[ad_1]

One month in the past, when wanting on the newest Chinese language credit score information, we stated that Beijing’s credit score flood is coming, even when the December information was a disappointment.

China’s Credit score Flood Is Coming, However December Was A Disappointment https://t.co/M9qmJRm0KX

— zerohedge (@zerohedge) January 11, 2023

Then two weeks later, we obtained affirmation that this was certainly coming, when a neighborhood information paper stated that “China Financial institution Lending in Jan. Could Hit Report at Over 4T Yuan”, to which our response was that China had simply wasted 3 years in one other pointless deleveraging experiment to get again the place it began: with huge credit score injections as the one means for progress.

China simply wasted 3 years in one other pointless deleveraging experiment to get again the place it began: with huge credit score injections as the one means for progress. https://t.co/nDrAaUHYJA

— zerohedge (@zerohedge) February 1, 2023

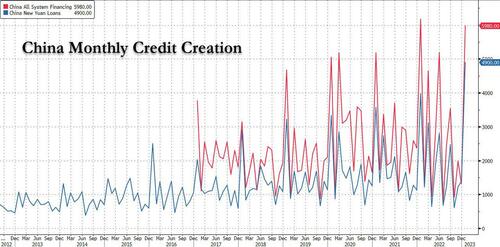

Quick ahead to at present when simply as we previewed a month in the past, the Chinese language Credit score Flood arrived with a bang, and a report 4.9 trillion in new loans, which smashed expectations as did the Whole Social Financing which got here at a close to report 6 trillion yuan, or nearly $1 trillion in whole new credit score (i.e., new cash) in only one month!

The massive image: Whole RMB loans stunned the market to the upside primarily on stronger company loans – company mortgage progress accelerated to 23.7% month-over-month annualized in January from 16.9% in December, though short-term company loans grew sooner than medium to long run loans. Family mortgage progress slowed in distinction – medium to long run loans to households (principally mortgages) contracted in January vs December final yr amid weak property transactions and early compensation of mortgages. Whole social financing and M2 beat expectations as properly on the again of stronger mortgage progress.

The important thing numbers:

- New CNY loans: RMB 4900BN in January (RMB loans to the true financial system: RMB 4930BN) vs. Bloomberg consensus: RMB 4200BN.

- Excellent CNY mortgage progress: 11.3% yoy in January (+12.7% mother sa ann, estimated by GS); December: 11.1% yoy (+12.1% mother sa ann).

- Whole social financing: RMB 5980 billion in January, vs. consensus: RMB 5400bn

- TSF inventory progress: 9.4% yoy in January, vs. 9.6% in December. The implied month-on-month progress of TSF inventory: 11.5% in January (seasonally adjusted annualized price), greater than double the 4.8% December price.

- M2: 12.6% yoy in January (21% mother sa ann estimated by GS) vs. Bloomberg consensus: 11.7% yoy, December: 11.8% yoy (+2.5% mother sa ann).

Courtesy of Goldman’s Maggie Wei, listed here are the details from the report:

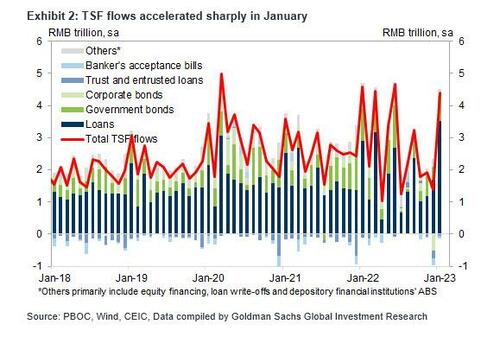

- 1. January whole social financing (TSF) got here in above market expectations, primarily on stronger mortgage progress. The sequential progress of TSF inventory accelerated to 11.5% mother sa annualized in January from 4.8% in December, and in year-on-year phrases, TSF inventory progress slowed to 9.4% from 9.6% in December. Amongst main TSF parts, new CNY loans rose strongly after seasonal adjustment, and shadow banking credit score turned much less unfavourable as properly. Belief loans, entrusted loans and undiscounted bankers’ acceptance payments mixed contracted by RMB 140bn in January, vs a contraction of RMB 453bn in December final yr. Company bond confirmed internet issuance of RMB 91bn, vs internet redemption of RMB 505bn in December, and authorities bond internet issuance rose to RMB 794bn, from RMB 425bn in December.

- 2. Total CNY loans got here in properly above market expectations, and the sequential progress of RMB loans accelerated to 12.7% mother sa annualized from 12.1% in December. Yr-on-year progress of RMB loans was 11.3% in January, edging up from 11.1% in December. Primarily based on mortgage breakdown by totally different sectors after our seasonal adjustment, company mortgage progress accelerated whereas family mortgage progress slowed. Particularly, family short-term mortgage progress slowed to three.4% month-over-month annualized from 5.7% in December, and family medium to long run loans, that are principally mortgages, contracted by 2.2% in January from 5.2% enlargement in December final yr, on the again of gradual property transactions and early compensation of mortgages, regardless of on-going property coverage easing.

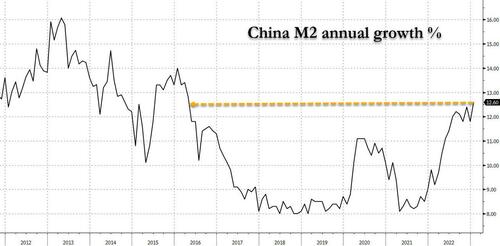

- 3. M2 progress accelerated to 12.6% yoy in January from 11.8% in December, above market expectations and the very best since 2016. FX inflows have possible been fairly robust in January, including to the general M2 progress within the month, moreover the contribution from sooner RMB mortgage progress.

- 4. January mortgage and credit score information have been stronger than expectations, totally on increased RMB loans to the company sector. The acceleration in company loans mirrored coverage assist and a few enchancment in credit score demand – policymakers urged business banks to speed up mortgage extensions and market coloration suggests sooner mortgage progress in infrastructure and manufacturing sectors. Nonetheless, company short-term loans grew sooner than long-term loans – short-term loans expanded by 39.3% month-over-month annualized, vs 5.4% in December final yr, and medium to long run loans expanded by 28.2% month-over-month annualized, vs 24.4% in December. Whether or not the quick pace of company mortgage progress might be sustainable thus stays to be seen. In distinction, the weak family loans and specifically family medium to long run mortgage progress highlighted the challenges within the property sector – regardless of the on-going coverage easing within the sector, households selected to repay mortgages early amid falling mortgages charges and comparatively conservative expectations on future property costs.

- 5. PBOC revised the statistical requirements for cash and credit score information this month by together with credit score extensions from client credit score firms, wealth administration firms, and monetary asset funding firms to the mortgage and TSF information, although this impression is comparatively small. In line with the PBOC, whole mortgage extensions by these firms stood at RMB 841bn in January, round 0.4% of excellent RMB mortgage inventory.

Backside line, the January mortgage and credit score information got here crimson scorching as we anticipated and as China warned, clearly anticipating this end result and hinting that there’s far more to return (no shock that the PBOC launched greater than 1trillion yuan in new liquidity in simply the previous three days). The acceleration in financial institution loans mirrored coverage assist – business banks prolonged extra loans to property builders after the “property 16 measures”, and coverage banks’ credit score facility concentrating on at infrastructure funding in current months possible additionally added to total RMB mortgage progress. On the identical time, the sharp upward reversal in TSF progress signifies that Beijing has absolutely capitulated in relation to new containing the subsequent credit score bubble and is now pursuing it wholeheartedly because it hopes to reverse three years of subdued progress by China’s financial system throughout its Zero Covid nightmare.

The query is how quickly and the way extensively China’s huge credit score impulse reboot will flood the world. One factor is evident: the burst increased in credit score will result in an much more highly effective bounce in Chinese language shares within the close to time period.

The chart under mainly summarizes my tackle the credit score information Beijing simply launched. pic.twitter.com/Tpd0mtcD8T

— Shanghai Macro Strategist (@ShanghaiMacro) February 10, 2023

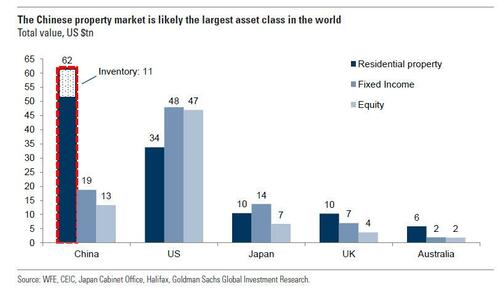

How broadly that spreads throughout the globe stays to be seen and can be a operate of how a lot inflation China manages to export to the world within the subsequent yr. This a subject we mentioned in “Nikileaks Spooks Markets That Chinese language Reopening Could Be Inflationary, However Wall Avenue Disagrees.” However what is maybe most vital is that the wobbly basis of the world’s greatest asset bubble – China’s property market..

… is about to be bolstered with financial concrete, as mentioned in “In Large Coverage Reversal, China Will Ease “Three Pink Strains” Rule To Kickstart World’s Largest Asset Bubble“, and never lengthy after count on all world “excessive beta” asset courses to observe swimsuit.

Loading…

[ad_2]