[ad_1]

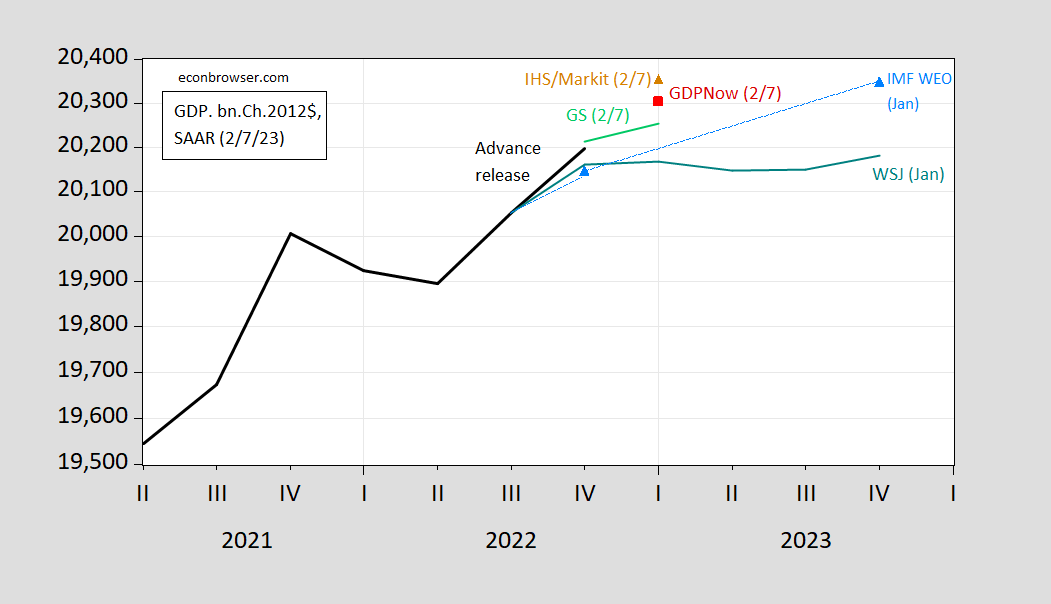

Listed below are a number of nowcasts of 2023Q1 GDP, positioned towards the January WSJ imply forecast and IMF WEO projection of 31 January.

Determine 1: GDP (daring black), GDPNow (crimson sq.), IHS Markit/S&P World (tan triangle), Goldman Sachs (gentle inexperienced line), WSJ January survey imply forecast (inexperienced line), IMF WEO projection (sky blue triangles). Supply: BEA 2022Q4 advance, Atlanta Fed, IHS-Markit/S&P World, Goldman Sachs, WSJ January survey, IMF WEO replace, and writer’s calculations.

These estimates now incorporate the most recent accessible commerce information (i.e., for December).

Curiously there’s fairly a dispersion in nowcasts/monitoring estimates for Q1 development, ranging between 0.8% SAAR (GS) and three.1% (IHS Markit), with GDPNow at 2.1%. IHS Markit baseline is for a light recession beginning at Q1 and restoration at Q3 (so I’d guess they’re saying peak at Q1, trough at Q3). Deutsche Financial institution baseline is for gentle recession in 2023H2, arguing that sturdy employment development argues towards imminent recession. Jan Hatzius at Goldman Sachs yesterday indicated a recession likelihood of 25% (versus consensus round 65%) within the subsequent 12 months.

[ad_2]