[ad_1]

Sundry Images/iStock Editorial through Getty Photographs

CloudFlare (NYSE:NET) is scheduled to announce This autumn earnings outcomes on Thursday, February ninth, after market shut.

The consensus EPS Estimate is $0.04 (+Infinity% Y/Y) and the consensus Income Estimate is $274.17M (+41.6% Y/Y).

The cloud-based safety firm exceeded Wall Road estimates with its third quarter outcomes and raised full yr forecast, though analysts advised the monetary efficiency was not sturdy sufficient to justify the inventory’s excessive valuation.

In a preview notice forward of This autumn earnings, RBC Capital Markets stated it expects a slight replace to estimates amid an unsure macro backdrop, pushed by the corporate’s broad platform, worth will increase and product progress drivers.

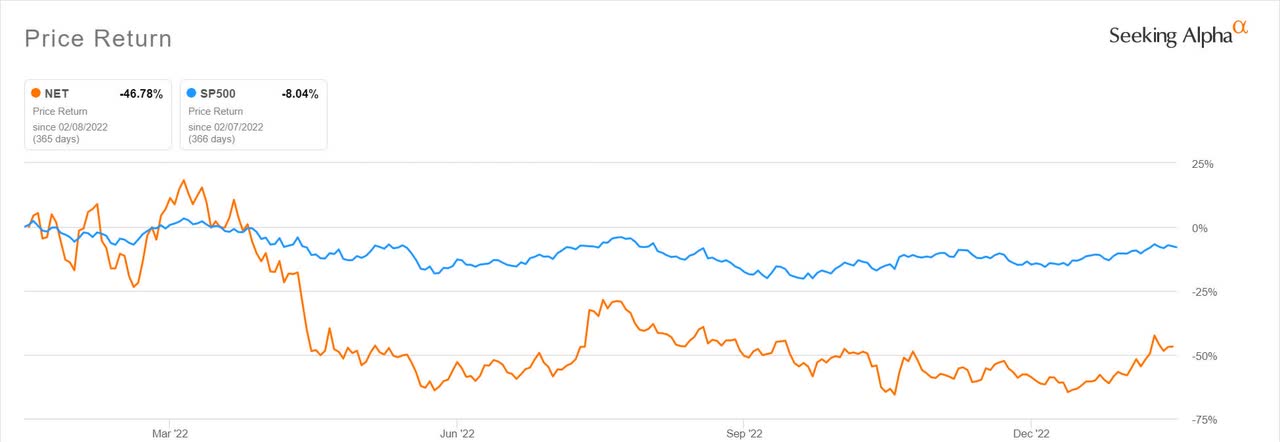

In the meantime, Wells Fargo famous that the main focus will likely be on administration outlook for 2023 and a shift in technique in direction of profitability as an alternative of driving income progress. With the inventory round -46.36% down prior to now yr, an SA contributor evaluation additionally advised it’s time for the corporate to vary its company mindset.

Wells Fargo’s Andrew Nowinski stated investor sentiment has develop into blended on Cloudflare (NET) as the corporate has to supply an preliminary outlook for fiscal 2023 and the consensus is asking for 35% year-over-year progress, in comparison with 48% progress in fiscal 2022.

Traders will likely be conserving a detailed eye on the variety of giant clients Cloudfare (NET) has and the corporate’s dollar-based internet retention charge, based on one current SA contributor.

Over the past 2 years, Cloudfare has overwhelmed EPS estimates 88% of the time and has overwhelmed income estimates 100% of the time.

[ad_2]