[ad_1]

Authored by Lance Roberts by way of RealInvestmentAdvice.com,

Gen Zers, in response to a current Amplify Cash survey, are overly optimistic about being rich. In reality, in response to the survey, they’re THE most financially optimistic technology. To wit:

“Practically three-quarters (72%) of Gen Zers imagine they’ll turn out to be rich sooner or later, making them probably the most financially optimistic technology.”

However, curiously, that optimism, as famous by the agency’s govt editor, is “extra than simply youthful optimism.”

“We’re surrounded by extremes of wealth and poverty, and I feel youthful people naturally gravitate to the extra constructive extremes. What’s extra, the idea of investing is a lot extra accessible at present, and I do know many Gen Zers imagine they’ll harness the ability of the market to construct wealth.” – Ismat Mangla

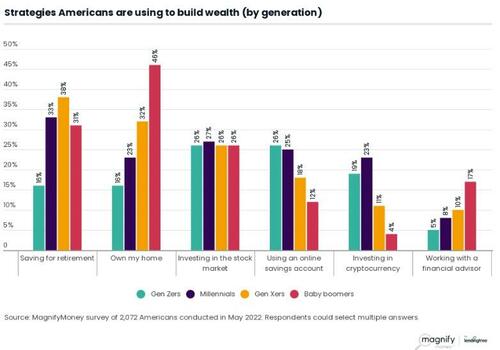

Apparently, Gen Zers are optimistic they’ll use the inventory market to construct wealth. Sadly, that hasn’t labored out nicely for the generations earlier than them.

Since 1980, there have been three main bull market cycles. The primary began within the mid-80s and culminated within the Dot.com bust on the flip of the century. The early 2000s noticed the inflation of the “actual property” bubble heading into the 2008 “monetary disaster.“ We dwell within the third “every thing bubble” fueled by a decade-long push of financial and financial interventions.

Nonetheless, 80% of People are nonetheless not “rich after these three main bull markets.”

That’s in response to a number of the most up-to-datesurveys and Authorities statistics:

-

49% of adults ages 55 to 66 had no private retirement financial savings in 2017, in response to the U.S. Census Bureau’s Survey of Revenue and Program Participation (SIPP).

-

The newest Federal Reserve Survey of Client Funds discovered that the median financial savings in People’ retirement accounts have been $65,000.

-

Lower than half of these surveyed saved $100,000. Not sufficient to help a median retirement earnings of round $40,000 a yr.

-

One in six say they’ve saved nothing. A 3rd at the moment makes NO contributions.

-

80% of individuals anticipated to see their residing requirements fall in retirement. 10% feared they wouldn’t be capable of retire in any respect.

Will or not it’s totally different for Gen Zers sooner or later? Sadly, it possible received’t be for a similar causes that utilizing the inventory market to construct wealth didn’t work for the generations earlier than them.

80% Of People Aren’t Rich

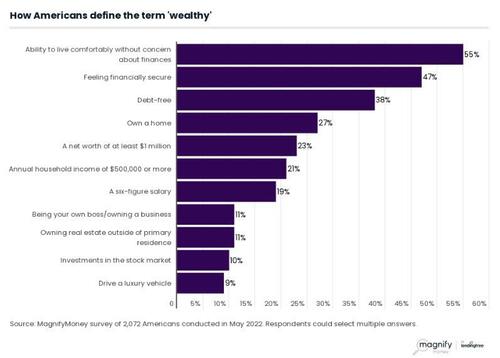

In response to the Amplify survey, Gen Zers outlined “being rich” by a number of measures:

Most surveyed outline “rich” as residing comfortably with out concern about their funds. As proven beneath, that purpose has eluded all however the high 20% of earnings earners.

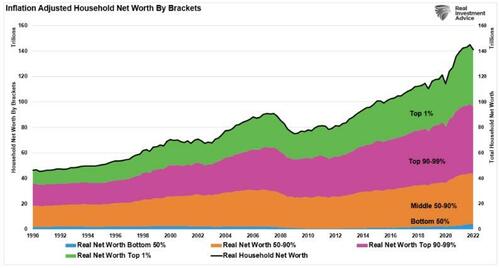

Whereas 72% of Gen Zers imagine they are going to be rich, the web price of the underside 50% of People has remained comparatively unchanged since 1990. Whereas the center 50-90% of People have seen a rise in web price, it has not been sufficient to maintain up with the “way of life,” which, as mentioned beforehand, continues to push People additional into debt.

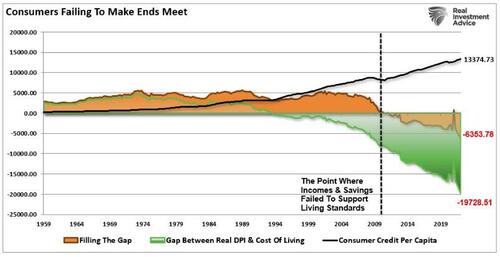

“The present hole between financial savings, earnings, and the price of residing is operating on the highest annual deficit on report. It at the moment requires roughly $6,300 a yr in extra debt to keep up the present way of life. Both that or spending will get decreased which is the possible final result as a recession turns into extra seen.” – The One Chart To Ignore

One other Amplify Cash survey helps this bit of research by exhibiting that roughly 50% of working People dwell “paycheck-to-paycheck,” which means they don’t have any cash left after bills. Whereas that was frequent amongst these making lower than $35,000 yearly (76%), 31% of these making greater than $100,000 skilled the identical.

The crucial level is that it’s onerous to rely on the inventory market to construct wealth while you don’t have extra financial savings with which to speculate.

The Inventory Market Gained’t Make You Rich

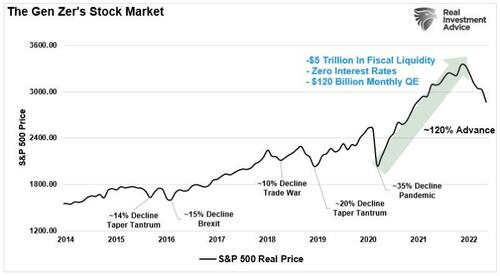

Era Z, born between 1992 and 2002, was between 5 and 16 years outdated in the course of the monetary disaster. Such is essential as a result of they’ve by no means actually skilled a “bear market.” Any recommendation they could have acquired from monetary advisors suggesting warning, asset allocation, or danger administration was repeatedly confirmed to underperform the market.

“Ha….Boomers simply don’t get it.”

Nonetheless, since they turned sufficiently old to open an funding account, they’ve solely seen a “liquidity-driven” bull market that fostered a technology of “Purchase The F***ing Dip “ers.

Nonetheless, whereas the shortage of financial savings was one of many key factors in “The One Chart To Ignore,” the opposite key level, and why 80% of People didn’t construct wealth, is that “markets don’t compound returns.“

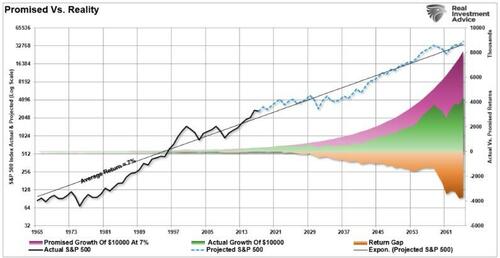

“There’s a important distinction between the AVERAGE and ACTUAL returns acquired. As I confirmed beforehand, the affect of losses destroys the annualized ‘compounding’ impact of cash. (The purple shaded space exhibits the “common” return of seven% yearly. Nonetheless, the differential between the promised and “precise return” is the return hole.)“

Whereas 26% of Gen Zers suppose that investing within the inventory market and 19% in Cryptocurrencies might be their ticket to monetary wealth, a variety of monetary historical past suggests this is not going to be the case.

Whereas Gen Zers are very optimistic they are going to be rich sooner or later, a mountain of statistical and monetary proof argues on the contrary. Will some Gen Zers attain a excessive degree of wealth? Completely. Roughly 10% of them. The rest will possible comply with the precise statistical breakdown of the generations earlier than them.

The explanations for that disappointing final result stay the identical. If investing cash labored because the mainstream media suggests, as famous above, then why, after three of probably the most important bull markets in historical past, are 80% of People so woefully unprepared for retirement?

The essential level to know when investing cash is that this: the monetary market will do considered one of two issues to your monetary future.

-

In case you deal with the monetary markets as a software to regulate your present financial savings for inflation over time, the markets will KEEP you rich.

-

Nonetheless, if you happen to try to use the markets to MAKE you rich, the market will shift your capital to these within the first class.

Expertise tends to be a brutal instructor, however it’s only by means of expertise that we learn to construct wealth efficiently over the long run.

How Cash Actually Works

It isn’t nearly investing cash. There are additionally very important factors concerning the cash itself.

1. Your profession offers your wealth.

You probably will make far more cash from your small business or occupation than out of your investments. Solely very not often does somebody make a big fortune from investments, and it’s usually people who have a enterprise investing wealth for others for a payment or participation. (This even consists of Warren Buffett.)

Focus in your profession, or enterprise, because the generator of your wealth.

2. Lower your expenses. Plenty of it.

“Dwell on lower than you make and save the remaining.” Such sounds easy sufficient however is exceedingly troublesome in actuality. Provided that 80% of People have lower than $500 in financial savings tells the true story. Nonetheless, with out financial savings, we are able to’t make investments to develop our financial savings into future wealth.

3. The true purpose of investing cash is to regulate financial savings for inflation.

As traders we get swept up into the “on line casino” referred to as the inventory market. Nonetheless, the true purpose of investing is to make sure that our “financial savings” alter for future buying energy parity sooner or later. Whereas $1 million seems like so much at present, in 30-years will probably be price far much less because of the affect of inflation. Our true purpose of investing is NOT to beat some random benchmark index by taking up extra danger. Somewhat, our true benchmark is the speed of inflation.

4. Don’t assume you possibly can substitute your wealth.

The truth that you earned what you’ve got doesn’t imply that you might earn it once more if you happen to misplaced it. Deal with what you’ve got as if you might by no means earn it once more. By no means, take probabilities along with your wealth on the belief that you might get it again.

5. Don’t use leverage.

When somebody goes fully broke, it’s nearly at all times as a result of they used borrowed cash. Utilizing margin accounts, or mortgages (for apart from your property), places you liable to being worn out throughout a compelled liquidation. In case you deal with all of your investments on a money foundation, it’s nearly not possible to lose every thing—it doesn’t matter what may occur on the planet—particularly if you happen to comply with the opposite guidelines given right here.

6. Everytime you’re doubtful, it’s at all times higher to err on the facet of security.

In case you go up a chance to extend your fortune, one other one might be alongside quickly sufficient. However if you happen to lose your life financial savings simply as soon as, you may by no means get an opportunity to switch it. At all times err on the facet of warning. At all times ask the query of what CAN go “improper” reasonably than specializing in what you “HOPE” will go proper.

Investing cash in our future just isn’t so simple as a lot of the media makes it appear. All of us need to have the ability to under-save at present for tomorrow’s wants by hoping the markets will make up the distinction. Sadly, there isn’t any magic trick to constructing wealth.

The method of saving diligently, investing conservatively, and managing expectations will construct wealth over time.

It’s boring. Nevertheless it works.

Irrespective of your age, it’s not too late to begin making higher decisions.

Loading…

[ad_2]