[ad_1]

Vitality firms are planning to go public within the US on the quickest charge in six years, as a sector that has lengthy been out of favour advantages from renewed investor urge for food for companies that generate regular cashflows moderately than prioritising long-term development.

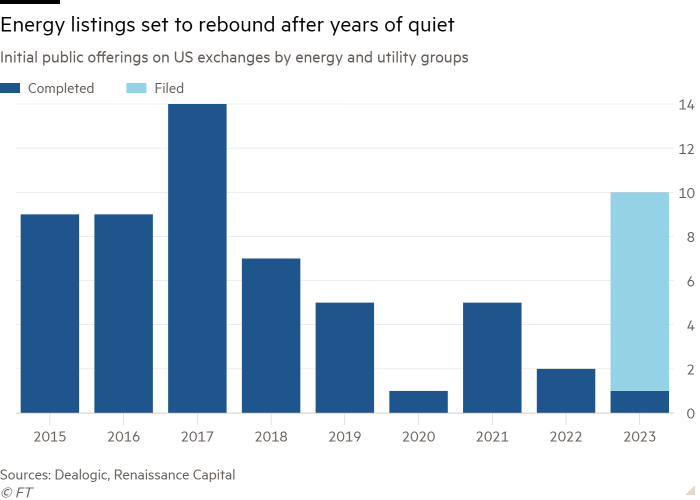

Texas-based oil and gasoline producer TXO Vitality Companions in January turned the primary power group to listing within the US in additional than six months, and an extra 9 firms within the power and utility sector have publicly filed or up to date preliminary public providing paperwork prior to now 90 days, in response to information from Renaissance Capital.

If these listings go forward as deliberate this 12 months, 2023 would already grow to be probably the most energetic 12 months for power IPOs since 2017, and bankers anticipate an extra flurry of offers within the coming months.

The figures mark a resurgence for a sector that has struggled to boost money in recent times, stung by unstable oil costs, a hangover from a decade of debt-fuelled drilling that racked up big losses, and distaste for polluting firms amongst environmentally-minded buyers.

“What we’re seeing now’s a lot better engagement and a broader set of buyers making themselves out there to take a look at IPOs within the power sector,” mentioned Justin Bowman, head of power fairness capital markets at Stifel. “The pipeline is continuous to construct with names that . . . haven’t been in a position to actually entry the IPO market” in recent times.

Tumbling inventory markets and rising rates of interest made it tough for firms in any sector to go public final 12 months — and solely two power firms did so — however offers from the sector have been subdued even in the course of the growth years of 2020 and 2021, with oil and gasoline producers nonetheless reeling from the pandemic-induced value crash.

Vitality and utilities accounted for simply three of the greater than 270 conventional IPOs that raised greater than $100mn in 2021, in response to Dealogic. They’re greater than a 3rd of the present public pipeline of similarly-sized offers.

A rebound in commodity costs within the wake of Russia’s invasion of Ukraine and a newfound deal with stability sheet self-discipline has made power the best-performing sector within the S&P 500 for the previous two years. Supermajors together with Exxon and Chevron, in addition to many impartial producers, reported file income in 2022, which they used to pay down debt and return money to shareholders by means of dividends and share buybacks.

Conventional fossil gasoline producers and renewable specialists alike are benefiting from the elevated urge for food in capital markets.

TXO, which raised $100mn final month, adopted the playbook of already-listed oil and gasoline producers which have not too long ago targeted on capital returns, promising to distribute all of its out there money to buyers every quarter.

Atlas Vitality Options, which filed preliminary paperwork in January, reported a web revenue of $217mn in 2022 and mentioned it intends to “often return capital to our stockholders”. The corporate, which provides sand to be used in fracking, is anticipated to boost a number of hundred million {dollars}.

The deal growth can also be set to hit Canada’s markets, with French supermajor TotalEnergies planning to spin out its Canadian oil sands enterprise this 12 months on the Toronto Inventory Change in what analysts anticipate can be one of many largest IPOs the TSX has seen in years.

In the meantime, renewable power producers are attracting growth-focused buyers who had beforehand targeted on areas reminiscent of software program which have suffered within the latest downturn.

“Tech buyers are stepping in and taking a look at photo voltaic and renewable firms as a result of the view is there’s a really long-term secular development story for these industries, very like the software-as-a-service firms have been a couple of years in the past,” mentioned one other senior ECM banker.

Israeli group Enlight Renewable Vitality raised nearly $300mn by means of a secondary itemizing on Nasdaq this month, whereas MN8 Vitality and REV Renewables are each planning IPOs.

The development can also be benefiting firms in energy-adjacent sectors. Final week California-based Nextracker, which produces expertise for photo voltaic panels, accomplished the most important IPO of the 12 months thus far.

Graham Worth, senior fairness analysis affiliate at Raymond James, mentioned Nextracker’s’s success was helped by the Inflation Discount Act — the sweeping new US local weather invoice which pumps $369bn into clear power within the type of tax credit over the approaching decade. He mentioned the subsidies would drive growing capital market exercise amongst inexperienced power teams.

“I do suppose the Inflation Discount Act has in all probability already spurred slightly little bit of exercise,” he mentioned. “A few of these manufacturing credit are so in depth that they will scale up and will be capable of carry ahead that profitability timeline and get extra conservative buyers .”

[ad_2]