[ad_1]

The UK financial outlook for this yr has improved, with analysts predicting a smaller contraction in output than beforehand due to falling vitality costs and higher than anticipated enterprise and client sentiment.

In December and January, economists anticipated gross home product to drop by 1 per cent this yr, in line with information from Consensus Economics, which polls main forecasters.

Nonetheless, the information for the week of February 20 reveals that economists are upgrading their forecasts. The typical forecast entails a 0.6 per cent fall in GDP in 2023.

The UK recorded higher financial information final week. The newest S&P World/Cips flash composite buying managers’ index confirmed British enterprise exercise rebounded in February after six months of declining output.

Client confidence in February reached its highest degree in virtually a yr, in line with analysis group GfK. And official information in regards to the public funds confirmed chancellor Jeremy Hunt was on track to internet a windfall of £30bn after the UK recorded a shock surplus in January.

Whereas the price of dwelling disaster is much from over, and the Financial institution of England may increase rates of interest additional to curb inflation, there was a pointy fall in wholesale vitality costs, which soared after Russia’s invasion of Ukraine in February final yr.

The UK wholesale fuel worth is now beneath £1.30 a therm, half the value of mid-December and down from a peak of £5.95 final August.

Liz Martins, economist at HSBC, mentioned that given the higher financial information and falling vitality costs “it’s now believable that there isn’t any recession in any respect”.

“That might be a outstanding end result given the dimensions of the vitality shock and financial tightening that now we have had,” she added.

Allan Monks, economist at JPMorgan, estimates the financial system will develop by 0.4 per cent this yr, partly owing to decrease vitality costs.

Ellie Henderson, economist at Investec, mentioned “the autumn in vitality costs is the sunshine on a cloudy day” for the financial system as a result of it eased stress on companies and households.

Decrease wholesale fuel costs imply the federal government’s cap on family vitality payments has turn into cheaper for ministers.

It has fuelled expectations that chancellor Jeremy Hunt might not proceed with plans to lift the cap from its present annual degree of £2,500 to £3,000 in April.

Susannah Streeter, analyst at Hargreaves Lansdown, mentioned the autumn in fuel costs ought to for enterprise “imply an easing off of punishing enter costs, which ought to allow them to restrict hikes handed on to prospects”.

Greater than three quarters of enterprise leaders are assured about their corporations’ prospects in 2023, in line with a brand new survey printed by the Boston Consulting Group.

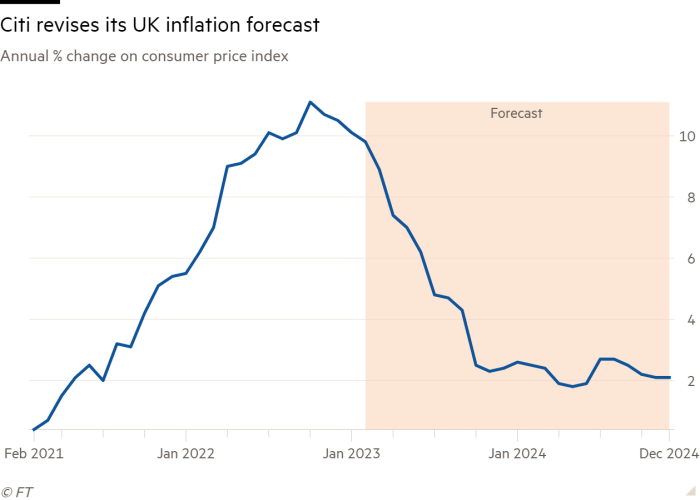

Some analysts, together with Citigroup, anticipate inflation to return to the BoE goal of two per cent within the second half of 2023. The central financial institution anticipates inflation of 4 per cent within the fourth quarter.

Monks predicts the unemployment charge to stabilise at about 3.7 per cent, as an alternative of rising as beforehand anticipated. This “would imply there’s scope for combination family actual incomes to do higher this yr”, he mentioned.

Victoria Clarke, economist at Santander CIB, expects “a return to optimistic actual pay development within the second half of the yr, which ought to help family spending and financial momentum”.

Nonetheless, the financial system nonetheless has loads of headwinds, not least as a result of larger rates of interest have but to impression absolutely on customers and companies.

Streeter mentioned demand within the financial system may evaporate as extra householders and companies withstand sharply larger borrowing prices.

“So, a milder recession nonetheless can’t be dominated out and on the very least we’ll be heading for an early noughties interval of stagnation,’’ she added.

Extra reporting by Daniel Thomas

[ad_2]