[ad_1]

I carry on listening to this chorus from folks like former senator Toomey (on Bloomberg TV at this time) that the 2018 deregulation had nothing to do with SVB’s travails; slightly its issues (presumably additionally Credit score Suisse’s too) was resulting from financial and monetary profligacy. I believed it could be helpful to recap the trail of anticipated rates of interest.

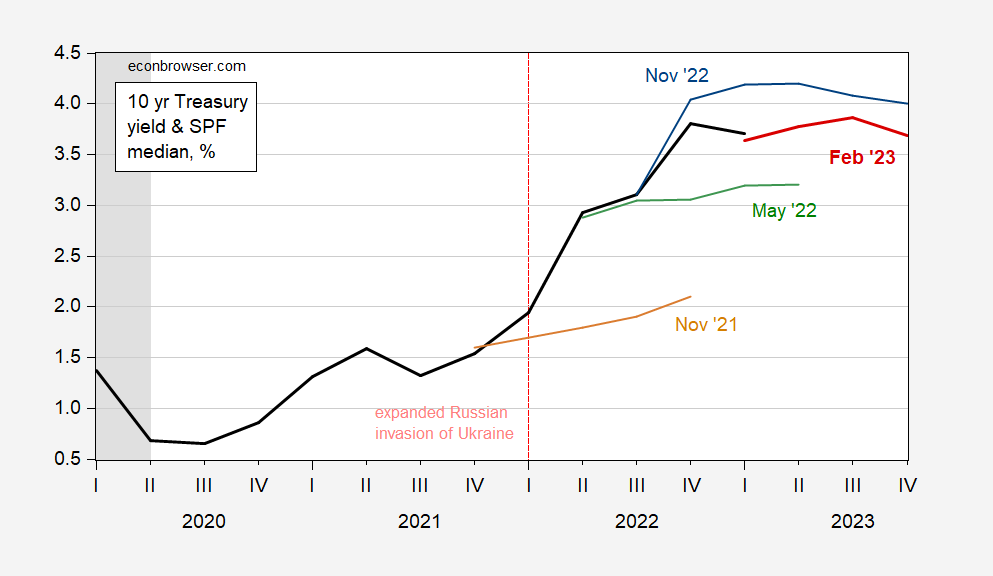

Determine 1: Ten 12 months Treasury yield (black), and median forecast from February 2023 Survey of Skilled Forecasters (crimson), from November 2022 (blue), Could 2022 (inexperienced), and November 2021 (tan). 2023Q1 statement for knowledge by March 15. Supply: Treasury through FRED and Philadelphia Fed SPF (varied), and creator’s calculations.

Whereas as of 2023Q1, the ten 12 months rate of interest was 2.54 ppts above that forecasted in November 2021 – over a 12 months in the past – it’s about half a share level beneath that forecasted in November of 2022.

In different phrases, even earlier than the Russian invasion, banks ought to have anticipated an increase in long run bond yields. Definitely by Could 2022, the forecast was such that the ensuing shock in Q1 was solely half a share level.

Absolutely, had rates of interest not risen a lot over the previous 12 months, the SVB collapse won’t have occurred so quickly. However given the downturn within the tech sector, SVB (given not topic to annual stress assessments, and liquidity necessities) would have in all probability encountered a run (Toomey’s assurances however).

[ad_2]