[ad_1]

You’ve gotten a lot to fret about. Tremendous micro organism, ecological collapse, bin day, Liverpool’s present kind, no matter “deinfluencing” is.

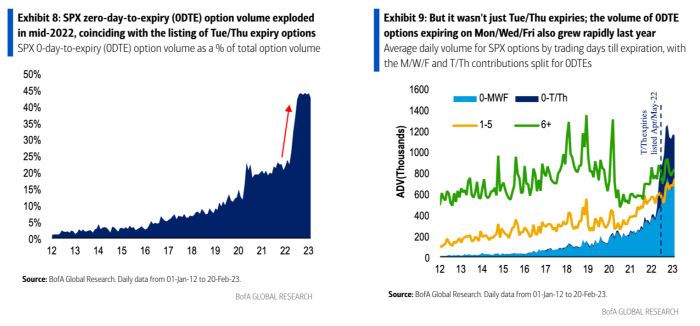

So it’s good to get some reassurance kind Financial institution of America that you just positively don’t want to fret about zero-day-to-expiry (0DTE) choices, which have been the best factor in US fairness derivatives [ed: contradiction?] for just a few years now.

If that is your first brush with 0DTE, worry not! In contrast to many monetary devices, they principally do what they are saying on the tin — expiring on the identical day that they’re traded.

And boy are they fashionable. These days, greater than two-fifths of typical S&P 500 choices quantity is on 0DTEs, about $1tn price a day. And that’s worrying on the floor, as BofA’s analysts clarify:

Questions naturally abound relating to who’s concerned, typical methods being employed, and potential market impression, with some elevating the alarm that directional finish customers are internet brief out-of-the-money 0DTEs, thus sowing the seeds for a “tail wags the canine” occasion akin to the Feb-18 “Volmageddon”.

Such fears have been lately raised by Marko Kolanovic of JPMorgan, who in a word final week warned that 0DTEs are at the moment suppressing volatility, however that within the occasion of a big market transfer might serve to all of a sudden ramp it up. Sprach Kolanovic:

If there’s a large transfer when these choices get within the cash, and sellers can not help these positions, pressured overlaying would lead to very massive directional flows.

The “actuality”, BofA argues, is “extra nuanced”:

(i) half of all SPX 0DTE choice trades are “single-leg auto-execution”, a class uniquely skewed in direction of extra ask quantity early within the day however extra bid quantity later within the day (in keeping with 0DTE patrons within the morning who then unwind because the day progresses); (ii) SPX 0DTE implied vol sometimes trades 10-15 vol factors above longer-dated implies and with an embedded vol threat premium (VRP) 2.5x bigger and sure inconsistent with a market overrun by choice sellers; and (iii) historical past reveals excessive payout ratios can often be achieved by directionally proudly owning 0DTE “lottery tickets” regardless of paying elevated vol.

Phrases! In barely extra human:

— Most of those trades are simply getting used to make one-way trades on the open

— Precise volatility just isn’t as excessive because the choices indicate

— 0DTEs could make you cash so are good, truly

Right here’s how them phrases appears to be like like in pickchurrs:

They add:

This isn’t to say that 0DTEs can’t be “weaponized” sooner or later to exacerbate intraday fragility and/or imply reversion. Nonetheless, the proof thus far means that 0DTE positioning is extra balanced/advanced than a market that’s merely one-way brief tails.

So, uh, calm down.

[ad_2]