[ad_1]

Authored by Charles Hugh Smith through OfTwoMinds weblog,

The online results of hyper-globalization and hyper-financialization is the crumbling of the center class.

Neofeudal societies and economies lack a vibrant center class. That is the defining function of feudalism and its up to date V2.0, neofeudalism: a the Aristocracy (based mostly on delivery or finance, it would not matter) controls the overwhelming majority of wealth, political energy and productive capital, all served by a powerless peasantry.

The fashionable variations of capitalism emerged when a European center class arose and have become highly effective sufficient economically and politically to dismantle feudalism. The basics of the center class are:

1. A mindset / set of values embracing (as highlighted by author Peter Frost) “thrift, prudence, negotiation, and exhausting work.”

2. Entry to markets and credit score so enterprises might be established and expanded.

3. Enough training to navigate laws and the necessities of enterprise.

4. The free stream of labor, capital, items and companies.

Feudal economies lacked these fundamentals by design. All these forces have been restricted to implement the facility and perquisites of the The Aristocracy.

Neofeudalism is a trickier beast. Neofeudal economies and societies make a giant PR present of being open to new enterprise, however the real-world actuality will not be so heat and fuzzy: new cartels and monopolies come up in a fierce wrestle to stamp out competitors and affect regulators to not simply allow predatory cartels/monopolies however defend them.

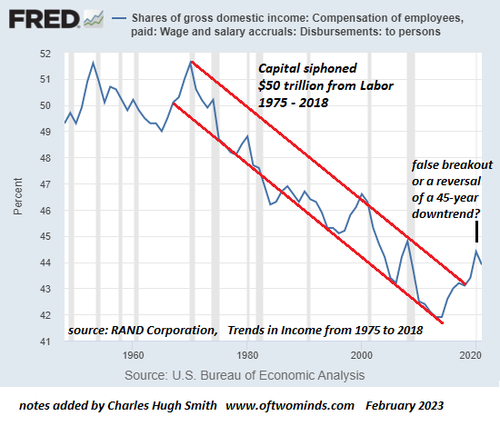

The previous 30 years may be characterised by the ascent of capital and the decline of labor. Because the chart beneath exhibits, wages’ share of the financial system has been in a 45-year decline. The current uptick could also be a false breakout or it is likely to be a change in pattern. It is too early to inform. However in any occasion, wages–the bedrock not simply of the working class however of the center class–have been chipped away to the tune of $50 trillion siphoned away by capital.

(Supply: Traits in Revenue From 1975 to 2018 RAND Company)

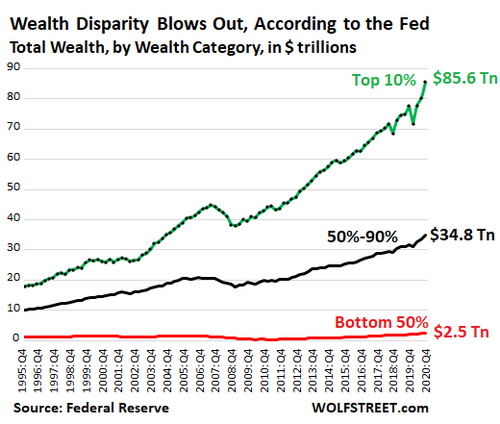

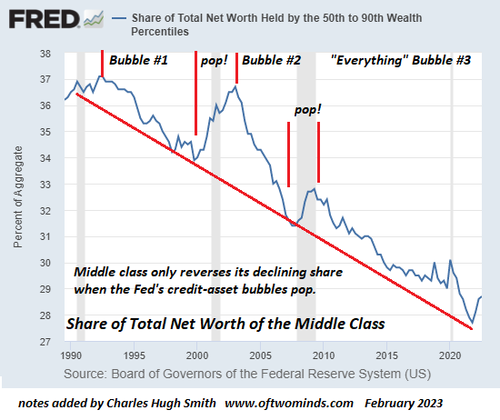

One other mechanism is seen within the charts beneath displaying the Share of Complete Web Value of the highest 1% and the center class, i.e. the households between 50% and 90% (this broad definition consists of the spectrum fron decrease center class, households with incomes across the median, and upper-middle class households incomes significantly extra).

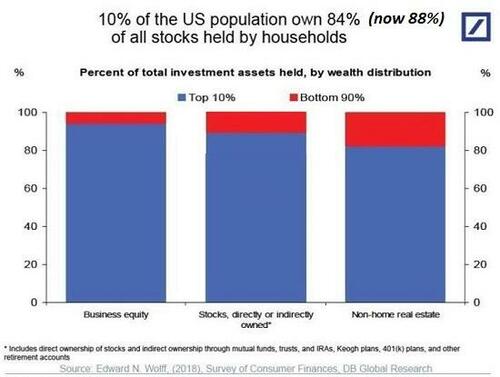

Because the chart beneath exhibits, the highest 10% personal the overwhelming majority of income-producing belongings:, shares bonds, earnings actual property and enterprises. The relative share owned by the center class is at finest modest, at worst negligible.

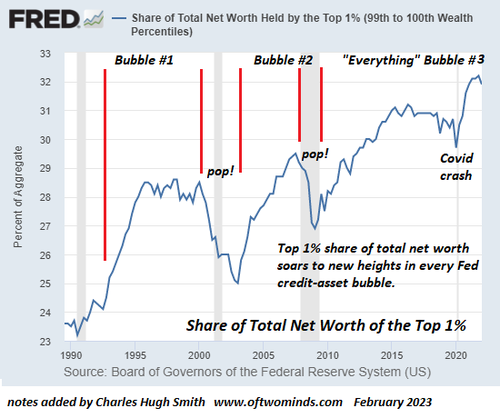

The important thing financial dynamic of the previous 30 years is central bank-driven credit-asset bubbles which propel the belongings owned by the highest 10% to the moon. Those that personal few such belongings don’t profit from these asset bubbles, so their share of web value (wealth) declines accordingly.

The 2 main forces up to now 30 years are financialization and globalization, forces which accelerated beneath central financial institution / Neoliberal commerce insurance policies into hyper-financialization and hyper-globalization: hyper-financialization continuously inflates ever-larger asset bubbles, enriching the already-rich, whereas hyper-globalization forces labor to compete with lower-cost workforces globally, successfully transferring wages to capital, which might optimize labor / regulatory /credit score / foreign money arbitrage to maximise company earnings on the expense of the underside 90% who depend upon wages for his or her earnings quite than capital.

Essentially the most hanging function of the fortunes of the highest 1% and the center class is clearly seen: the share of whole wealth of the highest 1% soars to new heights in each bubble, whereas the share of the center class dives.

The share of the center class solely rises when asset bubbles pop. That is the results of the highest tier of US households proudly owning the overwhelming majority of belongings: as bubbles pop, those that personal few belongings endure far lower than those that personal many of the belongings that bubble larger on the again of central financial institution stimulus and straightforward credit score.

When the bubbles inevitably pop, the share of the highest 1% crashes because the share of the center class makes a short lived acquire.

Please have a look. It is quite outstanding, is not it?

The online results of hyper-globalization and hyper-financialization is the crumbling of the center class, which has seen its share of the nation’s wealth and earnings eroded for the previous 45 years, a pattern that accelerated up to now 20 years.

Neofeudal economies and societies are static, brittle, dysfunctional and incapable of producing broad-based prosperity. Does that sound like an financial system we all know?

* * *

My new e book is now accessible at a ten% low cost ($8.95 e-book, $18 print): Self-Reliance within the twenty first Century. Learn the primary chapter free of charge (PDF)

Grow to be a $1/month patron of my work through patreon.com.

Loading…

[ad_2]