[ad_1]

Through the days of simple cash, probably the most extensively tracked numbers in credit score markets turned an unlucky punchline.

Article content

(Bloomberg) — During the days of easy money, one of the most widely tracked numbers in credit markets became an unfortunate punchline.

Advertisement 2

Article content material

Ebitda, which stands for earnings earlier than curiosity, taxes, depreciation and amortization — a determine that’s akin to an organization’s money stream and, thus, its skill to pay its money owed — was as an alternative mocked as a advertising gimmick. When bankers and personal fairness corporations requested buyers to purchase a chunk of their loans funding buyouts and different transactions, they’d layer on so-called add-backs to earnings projections that, to some, defied purpose.

Article content material

“Ebitda: Finally busted, attention-grabbing principle, deeply aspirational,” one Moody’s analyst joked in 2017. Sixth Avenue Companions co-founder Alan Waxman had a extra blunt evaluation, warning an viewers at a non-public convention that such “faux Ebitda” threatened to exacerbate the subsequent financial droop.

Commercial 3

Article content material

Now, amid rising rates of interest, persistent inflation and warnings of a possible recession on the horizon, analysis from S&P International Rankings is underscoring simply how removed from actuality the earnings projections are proving to be.

As Bloomberg’s Diana Li wrote on Friday, 97% of speculative-grade corporations that introduced acquisitions in 2019 fell wanting forecasts of their first 12 months of earnings, in accordance with S&P. For 2018 offers, it was 96% and 93% for 2017 acquisitions. Even after the financial system was flooded with fiscal and financial stimulus after the pandemic, about 77% of buyouts and acquisitions from 2019 had been nonetheless wanting their projected earnings, S&P’s analysis reveals.

The larger fear is that years of rosy earnings projections is masking the quantity of leverage on the steadiness sheets of the lowest-rated corporations. By 2019, earlier than the Covid-19 pandemic despatched markets tumbling the next 12 months, add-backs had been accounting for about 28% of whole adjusted Ebitda figures used to market acquisition loans, Covenant Overview knowledge on the time confirmed. That was up from 17% in 2017.

Commercial 4

Article content material

The S&P analysts this week mentioned the most recent knowledge reinforces their view that these Ebitda figures are “not a practical indication of future Ebitda and that corporations constantly overestimate debt reimbursement.”

“Collectively, these results meaningfully underestimate precise future leverage and credit score threat,” they wrote.

Elsewhere:

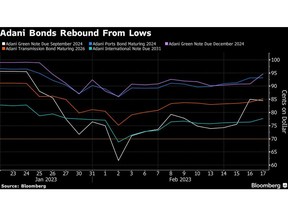

- Adani Group bonds rallied this previous week as executives sought to reassure debt buyers that the conglomerate will handle its debt maturities within the coming months. Choices included issuing personal placement notes and utilizing money from operations to repay Adani Inexperienced Vitality bonds maturing subsequent 12 months. The bonds had dropped to distressed ranges after the Adani Group was focused by brief vendor Hindenburg Analysis.

Commercial 5

Article content material

- Apollo International Administration and Goldman Sachs are planning personal credit score funds that can compete with Blackstone for wealthy European purchasers. Whereas buyers have lengthy been in a position to take part in US personal credit score by way of enterprise growth corporations, laws and complexity has restricted people’ entry to such funds in Europe till lately.

- A rally within the bonds of China’s debt-laden builders — fueled by a sequence of coverage steps to ease strains within the nation’s property sector – is now dropping steam amid a persistent housing droop. A Bloomberg index of US dollar-denominated junk bonds in China recorded a loss for the second straight week, snapping a document 13 weeks of features.

- Hassle is brewing in one other nook of China’s credit score market. Native authorities financing automobiles (LGFVs), which turned the primary patrons of half-finished tasks of defaulted builders, have been caught up in a funding droop. The scenario prompted a senior monetary official from one among China’s poorest provinces to make a uncommon public plea for buyers to purchase bonds of its LGFVs.

—With help from Alice Huang, Bruce Douglas and Diana Li.

(Updates so as to add chart.)

[ad_2]

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We’ve enabled e mail notifications—you’ll now obtain an e mail should you obtain a reply to your remark, there may be an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Group Tips for extra info and particulars on the right way to regulate your e mail settings.

Be part of the Dialog