[ad_1]

The greenback has rebounded from a 10-month low as buyers push up their forecasts for US rates of interest after indicators of cussed inflation and unexpectedly robust financial exercise.

The world’s most vital reserve forex rose to a 20-year excessive in September however tumbled 11.2 per cent over the next 4 months as US inflation declined from a multi-decade peak, permitting the Federal Reserve to gradual the tempo at which it raised rates of interest in the direction of the top of 2022. Tamer fee rises and the prospect of regular and even falling charges in 2023 eliminated one of many forex’s key helps.

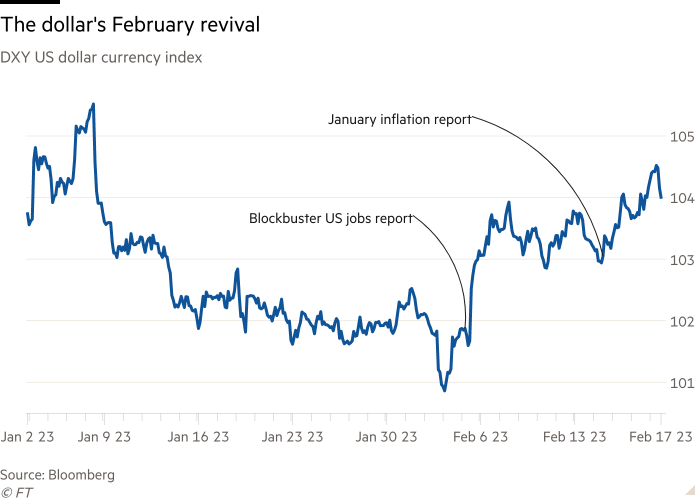

Nonetheless, February has begun with a flurry of financial information suggesting the world’s greatest economic system stays in impolite well being, pushing the greenback again up by 3 per cent in opposition to a basket of six different main currencies for the reason that begin of the month and erasing January’s decline.

The US final month added greater than half 1,000,000 jobs, virtually triple the consensus forecast, whereas inflation fell to six.4 per cent, a smaller lower than anticipated.

“The inflation report has ruined markets’ good little disinflationary plan,” stated Florian Ielpo, multi-asset portfolio supervisor at Lombard Odier, with central banks more likely to preserve their upward stress on charges consequently.

Jordan Rochester, a international trade strategist at Nomura, stated February started “with everybody within the macroeconomic neighborhood assuming the greenback would unload in opposition to the euro and the yen. Since then virtually each single US information level has are available in stronger than anticipated, and markets have slowly come round to what the Fed has been saying for a very long time, that charges have additional to go and might be stored on maintain for some time.”

Benchmark US rates of interest stand in a spread of 4.5 per cent to 4.75 per cent. Initially of February, futures markets have been pricing in a charges peak near 4.9 per cent, with two cuts within the second half of the yr taking borrowing prices to about 4.4 per cent heading into 2024.

Simply over two weeks later, markets had shifted to foretell a peak at 5.28 per cent, ending the yr simply above 5 per cent following a single minimize.

Nonetheless, some buyers doubt the greenback rally has for much longer left to run. The haven forex is more likely to proceed to rise this quarter however “resume its downward trajectory as world progress and threat sentiment enhance,” stated analysts at UBS.

[ad_2]