[ad_1]

Goldman sums up the week’s fairness buying and selling succinctly:

This week has been most aggressive combination web promoting throughout HFs and LO$ on the 12 months (Monday-Thursday) by an element of 4x. LOs confirmed the most important weekly web promoting because the first week of 2023, however HFs added to this promoting dynamic as properly, promoting probably the most in per week since mid-Dec of ’23.

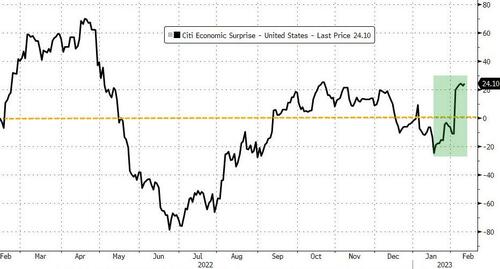

With the ‘imminent H1 recession / Fed pivot’ narrative taking a beating lately with US macro information stunning to the upside, and FedSpeak has (as soon as once more) reassured that there shall be no pivot…

Supply: Bloomberg

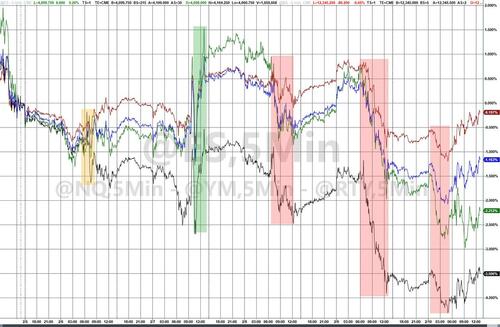

This ‘adjustment’ has despatched the market’s expectations for The Fed’s rate-trajectory considerably hawkishly increased with terminal charges including 35bps of further hikes this week alone…

Supply: Bloomberg

All of which prompted ache for bond and inventory bulls this week with all of the US main fairness indices within the purple on the week, led by a puke in Small Caps and Massive-Tech. The Dow was the least ugly horse within the glue manufacturing facility…

The vitality sector was the one one to shut the week inexperienced with Shopper Discretionary and Actual Property puking hardest…

Supply: Bloomberg

(who might have seen that coming?)

Translation: simply as tech is now outperforming each different sector on account of a seemingly infinite brief squeeze, the identical hedge funds that are quickly degrossing as they don’t know what to do… are apparently satisfied that the sector to brief is vitality regardless of a close to report buyback introduced by Chevron and report money movement from Exxon. Translation: they’re about to be steamrolled once more, solely as a substitute of tech, the following large squeeze shall be in vitality as all these current shorts are violently unwound.

…and bonds have been a one-way road increased in yields because the higher than anticipated payrolls print. The short-end (really extra the stomach) has considerably underperformed this week as hawkish actuality is priced again in…

Supply: Bloomberg

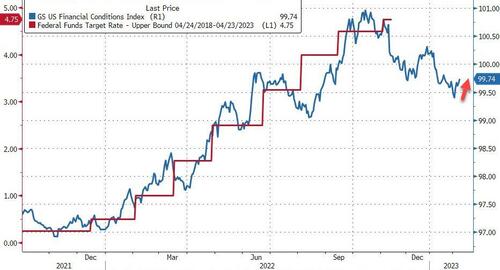

And this has began to ‘tighten’ monetary situations (regardless of Powell’s nonchalance) after 4 months of utmost loosening (which suggests ‘peak Fed’ has already occurred…

Supply: Bloomberg

And notably, with charges rising once more, the a number of growth that lifted shares all 12 months is going through peril…

Supply: Bloomberg

After an nearly continuous short-squeeze all 12 months, the ‘most shorted’ inventory basket is down 6 straight days and the largest weekly drop since September.

Supply: Bloomberg

The greenback ended the week modestly increased, holding its good points from final Friday’s payrolls print…

Supply: Bloomberg

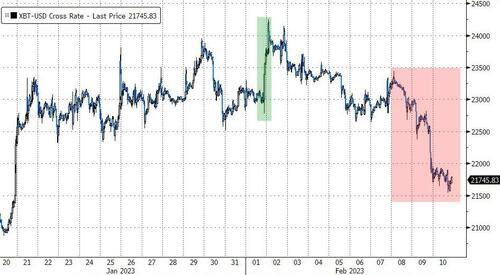

Bitcoin tumbled this week after final week’s surge, breaking again under $22k…

Supply: Bloomberg

Gold prolonged final week’s losses, unable to interrupt again above $1900…

Oil costs rebounded considerably this week with WTI again above $80…

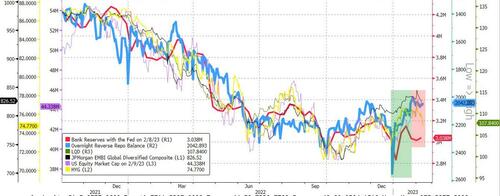

Lastly, repos proceed to be all that issues… and that is not an excellent factor anymore…

Supply: Bloomberg

It is all one large Fed commerce…

Check out this (ugly) chart under.

white: Fed Funds charge in August/24 – July/23 (inverted: increased -> extra cuts are priced)

different: $SPY, Gold, #bitcoin, $AGG, $HYG, metals

All bottomed in October and topped lately.

That is all one large Fed commerce. Nothing else issues. pic.twitter.com/laZFBkVdQT

— Paulo Gitz, CFA (@PauloGitz) February 2, 2023

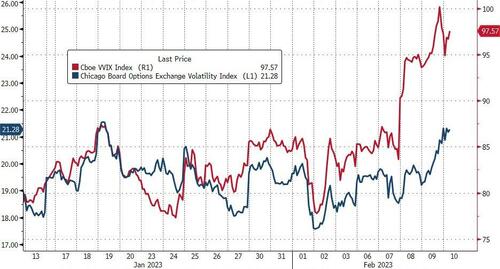

And VVIX is warning that subsequent week goes to be chaotic with CPI and OpEx…

Supply: Bloomberg

VVIX at all times is aware of…

Loading…

[ad_2]