, not a disaster, and is offset by the truth that the 2 fundamental banks have quasi-monopolistic earnings energy regionally. Given the time and a few monetary represssion (a la the US) and the native points can be manageable.

In different phrases, the financial institution that’s the epicenter of the issue was pushed into the ditch by international consumers. Now admittedly, the native financial institution supervisors did nothing to cease that, however are you able to level to a single nationwide financial institution regulator (ex the Canadians) that put a lot in the best way of constraints on their banks previous to the disaster?

And the concept that Cyprus is a hotbed of Russian Mafia cash additionally seems to be exaggerated. This appears to be a mix of a have to scapegoat the newest supplicant to the Trokia plus Anglo-German prejudice towards Central and Southern Europe.

In truth, solely €20 billion of the €70 billion in financial institution deposits have been from Russians. Bear in mind that there have been many Russian retirees in Cyprus, so they’d be nicely represented on this group. Equally, Russian businessmen serving the Cyprus market or performing as facilitators of funding into Russia through Cyprus would have places of work and due to this fact deposits in Cyprus.

Firms investing in Russia via Cyprus would presumably want a Cyprus authorized entity and due to this fact checking account. The rationale for international companies to make the most of Cyprus is that its courts function on an English-law foundation and contracts written for inbound Russian funding would specify English regulation as governing regulation. And my understanding was that the Cyprus courts had popularity. I had a colleague who as a really small fry was extraordinarily cautious about his publicity when doing offers within the CIS. He would repeatedly go for disputes to be adjudicated in Cyprus.

And since when is anybody upset by cash laundering/tax losses exterior their jurisdiction? Have you ever ever heard gnashing of enamel and rending of sackcloth over Citigroup’s long-standing and really giant Latin American wealth administration enterprise, which is widely known to consist considerably of what’s politely referred to as flight capital? How concerning the infamous Belgian dentists taking suitcase cash to Luxembourg?

Wikipedia is uncharacteristically even-handed in its recap:

A minority proportion of it was held by residents of different international locations (lots of whom from Russia), who most popular Cypriot banks due to their increased curiosity on checking account deposits, comparatively low company tax, and simpler entry to the remainder of the European banking sector. This resulted in quite a few insinuations by US and European media, which introduced Cyprus as a “tax haven” and urged that the possible bailout loans have been meant for saving the accounts of Russian depositors.

So at first blush, the tough dealing with of Cyprus pushed by Germany’s finance minister, Wolfgang Schauble, being introduced with a scenario the place he might give his wrathful tendencies free rein. As we and others chronicled on the time, with appreciable alarm, the Trokia was decided to make the Cyprus banking system eat losses, regardless that they have been largely Greek in origin. And the explanation the depositors have been bled was that if you happen to have been going the bail-in route, there have been no different acceptable deep pockets. From a March 2013 submit:

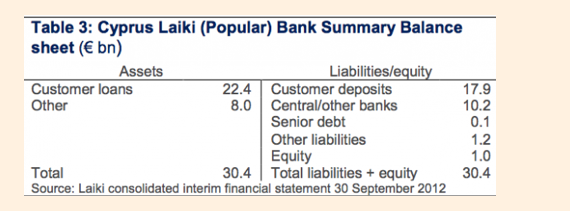

In a superb and necessary submit, “A silly thought whose time had come,” Joseph Cotterill of FT Alphaville explains why the axe fell on the depositors. First, take a look on the steadiness sheet of one of many two large (and about to fall over) banks:

Discover there’s just about squat in the best way of fairness and senior debt. The “different liabilities” could also be secured. So then we get to liabilities to central and different banks. The liabilities to central banks are usually not going to be haircut; that’s a part of the “personal sector participation” premise. Bear in mind, banks in periphery international locations have been pledging any asset the ECB will take to it, and any stuff the ECB gained’t take to their very own central financial institution. Within the case of the Cypriot banks, the publicity is sort of completely that of the native central financial institution. Once more from Cotterill:

As of January, the Cypriot central financial institution was extending round €9bn of secret liquidity in return for collateral not accepted at regular ECB liquidity ops. A lot of it (it’s naturally tough to find out how a lot) was most likely going to Laiki.

Now keep in mind, that’s €9 billion of Cyprus loans to the banks, primarily Laiki, which is junior to deposits, versus the €5.8 billion to be seized from depositors. So why aren’t the loans from the Cyprus central financial institution being written down and the Cyprus sovereign debt traders taking losses? Properly, it seems it’s simpler to screw retail prospects than it’s skilled traders:

As it’s, there have been numerous good the reason why a sovereign debt restructuring didn’t occur. I don’t wish to downplay them. Notably, the truth that the bonds that have been finest to restructure have been ruled beneath English regulation, and have been doubtless held by the form of investor who’s prepared to litigate. I listed the issues right here. Round all of it was the shortcoming to get write-downs out of Cypriot domestic-law sovereign debt, as a result of that was held by the banks which already bore large black holes of their steadiness sheets. Once more we come as much as one thing that might be raised within the defence of the deposit levy — native publicity was so nice all over the place, that any distribution of losses would have been painful. For the widow depositor, substitute the pension fund holding local-law bonds.

In the course of the negotiations, the Troika made clear it needed the Cyprus banks to soak up a set stage of losses, and didn’t care a lot about how the mathematics labored. The Cyprus authorities and the Eurocrats initially mentioned whacking each deposits beneath €100,000, which have been purported to be assured, and a better expropriation on deposits over that stage. The notion of “taxing” supposedly sacrosanct assured deposits freaked out analysts and commentators, who argued that transfer might create financial institution runs everywhere in the still-shaky Eurozone periphery.

Ultimately, deposits over €100,000 have been haircut by 47.5%. Thoughts you, any non-trivial enterprise will routinely have balances over that stage. So we and others predicted the apparent: that the bail-in would hit the economic system laborious:

And massive depositors suffered even when their accounts have been at sound banks.

This was the thanks Cyprus bought for being Eurozone citizen and sending €3 billion to assist the Greek authorities.

Thus far, the Russian angle appears incidental, however whenever you dig deeper, it seems to be materials. Recall in 2011, Russia gave a €2.5 billion mortgage to Cyprus to maintain it afloat. However these funds have been for the federal government, not the wobbly banks. Putin was reportedly ripshit at Russia not being included within the bailout negotiations.

And the Cyprus authorities turned to Russia for assist, together with asking them to bail out Laiki and providing up offshore fuel property. Then Prime Minister Medvedev bothered calling a press convention to say Russia had no thought what they have been price and the Turks weren’t blissful (true). 1

As we wrote in a March 20 submit:

The cynic in me wonders if the crippling Cyprus worldwide banking enterprise isn’t merely an unintentional by-product, however in actual fact was the motivator for the ambush of the brand new [pro EU, pro austerity] President. Because the Monetary Instances signifies, legit Russian companies are scrambling to maneuver their offers to different tax haven facilities, like Luxembourg. Keep in mind that Russia is funneling arms to Syria. Meaning paying arms retailers. I’d assume it’s tougher to maneuver these funds quietly via banking facilities within the US or UK banking complexes than one largely exterior it (nicely, you may all the time use overinvoicing and different tips, however I assume that’s extra cumbersome).

And on March 21, we chronicled a latest rise of non-organic messaging concerning the supposed Russian place within the Cyprus banking system:

This transfer by the EU more and more has the odor of a proxy Germany v. Russia battle via Cyprus. However why? I’ve had Germans say they assume their future is extra aligned with Russia than the US. Why exit of your option to alienate a provider of necessary assets? I can’t fathom the logic right here.

And there are indicators the bottom for a transfer towards Cyprus was being seeded months in the past. Reader Dr. Kevin despatched alongside an article a couple of Russian tax fraud, Hermitage, and the headline and far of the textual content tries to make Cyprus one way or the other accountable. In truth, all the primary actors have been Russian and the Russian authorities was the loser. Our Richard Smith occurs to know the case nicely, because it used shell corporations shaped by the infamous New Zealand incorporator, GT Group. Cypriot banks are recognized to have been concerned, however to the tune of simply $31Mn. A minimum of equally at fault: New Zealand, Moldova, the UK, and, after all, Russia. But it’s Cyprus that’s attracting opprobrium (and now, rather more).

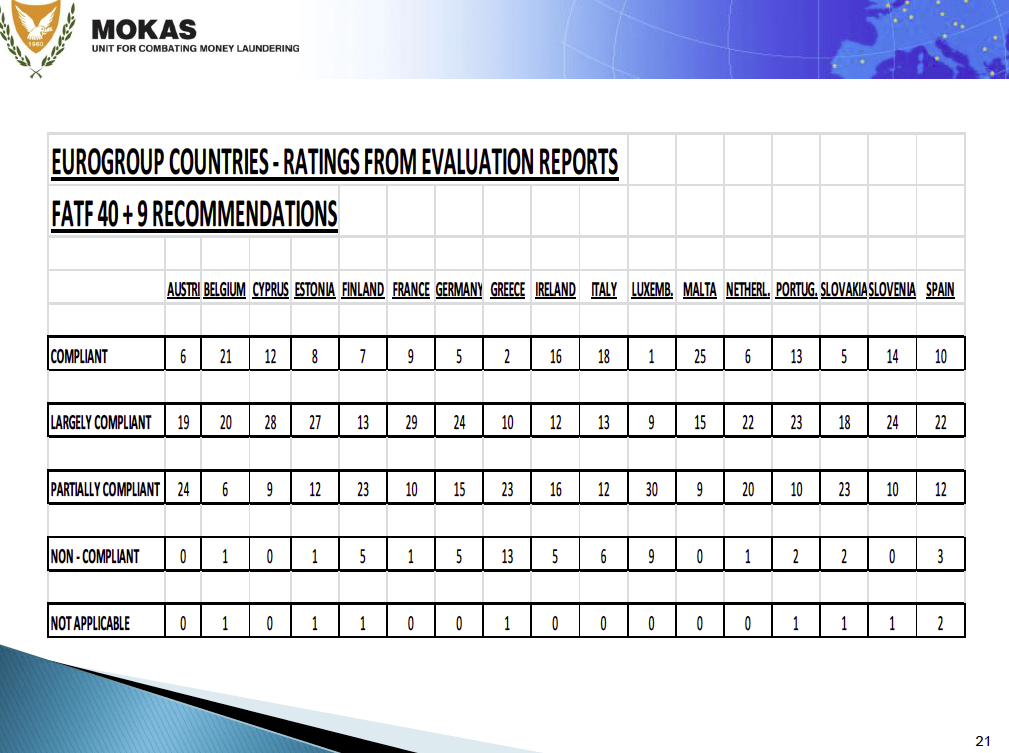

In truth, if you happen to take a look at actual cash laundering (versus tax avoidance of the type that Apple, GE, Starbucks, and a horde of multinationals have interaction in via numerous jurisdictions), Cyprus will get higher marks than Germany from the official Council of Europe physique that evaluated anti-money laundering measures (cumbersomely named the Committee of Consultants on the Analysis of Anti-Cash Laundering Measures and the Financing of Terrorism, aka MoneyVal). See this desk (full report right here). Discover that Cyprus is without doubt one of the few international locations that’s absolutely criticism (click on to enlarge):

And the propaganda towards Cyprus began months in the past. I pinged the writer of the Cyprus.com articles we’ve featured, and he wrote:

Cyprus is (was?), bar none, the very best jurisdiction for routing funding into Russia – it has the very best treaty charges with Russia and also you keep away from the Russian tax/authorized system.

so, it’s virtually malpractice NOT to construction funding into Russia as a Cyprus co.

(BP-Russia is a Cyprus firm and their accomplice AAR are additionally a Cyprus firm. So after they have been combating final 12 months, they have been having the board conferences in Limassol).

***

All these articles are the equal of “discovering and being shocked by” that 100% of public corporations concerned in SEC violations or 100% of LLC subs of FT 500 corporations partaking in tax structuring have been integrated in Delaware. Clearly, there should be one thing very shady about Delaware that causes SEC violations, versus noting that *everybody* makes use of a Delaware corp, whether or not they’re good, imply or detached.

The people who find themselves behind these articles know higher and I observed this about 6 months in the past that the drumbeat of those articles began out of nowhere and simply saved repeating “cyprus = cash laundering for Russia”.

As if the EU simply found 6 months in the past that Cyprus has a tax treaty with Russia…and each nation within the EU, the USA that each one the governments clearly voluntarily signed.

That’s after I knew the setup was coming. Why now? Why so constant? Even the FT which actually ought to know higher has mainly not written an article about Cyprus within the final six months with out some kind of ‘shady Russian’ insinuation.

That is how this check of financial savings confiscation is being bought in the remainder of Europe. “Yeah, I do know it appears dangerous, however it’s a particular case as a result of cyprus have all this Russian mobster cash there so it’s honest to take their cash”

The ECB has given Cyprus nearly no runway. It’s a deal by finish of Monday or off with their heads. Given the problem of cobbling anything collectively, this would appear to pressure Cyprus into solely with the ability to construction one more variant of the “rape depositors” plan.

Again to the present submit. So regardless that Cyprus was more likely to have been handled badly by advantage of its small measurement and northern European prejudice towards its south, the “not letting a disaster go to waste” seems to have resulted in Cypriots taking further lumps for the aim of getting at Russia. And sarcastically, Germany having been the important thing enforcer then is now on the receiving finish through the lack of low cost Russian fuel. As some readers are wont to say, karma is a bitch.

_____

1 These property are nonetheless nowhere to being developed regardless of later exploration discovering further fields. Along with Turkey partaking in threatening naval motion within the space, the EU can’t get out of its personal approach. From Cyprus Mail in August:

The EU has been making it abundantly clear that it wants new fuel provides this decade in order that it may possibly change Russian fuel, however not past 2030. Its official place is that will probably be decreasing fuel consumption as we strategy 2030 and past, consistent with its goal to realize net-zero emissions by 2050. Fuel consumption within the EU has already declined by about 11 per cent year-on-year, largely on account of the exorbitant costs.

That is clearly spelt-out within the latest MoU signed between EU-Egypt-Israel, the time period of which is restricted to 2030, with out provisions to increase it.

I consider this place will probably be challenged in a couple of years when it’s realised that renewables and hydrogen alone can’t present Europe’s vitality wants reliably.

However proper now that is the official EU coverage and it discourages oil corporations and institutional traders from investing in long-term tasks that rely upon supplying the EU with fuel

And the EU is about to overlook its renewables targets:

Europe isn’t going to spend money on renewables to exchange Russian fuel as a result of… it isn’t going to spend money on something. Except it will get entry to adequate fuel its going to go broke, nothing will get constructed, and dwelling requirements will fall. pic.twitter.com/Y7vhDYTRjl

— Philip Pilkington (@philippilk) February 1, 2023

[ad_2]