[ad_1]

On this each day bar chart of AAPL, under, I can see that the worth of AAPL is now again under the declining 200-day transferring common line. (A lot of bullish analysts, each technical and basic, have identified the variety of shares which are buying and selling above their 200-day transferring common traces. Right here is one management inventory that has reversed course.) The each day On-Stability-Quantity (OBV) line appears prefer it has made a prime in February. The Transferring Common Convergence Divergence (MACD) oscillator has crossed to the draw back for a take-profit promote sign.

On this weekly Japanese candlestick chart of AAPL, under, I can see that some latest candle patterns present higher shadows. Higher shadows are an indication that merchants are rejecting the highs and a warning signal that costs might retreat. The weekly OBV line reveals a decline from February 2022. The MACD oscillator is under the zero-line, however displaying a cover-shorts purchase sign.

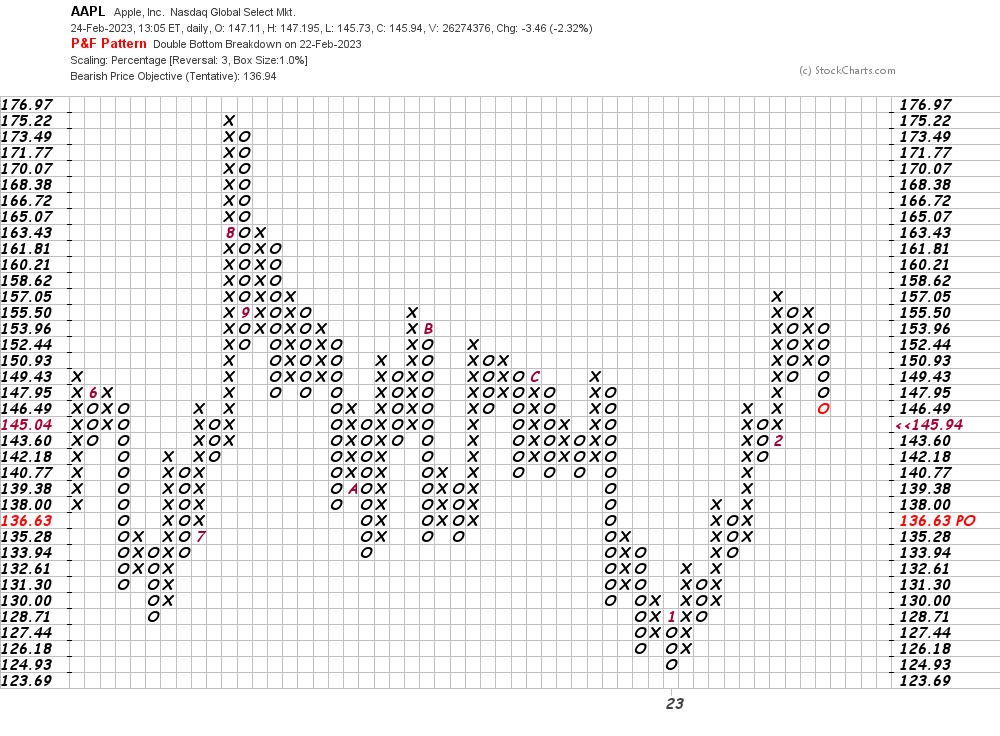

On this each day Level and Determine chart of AAPL, under, I can see a draw back value goal within the $137 space.

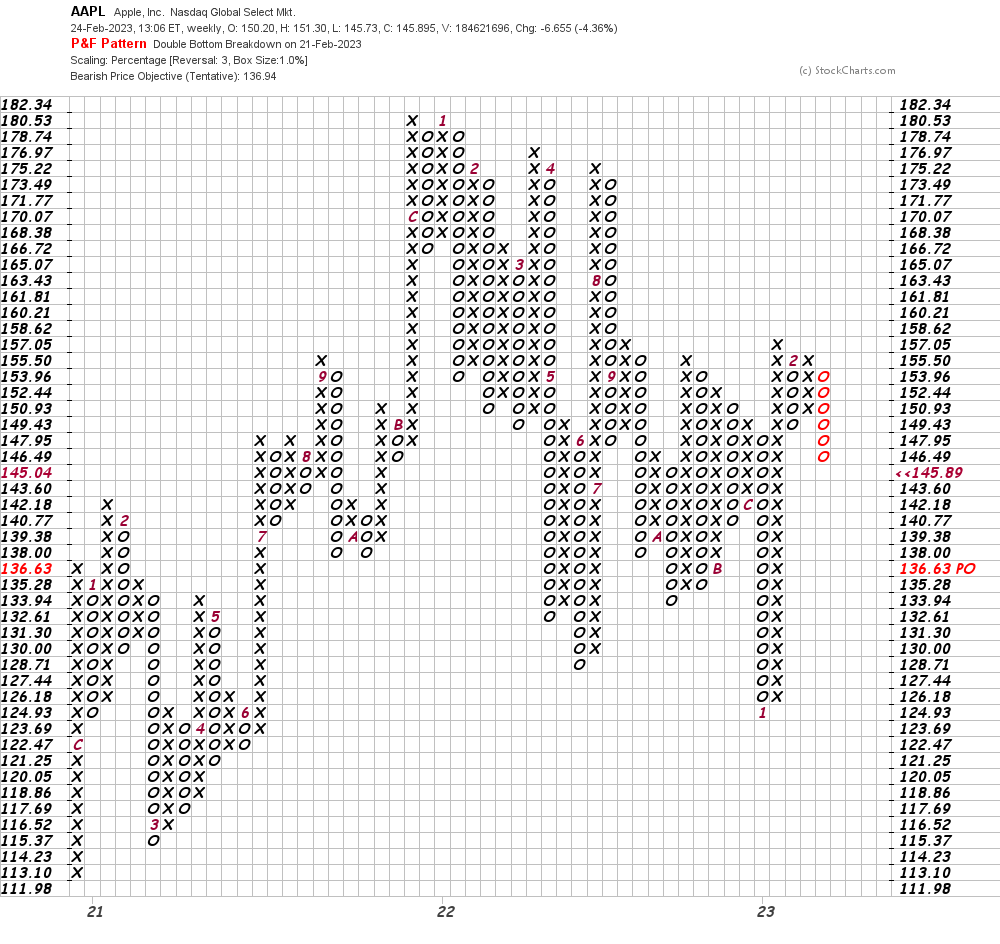

On this weekly Level and Determine chart of AAPL, under, a value goal of $137 can also be proven.

Backside line technique: Shares of AAPL are turning decrease. A pullback to the $137 space is feasible, however the early January low is the actual chart level to look at.

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Observe” subsequent to my byline to this text.

You probably have questions, please contact us right here.

E mail despatched

Thanks, your e mail to has been despatched efficiently.

Oops!

We’re sorry. There was an issue making an attempt to ship your e mail to .

Please contact buyer help to tell us.

Please Be a part of or Log In to E mail Our Authors.

E mail Actual Cash’s Wall Avenue Execs for additional evaluation and perception

Already a Subscriber? Login

[ad_2]