[ad_1]

Final Thursday, I talked on WPR’s Central Time in regards to the nationwide financial system and Wisconsin’s outlook given President Biden’s insurance policies. I famous that the macro outlook had improved considerably since final December, because the financial system proved extra resilient than anticipated, and inflation decelerated greater than anticipated. That was true nationally, in addition to domestically.

The Wisconsin Financial Outlook

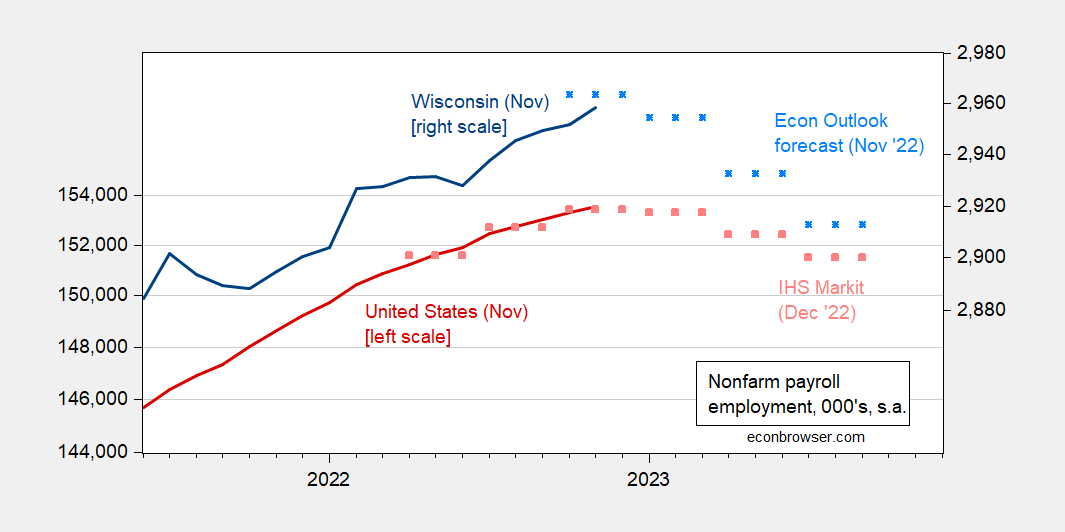

Determine 1 exhibits the projections from the November Wisconsin Financial Forecast replace and the December IHS Markit forecast for the nation (the Financial Forecast relies on nationwide inputs from the IHS Markit forecast). Therefore, the forecasted downturn in nonfarm payroll employment is pushed by the downturn on the nationwide degree.

Determine 1: US nonfarm payroll employment, November launch (pink), and forecast from December IHS Markit forecast (pink squares), Wisconsin nonfarm payroll employment, November launch (blue), and Wisconsin Financial Forecast replace of November (sky blue squares), all in 000’s, s.a. Supply: BLS by way of FRED, IHS Markit (Dec. 13, 2022), WI Dept of Income (November, launched in Dec.)

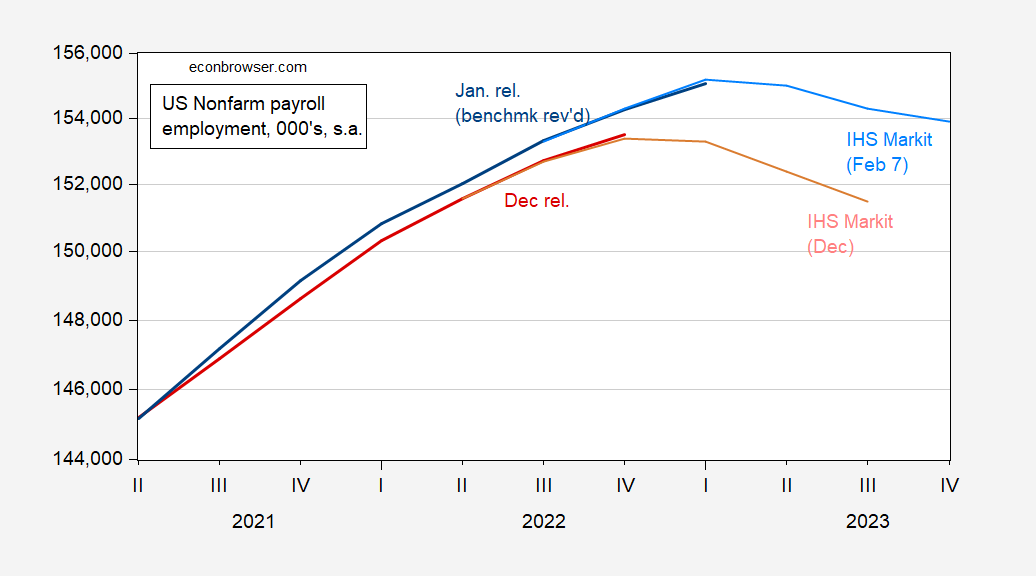

Since November, the financial outlook has improved, as was mentioned on this put up from yesterday. Because the Division of Income forecast depends on IHS Markit forecasts, it pays to look at how the IHS Markit forecast has advanced since December, as proven in Determine 2.

Determine 2: US nonfarm payroll employment from December launch (pink), from January launch (blue), IHS December forecast (pink), and February forecast (sky blue), all in 000’s, s.a. Supply: BLS by way of FRED, IHS December 13, and February 7.

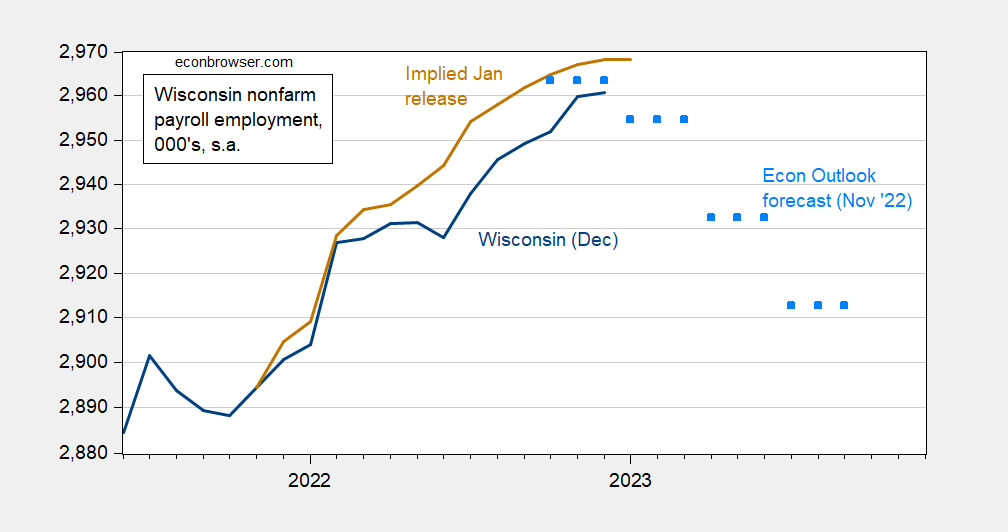

What does this suggest for the Wisconsin outlook? Determine 3 exhibits the employment numbers from the December launch (blue) and the November Division of Income forecast (sky blue squares).

Determine 3: Wisconsin nonfarm payroll employment from December launch (blue), Wisconsin Financial Forecast replace of November (sky blue squares), and estimated Wisconsin nonfarm payroll employment from January launch (brown line). Supply: BLS, WI Dept of Income (November, launched in Dec.), and creator’s calculations.

Given the improve in outlook, I might count on the subsequent Wisconsin Financial Forecast to indicate a much less pronounced — and a later — downturn in nonfarm payroll employment. Given the nationwide degree benchmark revision which raised nationwide degree NFP employment in December by about 800K, we must always anticipate an identical impact on Wisconsin degree employment. Sadly, we gained’t see the state degree benchmark revisions and January numbers till early March. Therefore, I take advantage of the first-difference relationship between Wisconsin employment and nationwide employment in logs, 2021M12-2022M12, to estimate a relationship:

ΔnpfWI = -0.002 + 1.44ΔnfpUS

Adj-R2 = 0.40, SER = 0.0017, DW = 1.90, Nobs = 13, daring denotes significance at 5% msl utilizing HAC sturdy commonplace errors.

I then use the benchmark revised development charges in nationwide employment to foretell the brand new degree of Wisconsin employment (working off of the particular degree of Wisconsin employment in 2021M11). This implied degree exhibits up in Determine 3 as a brown line.

Federal Insurance policies and Impression on Wisconsin

How has laws enacted since January of 2021 affected the Wisconsin financial system. I identified that a number of coverage measures have been put into place, together with the Bipartisan Infrastructure Legislation ($1.2 trillion over 5 years), the Inflation Discount Act ($400-$800 billion in tax credit and so on.), and CHIPS ($280 billion).

The primary measure is the best to evaluate. As of November 2022, $2.7 billion had been allotted, of which $2.4 billion was to transportation. The Administration anticipates about $5.4 billion to be allotted to Wisconsin ultimately. Utilizing a rule of thumb {that a} $100 billion expenditure leads to 1 million FTE years implies that one will get about 54,000 individual years of enhanced employment. Distributed over 5 years implies that nonfarm payroll employment is about 1% larger than in any other case.

One other manner to have a look at that is to think about $5.4 billion multiplied by 1.6 (Moody’s quantity for infrastructure, CBO vary is 0.4-2.2) is about 0.6% of GDP for every of 5 years (the place Wisconsin GDP was $303 billion in 2021).

The opposite provisions are more durable to evaluate. The Inflation Discount Act supplies tax credit and incentives for inexperienced expertise funding, together with an extension of the Inexpensive Care Act, at about $400 billion. To the extent that Wisconsin, as a medium trade heavy state, is concerned, the improved funding will spur additional GDP and employment will increase.

Lastly, the CHIPS act ($280 billion) supplies funds to subsidize the constructing of semiconductor chip services. Wisconsin got here near an funding from Intel (to make use of the Foxconn services – that’s one other story), however missed out. Nevertheless, to the extent that semiconductor chip provide is enhanced, this may scale back the price of manufacturing for Wisconsin manufacturing companies.

Then there are different non-actions. Specifically, the Administration has retained the Part 232 aluminum and metal tariffs, in addition to the Part 301 tariffs levied towards China. Since Wisconsin is a person of metal and aluminum, in addition to different intermediate inputs imported from overseas, on internet the retention of those tariffs and restrictions is probably going subtracting away from employment.

Russ (2020) estimates 75,000 jobs have been misplaced in 2019 because of the metal and aluminum tariffs, with in all probability extra occurring since then. Since Wisconsin accounted for about 3.8% of nationwide manufacturing employment in 2019, that meant that Wisconsin misplaced maybe round 3000 manufacturing jobs. That’s roughly 0.6 of Wisconsin manufacturing employment in 2022. (A giant quantity or not? Bear in mind, the Scott Walker administration and Republican legislature have been going to pay out as a lot as $3 billion in state funds to entice Foxconn to convey 13,000 jobs to Wisconsin.)

[ad_2]