[ad_1]

My mid-week morning practice WFH reads:

• All Markets Are Unsure: The Forecasters’ Corridor of Fame Has Zero Members: In any given 12 months, somebody, merely due quantity of forecasts, is “proper”. I’ve but to see anybody who can repeatedly, precisely forecast market outcomes. What we are able to say, with all certainty, trying backward, is that the S and P (and just about each different market) has inexorably risen. I discover it attention-grabbing that there isn’t any Forecasters’ Corridor of Fame. There isn’t a one to induct. (The Uncertainty of It All)

• The Chatbots Are Coming for Google: ChatGPT and a handful of startups based by Google alumni are aiming to reimagine seek for the AI age. (Businessweek) see additionally ChatGPT Sparked an AI Craze. Buyers Want a Lengthy-Time period Plan. Synthetic intelligence has sparked new competitors in web search—for the primary time in a long time. Right here’s the right way to construct an AI portfolio. (Barron’s)

• Stan the Man: How one man got here to exert immense affect over a whole era of central bankers — and nonetheless does: Stanley Fischer is the pocket-sized colossus of contemporary central banking. Though Fischer himself is lengthy retired, it now seems like yet one more of his disciples is to choose up the reins of main central. (Monetary Occasions)

• The Little Analysis Agency That Took On India’s Richest Man: Nate Anderson’s Hindenburg, named for the exploding airship, is locked in a battle with Gautam Adani, whose conglomerate is a pillar of the nation’s financial system. (Businessweek)

• PE Has Solely Scratched the Floor of Sports activities Investing. These Companies Are Making an attempt to Change: That. Generational, cultural, and authorized shifts are making sports activities investing extra enticing. Capital has but to comply with. (Institutional Investor)

• How Spotify’s podcast guess went mistaken: Invoice Simmons despatched an e mail to her boss. Simmons had offered the sports activities and popular culture audio empire The Ringer to Spotify a 12 months earlier for $200 million. Now he wrote Spotify CEO Daniel Ek to argue for protecting the Ringer’s mass viewers on Apple and its promoting income, pushed by the explosion of sports activities betting. (Semafor)

• Contained in the Close to-Collapse and Resurrection of the Redstone Media Empire: Within the new e book Unscripted, authors James Stewart and Rachel Abrams dissect the extended, tumultuous battle over the media behemoth that’s now Paramount World—and reveal how, in opposition to all odds, Shari Redstone emerged victorious. (Bloomberg)

• The Loss of life of the Sensible Shopper: Web retail was imagined to supercharge the knowledgeable client. What occurred? (The Atlantic)

• Affect Networks in Russia Misled European Customers, TikTok Says: The covert and coordinated marketing campaign was disclosed in a brand new report that additionally addressed misinformation, pretend accounts and moderation struggles. (New York Occasions) see additionally Misinformation on Misinformation: Conceptual and Methodological Challenges. Alarmist narratives about on-line misinformation proceed to realize traction regardless of proof that its prevalence and affect are overstated. Drawing on analysis inspecting the usage of large knowledge in social science and reception research, we determine six misconceptions about misinformation and spotlight the conceptual and methodological challenges they elevate. (Sage Journals)

• “You’re So Useless”: An Oral Historical past of Learn how to Lose a Man in 10 Days. Kate Hudson, Matthew McConaughey, and extra look again on 20 years of affection ferns and that yellow costume. (Self-importance Honest)

Make sure to take a look at our Masters in Enterprise interview this weekend with Rick Rieder, Chief Funding Officer of World Mounted Revenue at BlackRock, Head of the World Allocation Funding Group, and Senior Managing Director. Rieder helps to handle $2.5 trillion in fixed-income property as a member of BlackRock’s World Working Committee and is Chairman of the firm-wide BlackRock Funding Council.

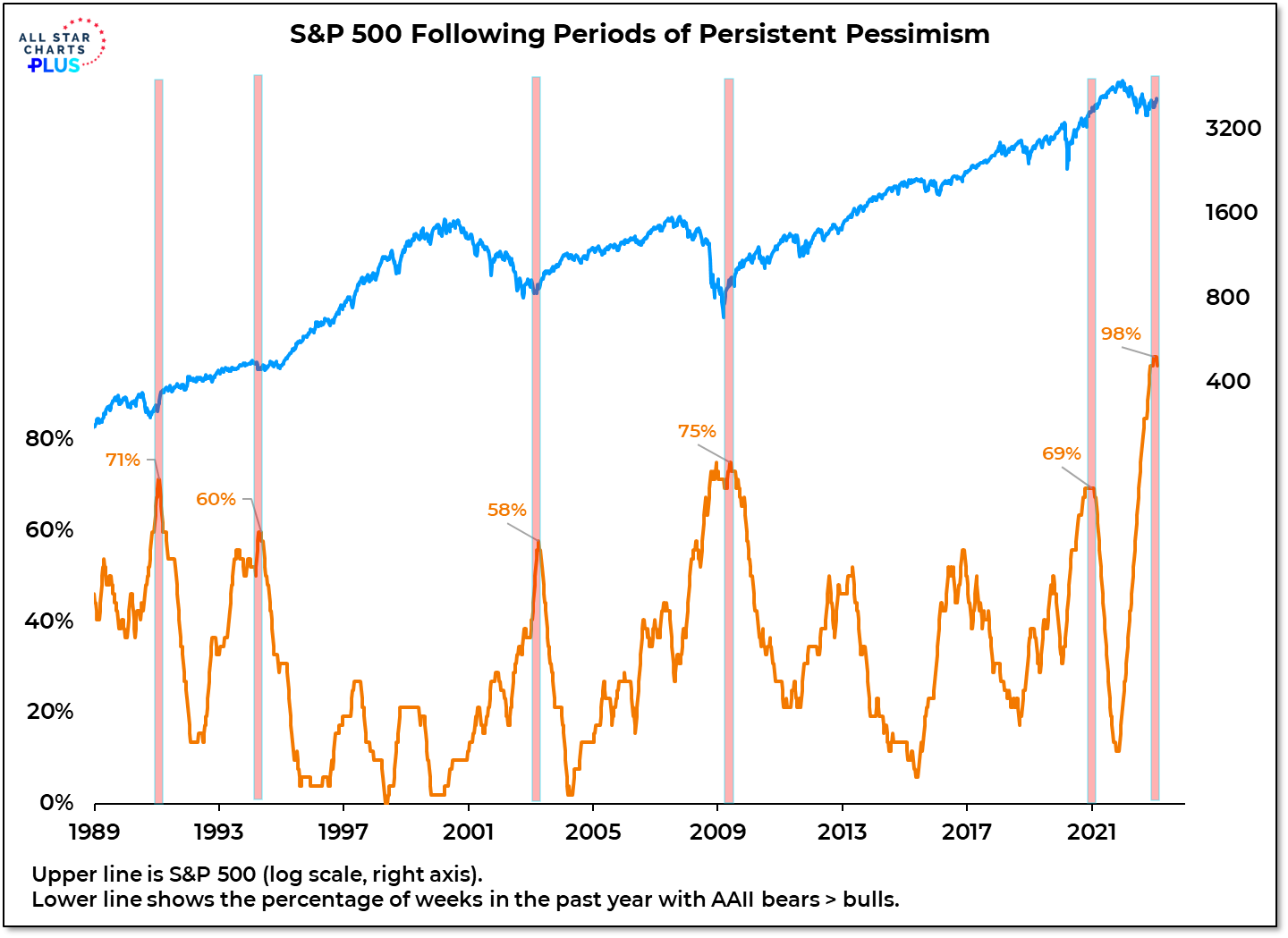

Shares don’t normally endure after persistent pessimism fades

Supply: @WillieDelwiche

Join our reads-only mailing listing right here.

[ad_2]