[ad_1]

Russia’s invasion of Ukraine a yr in the past reverberated by way of world markets. For ever and ever to Europe’s most intense battle for the reason that second world conflict, the results are nonetheless being felt.

Monetary Instances reporters have a look at what has occurred in key markets and what may occur subsequent.

Putin’s power conflict backfires

Working nearly in parallel to Russia’s invasion of Ukraine has been the power conflict President Vladimir Putin unleashed towards Europe. The squeeze on gasoline provides began earlier, in what many business commentators now consider was an try and weaken Europe’s resolve earlier than the primary photographs have been even fired.

However Moscow’s weaponisation of gasoline provides ramped up dramatically as western powers threw their help behind Kyiv.

Russian gasoline exports, which as soon as met about 40 per cent of Europe’s demand, have been reduce by greater than three-quarters to EU nations up to now yr, stoking an power disaster throughout the continent.

However Putin’s power conflict is not going to plan. Senior figures within the business consider that for all Russia’s undoubted sway in oil and gasoline markets, the president is now looking at defeat in markets he as soon as thought he might dominate.

“Russia performed the power card and it didn’t win,” Fatih Birol, head of the Worldwide Power Company, informed the Monetary Instances this week.

“It wasn’t simply meant to trigger ache in Europe for its personal sake it was designed to alter European coverage,” stated Laurent Ruseckas, government director at S&P World Commodity Insights. “If something, it made Europe extra decided to not be bullied into altering positions.”

European gasoline costs have fallen by 85 per cent from their August peak, bolstering the broader economic system, which now seems prone to keep away from a deep recession.

The continent has additionally prevented the worst potential outcomes resembling outright gasoline shortages or rolling blackouts, which as soon as appeared a definite chance.

Certainly, there are indicators that Europe is now higher positioned to sort out subsequent winter too.

Comparatively delicate climate and Europe’s success in tapping different provides resembling seaborne liquefied pure gasoline imply that storage services throughout the continent are far fuller than regular for the time of yr.

Fuel in storage stood just under 65 per cent of capability as of Wednesday, in line with commerce physique Fuel Infrastructure Europe, with solely a month of winter nonetheless to run. On the day of Russia’s invasion, gasoline storage stood at simply 29 per cent.

“The storage refill subject for subsequent winter is not a giant burden,” stated Ruseckas.

Longer-term merchants together with Pierre Andurand, who has run one of many world’s most profitable power funds for greater than 15 years, assume Putin has already misplaced as he has obliterated his relationship with Russia’s major gasoline buyer.

Whereas Russia needs to promote extra gasoline to Asia, it might take a decade to reorient its pipelines east, with the gasfields that after equipped Europe not linked to the road it makes use of to feed China.

Andurand this month argued that China would even be able to power a tough discount with Moscow on value, and wouldn’t wish to repeat Europe’s mistake of changing into too reliant on anybody provider.

“As soon as Russia can solely promote gasoline to China, Beijing shall be able to resolve the worth,” Andurand stated.

Europe nonetheless faces challenges. Whereas gasoline costs have plummeted from the close to $500 a barrel degree (in oil phrases) they reached in August, they continue to be two-to-three occasions greater than historic norms.

Russia nonetheless provides about 10 per cent of the continent’s gasoline alongside pipelines operating by way of Ukraine and Turkey. Ought to Moscow resolve to chop these provides it’s prone to push costs greater once more, though it could be cautious of alienating Turkey.

Europe may also probably face stiffer competitors for LNG provides with Asia this yr as China’s economic system reopens after the tip of zero-Covid, although there may be some preliminary proof that Beijing is extra value delicate than feared.

Merchants look to extension of grain export deal

Worldwide merchants are targeted on the extension of the Black Sea grain export deal between Kyiv and Moscow that is because of expire subsequent month, amid Ukrainian accusations that Russian inspectors have been intentionally delaying the transit of grain ships within the port of Istanbul.

The settlement, brokered by Turkey and the UN final July, allowed Ukrainian grain shipments to circulate by way of the Black Sea, bringing costs down from their post-invasion peaks. Grain costs have since fallen to prewar ranges though they continue to be traditionally excessive.

Ukraine had been a number one participant within the meals commodity markets previous to the conflict, accounting for about 10 per cent of the worldwide wheat export market, just below half of the sunflower oil market and 16 per cent of the corn market.

Final November, the deal was prolonged regardless of Putin’s threats to terminate it, and there may be heightened uncertainty over how Moscow will act on the negotiation desk.

“If [the deal] is renewed — that’s nice information, but when it’s not achieved, then instantly you’re going to have a problem there with provides,” warned John Baffes, senior agricultural economist on the World Financial institution. “These points are going to have an effect on largely nations in north Africa and the Center East.”

Excessive inflation ensures rates of interest stay elevated

Inflation was already elevated in February 2022, as costs have been pressured greater by snarls in provide chains and the large fiscal stimulus unleashed to mood the worst results of the Covid-19 pandemic.

However these forces had been understood by central banks as transitory. The sanctions positioned on Russia in the beginning of the conflict drove up the costs of oil, gasoline and coal — amongst different commodities — including to inflation and rendering it extra persistent.

Whilst provide chains have been unblocked and pandemic money was spent, inflation continued to rise.

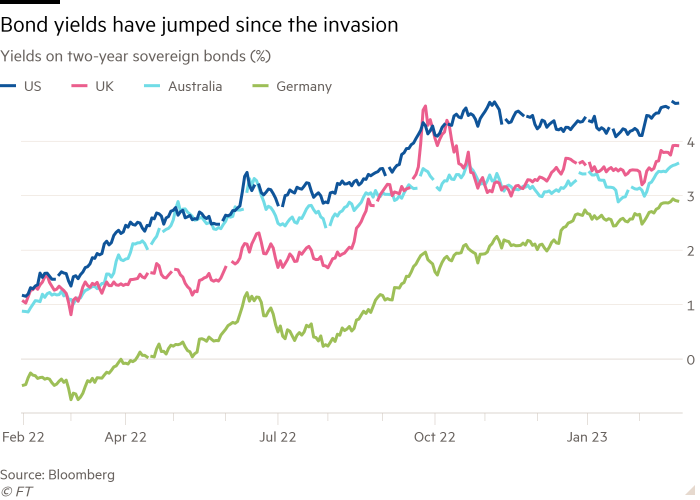

The persistence of that inflation has compelled central banks to lift rates of interest greater and better, lifting yields on sovereign debt. Two-year sovereign bond yields, which transfer with rates of interest, have risen greater than 2 proportion factors in Germany, the UK, the US and Australia, amongst others, within the final yr alone.

As the fee to borrow has risen for sovereign nations, so it has for corporations, pushing company bond yields greater and inventory costs decrease.

There’s little likelihood they may fall quickly. Though inflation globally has begun to gradual, the tempo stays far above goal for a lot of central banks, which have vowed to proceed their battle.

Rouble set to depreciate after recovering from post-invasion low

One yr on from Russia’s invasion of Ukraine and the rouble’s worth towards the greenback is near the place it was in the beginning of the battle — though there have been loads of twists alongside the way in which.

The Russian foreign money halved in worth to a document low of 150 to the greenback within the month after Putin ordered troops into Ukraine, regardless of Russia’s central financial institution greater than doubling rates of interest to twenty per cent in late February in an try and calm the nation’s more and more strained monetary system.

European and US sanctions — designed to chop Russia out of the worldwide funds system and freeze the tons of of billions of {dollars} of reserves amassed by the Financial institution of Russia — swiftly adopted. In late March, an emboldened US president Joe Biden declared that the rouble had been “nearly instantly lowered to rubble” because of this.

Then got here the rebound. Moscow’s imposition of capital controls meant the rouble had recovered nearly all of its losses by the beginning of April. The foreign money was additionally helped by the continued circulate of oil and gasoline exports.

It has steadily weakened since July, nonetheless, when it touched 51 towards the greenback, a degree final seen in 2015. In the present day it trades at 75.

With Russia’s capital account all however closed for main onerous currencies, “the trade fee doesn’t carry out its forward-looking position primarily based on expectations, it solely displays each day commerce flows, most of which is power commerce,” stated Commerzbank analyst Tatha Ghose.

Ghose anticipated the rouble to proceed to depreciate towards the buck in 2023, dragged decrease as western sanctions on Russian oil weigh on the nation’s present account.

[ad_2]