[ad_1]

By Gautham Krishnan of Container Information

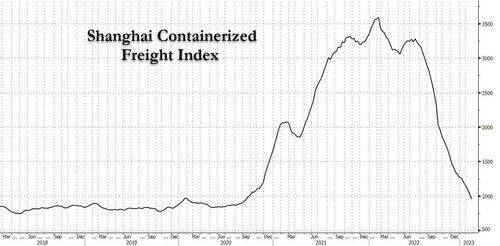

The Shanghai Containerized Freight Index (SCFI) issued after Chinese language New Yr 2023 noticed the index fall into the triple digits, closing at US$995 for the week ending 10 February 2023.

This was a stage final annexed in January 2020, the opening days of the pandemic part. Nonetheless, that wasn’t a primary. These ranges had been seen in 2012, 2015 and 2017, indicating that the spot charges a minimum of have now hit pre-pandemic ranges.

The manufacturing battle in China continues to be imminent as the newest figures for February counsel that the manufacturing unit gates costs for Jan 2023 in China are nonetheless decrease, hinting that the inexperienced shoots that had been seen in early Jan 2023 owing to the relief of the Chinese language Zero-Covid coverage might have been a attainable one-off.

Whilst inflation in Europe sees restoration from the trough on the finish of the third quarter of 2022, progress estimates within the international set-up for 2023, stay muted and hawkish. Add to that the situation of the transport world as 2023 stepped in 2022 January noticed a few of the highest congestions, whereas 40 days into 2023 seldom noticed ports reporting 10+ ready days, barring some, say the Baltimore port in america.

A string of latest container ships will see becoming a member of the prevailing fleet in 2023, with the entire rising by about 10% by the yr’s finish, ought to the supply timelines stay intact. The fleet progress will likely be just a little over a fourth of the prevailing fleet capability, if one had been to additionally account for the attainable scrapping of older vessels, by 2027, given the strong order e book exercise throughout the yards.

The world’s largest vessel operator, MSC has a dimension of about 39% of the prevailing fleet capability in numerous phases of a brand new constructing. All these may look to tame inflation within the medium time period, but in addition put resistance on costs, indicating that whereas we aren’t certain of the extent of the autumn coming, there could possibly be upside resistance.

In accordance with Chris Bryant, a Bloomberg οpinion columnist, Maersk foresees international container demand for the yr to fall by 2.5%. It is usually foreseeing the contract charges to fall and settle in step with the spot market. (It should already be seen that the long-term charges on Xeneta took a 13% dive, the earlier month to register the fifth straight month of consecutive losses.) This could possibly be an enormous hit when it comes to the general yield.

Rightly so, even the steering numbers for the logistics large stipulate the identical. Its working revenue numbers for 2023 are seen someplace between US$2-5 Billion for 2023, nearly 6-15% of its 2022 numbers at US$31 billion. In reality, they’re only a tad higher than the 2019 numbers of US$1.7 billion.

On the flip aspect although, the speed of falls has come down considerably, a minimum of on commerce lanes which have borne the larger brunt. The sharper falls in latest weeks have been attributed to the China-US East Coast and the Transatlantic commerce.

Whereas the previous did not right a lot in step with the China-Europe and China-USWC commerce, because of the shift in cargo lanes from US West Coast to East Coast owing to port ready occasions, the latter hit a excessive when it comes to charges within the fourth quarter of 2022.

We additionally noticed the Chinese language Containerized Freight Index (CCFI), the cousin of the SCFI, pulling up a weekly acquire submit the Chinese language New Yr because of charges throughout China-Japan, China-South America and the Mediterranean & Persian Sea commerce. Clever contracting measures and batching appear to be what the shippers ought to look out for within the near-term whereas additionally cautiously approaching the speed actions.

Loading…

[ad_2]