[ad_1]

A a lot hotter than anticipated Core PCE print has sparked a dramatic hawkish response throughout markets.

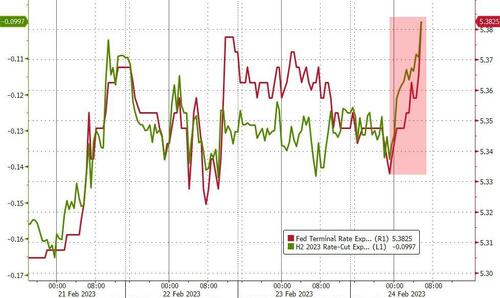

Expectations for The Fed’s terminal fee has spiked to five.39% and H2 2023 rate-cut expectations have dwindled to single-digits (simply 9bps priced in)…

Supply: Bloomberg

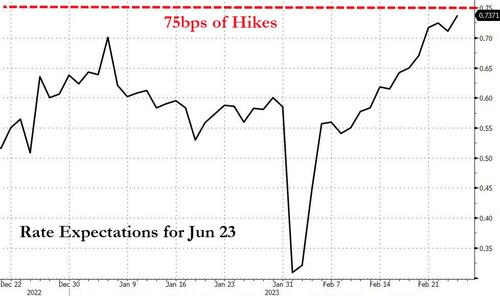

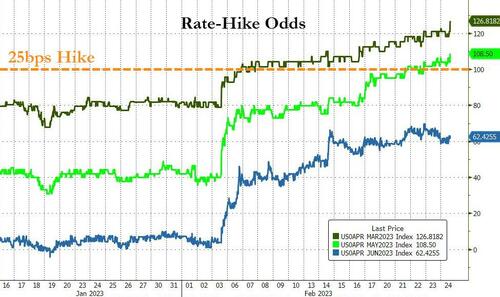

The market is now absolutely pricing in 3 x 25bps rate-hikes on the subsequent three FOMC conferences…

With the chances of a 50bps hike in March now up at round 25% (and a 25bps hike absolutely priced-in for

All of which despatched shares reeling, under yesterday’s lows…

And Treasury yields hovering increased on the short-end whereas the long-end has rallied (yields slower post-PCE)…

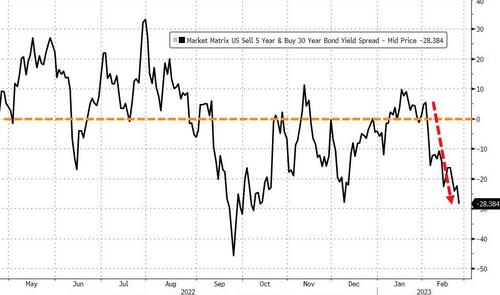

The yield curve (5s10s) is inverting deeper and deeper (pricing in recession/Fed coverage error)…

With 2Y yields pushing to contemporary cycle highs (highest since July 2007)…

The greenback is surging increased, erasing all the losses for the reason that January Payrolls droop…

Will the 0DTE avid gamers BTFD in shares once more?

Loading…

[ad_2]