[ad_1]

Authored by Bruce Wilds by way of Advancing Time weblog,

Ugliness awaits most boomers nearing retirement, not solely have they been lied to, however in addition they should take care of rigged markets, corruption, and incompetent advisors. Boomers make up the second-largest era in American historical past, it consists of over 72 million people. Those who have not already retired are on the point of. A giant drawback is most have little in the way in which of financial savings.

Including to this drawback is that the generations following the child boomer era are even worse off and America’s financial image is lower than rosy. It doesn’t assist that Individuals have been inspired through the years to spend and incur debt slightly than save. This encouragement comes from politicians hooked on the thought client spending creates a robust economic system.

This ends in many individuals retiring with little financial savings and depending on a authorities already deep in debt to take care of them of their older years. These of us which have studied the numbers come to shaking our heads in horror, merely put, one thing has to provide and more than likely guarantees will probably be damaged, When phrases like unsustainable and bancrupt have been muttered they merely get brushed apart by each day life.

For years these in energy have hidden and sheltered Individuals from the tough reality that the numbers merely don’t work however historical past exhibits politicians would slightly kick the can down the street than take care of actuality. To the many individuals which have been trying ahead to a cushty and leisurely life of their older years. The truth that issues could possibly be worse just isn’t one thing that can trigger most retirees to leap with pleasure.

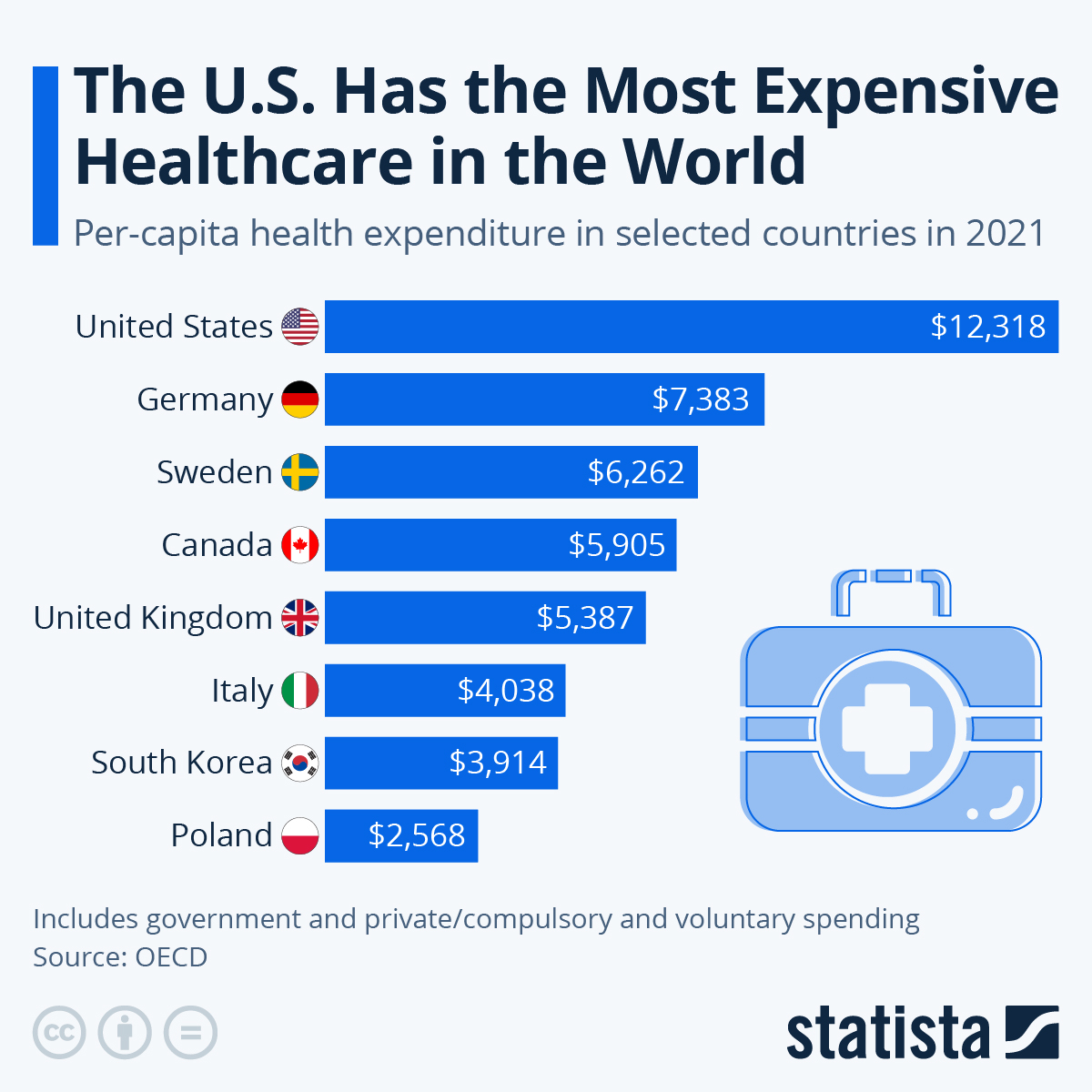

An instance of what we face is clear in healthcare. this can be a sector of the economic system that Washington has pledged to repair and even claimed it has. The chart put out by Statista exhibits the U.S. has the costliest healthcare system on the planet.

You will see that extra infographics at Statista

This issues should you contemplate it as a tax on the American folks and understand that healthcare is a serious expense for folks as they age. This hits medicare immediately within the coronary heart that means as value soar for this system one thing should be achieved. That one thing usually comes within the type of reducing advantages and charging recipients extra.

Whereas there’s extra to life than cash, few folks select to stay in poverty. Sadly, even most Individuals which have saved over their lifetime and achieved the proper factor are in peril.

Over time, the Fed has inflated the cash provide and in doing so it additionally inflated asset costs, together with shares, bonds, and actual property. A lot of that is the results of ballooning debt. Make no mistake about it, the federal government has fed on the debt trough and it has made our future much less promising. Sure, we’re roughly 33 trillion in debt, not counting the unfunded liabilities of social safety, medicare, and Medicaid.

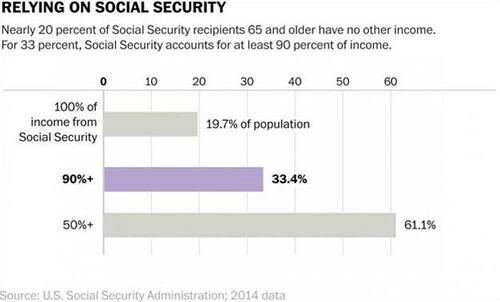

Whereas This Is An older Chart, Little Has Modified. Actuality Is Not Fairly

With the present trajectory of financial insurance policies and inflation operating above the return savers can earn from secure investments issues will solely worsen for retirees and people near retirement age. Contemplating the quantity of debt already amassed, the federal government goes to have a troublesome time placing collectively beneficiant new support packages to return to the help of these dependent upon its packages. This can lead to battle as each the younger and the previous are compelled to battle over the few scraps it may well present.

All this has created a state of affairs the place if the cash provide now contracts an enormous variety of defaults will happen and each companies and traders will incur massive losses. This risk to 401Ks and pension plans is actual and would make many boomers collateral harm in any effort they make to right the mess they’ve created. These in or nearing retirement ought to make an additional effort to scale back danger and hold their financial savings secure.

Loading…

[ad_2]