[ad_1]

The CBO launched its Finances and Financial Outlook, 2023-33 yesterday. The projection, primarily based on knowledge out there as of January 6, reveals a shallow decline in GDP in 2023Q1 and 2023Q2.

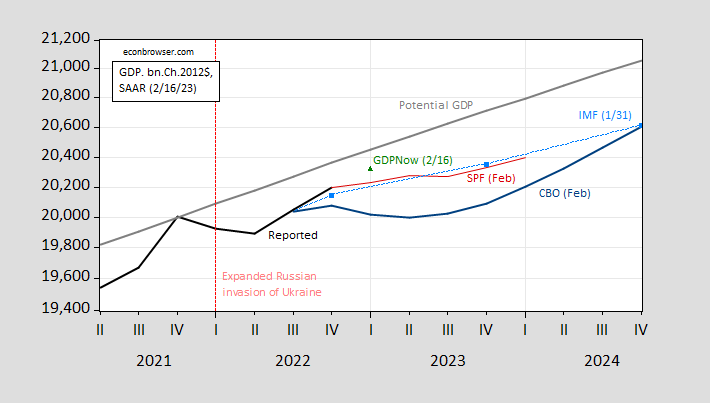

Determine 1: Reported GDP (daring black), CBO projection (blue), SPF median forecast (crimson), IMF WEO projection (sky blue), GDPNow at 2/16 (inexperienced triangle), potential GDP (grey), all in billions Ch.2012$ SAAR. Supply: BEA 2022Q4 advance launch, CBO, Philadelphia Fed, Atlanta Fed, IMF WEO (January), and creator’s calculations.

The CBO forecast was primarily based on knowledge out there January sixth, so doesn’t incorporate the This autumn advance launch, nor subsequent info.

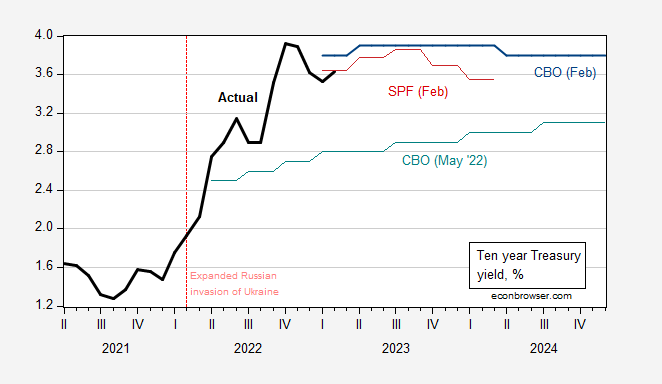

Observe that rates of interest are additionally projected to be a lot larger, following precise developments in monetary markets.

Determine 2: Ten yr Treasury yield (daring black), CBO February 2023 projection (blue), CBO Could 2022 projection (teal), and SPF February median forecast (crimson), all in %. 2023Q1 is for first half of quarter. Supply: Treasury through FRED, CBO (varied), and Philadelphia Fed.

The upper rates of interest — together with different developments — indicate slower development in GDP, so gradual there are two quarters of unfavourable development (though the Q2 charge is -0.1% q/q, basically zero). The implied peak for GDP is 2022Q4 within the CBO projection. Nonetheless, the doc makes no point out of a recession in 2023.

Determine 3: Nonfarm payroll employment – precise (daring blue), projected (blue), GDP – precise (daring pink), projected (pink), actual private earnings ex-current transfers – precise (daring mild inexperienced), actual private earnings – projected (mild inexperienced), actual consumption – precise (daring sky blue), projected (sky blue), all in logs, 2022Q4=0. 2023Q1 NFP commentary is for January. Supply: BLS, BEA 2022Q4 advance, CBO (February), creator’s calculations.

Whereas GDP does drop barely, NFP is flat, and consumption and private earnings proceed to rise. As NBER’s Enterprise Cycle Relationship Committee doesn’t place important reliance on GDP (given the quite a few revisions that happen to it), however fairly employment and private earnings, it is sensible that recession shouldn’t be projected.

GDPNow as of immediately signifies that GDP in 2023Q1 will probably be considerably larger than forecasted by CBO (inexperienced triangle in Determine 1; at 2.5% SAAR in Q1), and certainly larger even than the median from the February Survey of Skilled Forecasters. Nonetheless, that doesn’t imply the slowdown is canceled, merely maybe delayed.

[ad_2]