[ad_1]

Yves right here. The modest headline declare about oil costs and inflation appears affordable, if nothing else as a result of lead and lag results, in addition to the power of companies and customers to a level to curtail power use when costs rise.

Nonetheless, the CEPR paper summarized on this article contends that oil costs don’t have as a lot affect on inflation as conventionally assumed, and bases that declare on an evaluation of retail gasoline costs v. shopper inflation.

As a result of hour, I confess to not having learn the underlying CEPR research. Nonetheless…huh? First, as a result of modifications in refining spreads over time, modifications in oil costs no manner, no how change in a 1:1 relationship to costs on the pump.

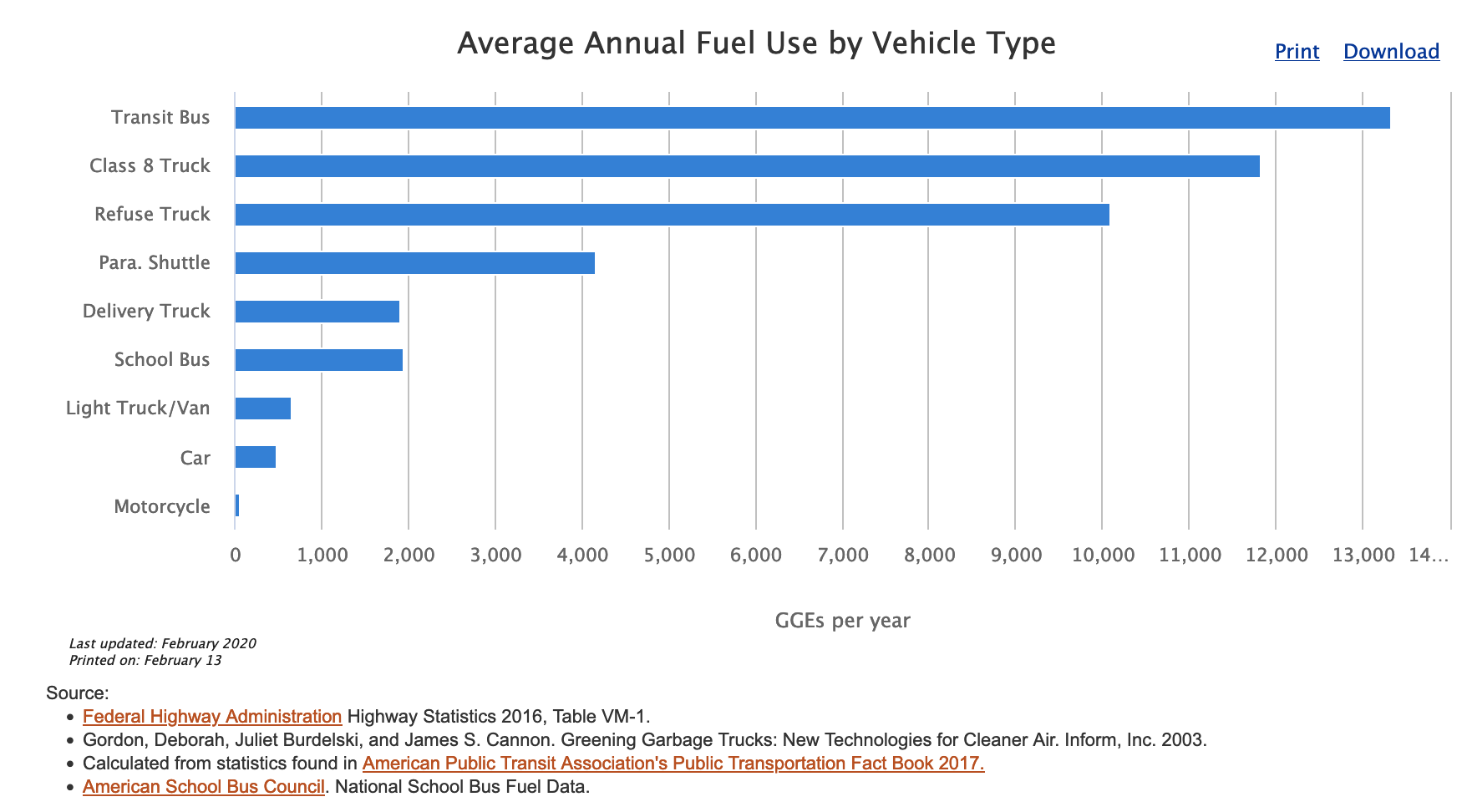

Second, gasoline is essentially the most closely consumed petroleum product within the US, at 44% of the entire in 2021. I used to be not capable of finding a breakdown of shopper versus industrial/municipal use. However consider the per car disparity is massive:

It has been extensively reported that will increase in gasoline costs to truckers has an affect on finish product prices, notably meals.

Equally, increased oil costs are commonly correlated with, and used to justify, a lot increased airfares.

Admittedly, the CEPR research falls again on its use of “core inflation,” derived from CPI and the private consumption expenditures, so one can argue that it’s narrowly appropriate in utilizing consumer-related figures throughout. However the Fed reliance on comparatively few and far jiggered key metrics is questionable.

I’ll ask my experts what they consider this work.

By Alex Kimani, a veteran finance author, investor, engineer and researcher for Safehaven.com. Initially revealed at OilPrice

- A brand new research has discovered that top gasoline costs have a a lot decrease affect on U.S. core inflation than earlier assumed.

- U.S. inflation has been falling since mid-2022 and presently stands at a extra palatable 6.5%.

- A lot of the rise in inflation triggered by rising crude costs happens within the first month after the rise in crude costs however is just short-lived.

For many years, the traditional knowledge in macroeconomics has been that top oil and gasoline costs are steadily the main reason for excessive inflation. In reality, many analysts have blamed the two main oil value shocks of the Nineteen Seventies for prime inflation through the decade. The argument has been that oil costs and inflation are linked in a cause-and-effect relationship, due to this fact, as oil costs climb, inflation tends to comply with in the identical course increased and vice-versa. That is supposedly the case as a result of oil is a serious enter within the economic system, and if enter prices rise, so ought to the price of finish merchandise.

However a brand new research has discovered that top gasoline costs have a a lot decrease affect on U.S. core inflation than earlier assumed. A deep dive into the most recent wave of excessive inflation in the US reveals that the connection between excessive power costs and inflation is hardly easy neither is it supported by accessible knowledge.

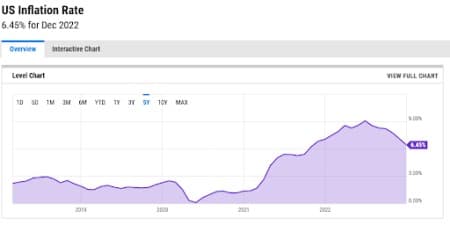

After an incessant climb to multi-decade highs, U.S. inflation has been falling since mid-2022 and presently stands at a extra palatable 6.5%.

Supply: Y-Charts

In keeping with a research by the Centre for Financial Coverage Analysis (CEPR), the share of motor-fuel spending within the shopper basket within the U.S. is ~4%, far lower than the shares for meals or shelter. Furthermore, a 1% enhance within the value of crude interprets to a mere 0.6% enhance within the value of gasoline, additional lessening the affect of crude costs on inflation.

CEPR goes on to say that a lot of the rise in inflation triggered by rising crude costs happens within the first month after the rise in crude costs however is just short-lived.

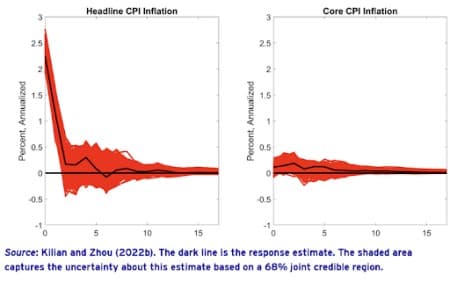

In keeping with CEPR, previous makes an attempt at quantifying the inflationary results of power value shocks typically relied on empirical strategies which have been demonstrated to be invalid.

By utilizing state-of-the-art vector autoregressive fashions, nevertheless, the group has discovered that whereas a one-time sudden enhance in gasoline costs does trigger a pointy enhance in U.S. headline shopper value inflation (CPI), the response solely persists for 2 months earlier than changing into indistinguishable from zero.

CEPR concludes that there is no such thing as a proof of persistent will increase in inflation as a result of rising gasoline costs or of delayed periodic inflation spikes, as wages are renegotiated.

Supply: CEPR

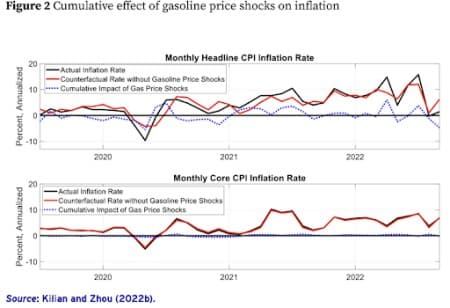

So, how would U.S. inflation have developed after June 2019 if gasoline costs had remained at beforehand low ranges? Effectively, CEPR has modeled this and located that inflation would solely be reasonably decrease. As an illustration, in Could 2022, increased gasoline costs added ~1.2 share factors to the 12-month headline shopper value index inflation fee in contrast with an precise fee of 8.5%, an affect CEPR says might be safely ignored.

Supply: CEPR

U.S. Deflation

There’s an rising faculty of thought that claims that economists ought to be extra frightened about potential deflation within the U.S. quite than the present inflation.

Final February, maverick inventory picker Cathie Wooden of ARK Make investments(NYSEARCA: ARKK) informed a webinar that advances in know-how will seemingly push productiveness charges increased, outweighing any positive aspects in wages.

“We now have a really sturdy viewpoint that productiveness positive aspects we are going to witness over the subsequent 5 to 10 years shall be astonishing. We predict productiveness will enhance 5%-plus, and we received’t have an inflation downside,” she mentioned.

Wooden stays one of many few outstanding fund managers who say that deflation, quite than inflation, shall be a driving drive within the U.S. economic system and inventory market over the subsequent few years. ARK Make investments has change into well-known for being one thing of a contrarian by betting on high-valuation, high-growth shares that soared through the early levels of the pandemic.

Again in December, in an opinion piece in Politico, Dartmouth Faculty economics professor David Blanchflower referred to as the Fed’s reliance on rate of interest hikes “guessenomics on zero knowledge”, additional predicting {that a} interval of deflation may be the top end result. EasyKnock Inc. CEO Jarred Kessler says that deflation could also be at hand, telling Benzinga, “I haven’t seen actual deflation in my or my dad and mom’ lifetime, however as dangerous because the economic system we’re taking a look at is, we could expertise a deflationary interval forward.”

In keeping with Kessler, authorities stimulus applications are guilty for the present financial woes, and folks will begin drawing on their house’s fairness once more as a result of “there aren’t plenty of choices left” after bank card debt not too long ago surged to 18-year excessive.

One other jarring signal: Bloomberg says the rental markets might be deflating, with house and house rental markets having dropped sharply over the previous 90 days whereas vacancies are rising.

[ad_2]