[ad_1]

January’s income alone was $77.2 million over legislative estimates.

As Mississippi lawmakers begin the appropriations course of in earnest this session, the query of what the state does with its further income can be among the many most hotly debated matters on the Capitol.

The speak has principally centered round whether or not to provide taxpayers a one-time rebate or absolutely eradicate the state particular person earnings tax.

In the present day’s report from the Joint Legislative Price range Committee will certainly gas that debate.

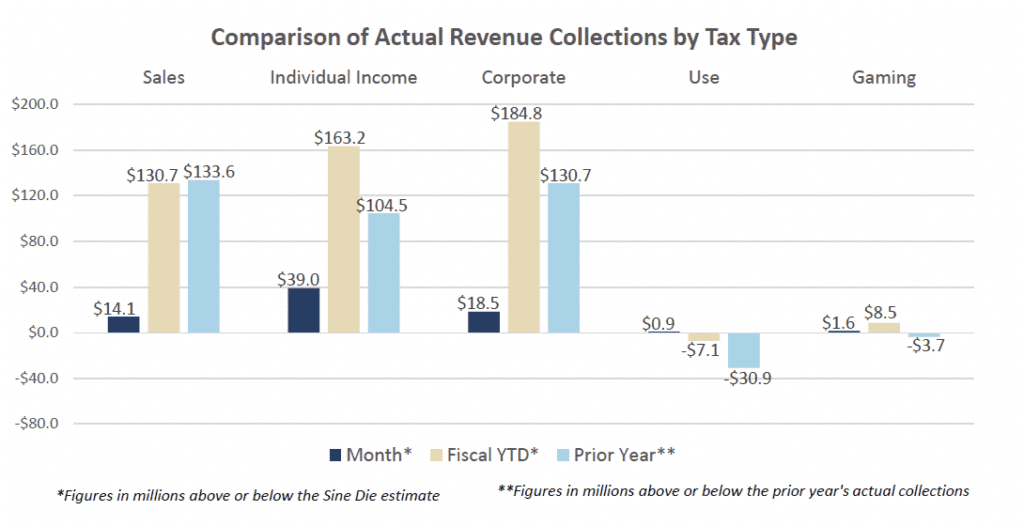

The report says that Mississippi income collections for the month of January 2023 are $77,243,229 or 15.10% above the sine die income estimate.

That brings the fiscal year-to-date income collections via January to over half a billion {dollars} – $502,055,666 or 13.25% – above the sine die income estimate.

Income collections via January 2023 are $363,604,438 or 9.25% above the prior yr’s collections.

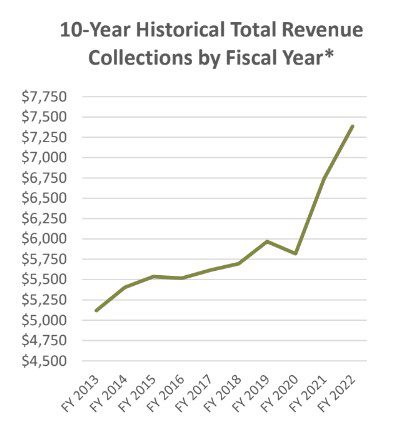

The entire fiscal yr 2023 sine die income estimate was $6,987,400,000.

The graph above compares the precise income collections to the sine die income estimate for every of the principle tax income sources. The figures replicate the quantity the precise collections for gross sales, particular person earnings, company, use and gaming taxes had been above or beneath the estimate for the month and monetary year-to-date. The graph additionally compares fiscal year-to-date precise collections to prior yr precise collections, as of January 31, 2022.

General, January 2023 Normal Fund collections had been $29,423,849 or 5.26% above January 2022 precise collections.

Gross sales tax collections for the month of January had been above the prior yr by $8.1 million. Particular person earnings tax collections had been above the prior yr by $3.9 million and company earnings tax collections had been above the prior yr by $14.4 million.

[ad_2]