[ad_1]

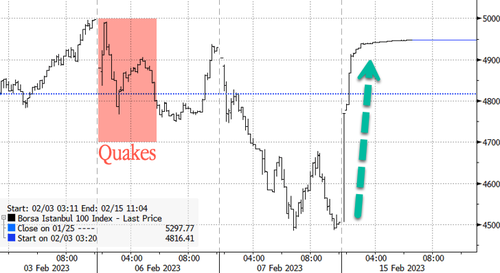

After a week-long suspension, Turkish shares soared Wednesday after the nation’s sovereign wealth fund supported monetary markets to forestall additional declines following final week’s twin earthquakes. The dying toll in Turkey and neighboring Syria has surpassed 40,000.

Listed here are the highest headlines through Bloomberg of the intervention to avoid wasting monetary markets:

- Turkey Shares Surge as State Assist Underwrites Reopening Enhance

- Turkey Injects Billions of Liras to Prop Up Shares Earlier than Open

- Turkey Wealth Fund to Assist Equities With New Mechanism

- Turkey Set to Briefly Droop Some Gold Imports

- Turkey Plans Tax Waiver for Share Buybacks on Inventory Trade

The Borsa Istanbul 100 Index jumped 9.82% right now, as the primary fairness benchmark recovered a lot of its losses for the reason that twin earthquakes rocked the nation’s southeast area on Feb. 6.

Bloomberg, citing officers with direct information of the matter, acknowledged that Turkey’s sovereign wealth fund supported equities in a brand new inner mechanism to suppress market volatility.

“All of the measures taken appear to have been profitable in boosting the fairness market.”

“The market response for now says many of the calls for of the market gamers are met,” stated Burak Isyar, the pinnacle of fairness analysis at ICBC Turkey Funding in Istanbul.

One other mechanism to help shares was Turkish corporations’ announcement of huge share buyback plans. Turkish Airways, Erdemir, and Isbank debuted new buyback applications. State-owned lenders Vakifbank and Halkbank boosted their present applications.

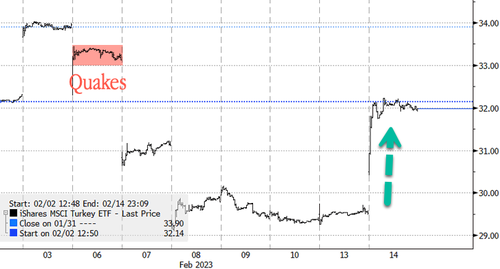

In New York, iShares MSCI Turkey Trade Traded Fund, the most important ETF targeting Turkish shares, jumped 8% yesterday and is up 6% in premarket buying and selling.

In the meantime, the variety of lifeless in Turkey and Syria crossed a grim mark right now, surpassing 40,000. Tens of 1000’s of persons are nonetheless lacking as quakes leveled giant swaths of ten cities.

Loading…

[ad_2]